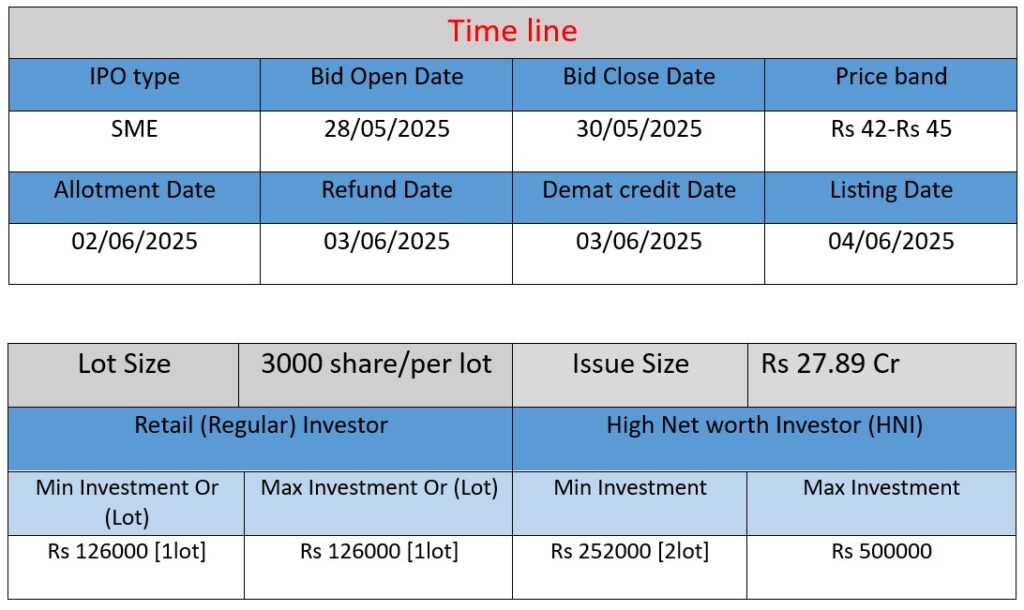

N R Vandana Tex Industries Ltd IPO opens on May 28, 2025, and closes on May 30, 2025, with an issue size of ₹27.89 crore. The IPO aims to raise funds primarily for working capital requirements, repayment of loans, and general corporate purposes. This SME IPO offers investors a chance to invest in a growing textile company known for its strong brand presence and extensive distribution network across India.

N R Vandana Tex Industries Limited is a Kolkata-based textile company with a rich history and a growing presence in India’s cotton apparel market. Below is a comprehensive overview of the company’s operations, strengths, and potential risks, compiled from multiple credible sources.

Company Overview: Operations & Business Model

Established in 1992, N R Vandana Tex Industries Limited specializes in designing, manufacturing, and wholesaling cotton textile products, including sarees, salwar suits, and bed sheets. The company markets its products under the brand names “Vandana” and “Tanaya” .

Operating primarily on a B2B model, the company has built a distribution network of 499 wholesalers across 31 states and union territories in India. Additionally, it leverages B2B e-commerce platforms to expand its reach. In recognition of its market presence, the company received the “Best Debutant – Apparels” award at the Ajio Business Partnership Meet in 2022 .

Strengths

1. Established Brand Presence

With over three decades in the textile industry, N R Vandana Tex Industries has cultivated strong brand recognition through its “Vandana” and “Tanaya” lines, catering to a diverse customer base across India .

2. Robust Distribution Network

The company’s extensive network of 499 wholesalers enables widespread product availability, enhancing market penetration and customer accessibility .

3. Financial Growth

In the fiscal year 2023, the company reported a 10.39% increase in total revenue and an 11.05% rise in net worth, indicating a positive growth trajectory .

4. Experienced Leadership

Under the guidance of Promoter and CFO Gyanesh Lohia, who brings over two decades of experience in the textile sector, the company benefits from strategic financial and operational management .

Risks & Challenges

1. High Debt Exposure

As per the latest records, the company has active open charges totaling ₹39.05 crore, indicating a significant debt burden that could impact financial flexibility .

2. Limited Workforce

With a reported workforce of only 8 employees as of April 2024, the company may face challenges in scaling operations and managing increased demand .

3. Market Competition

The textile industry is highly competitive, with numerous players offering similar products. Maintaining market share requires continuous innovation and effective marketing strategies.

4. IPO-Related Uncertainties

The company has filed a Draft Red Herring Prospectus (DRHP) for an SME IPO, aiming to raise funds for working capital, loan repayment, and general corporate purposes. However, the success of the IPO and subsequent market performance remain uncertain .

In summary, N R Vandana Tex Industries Limited has established a solid foundation in the Indian textile market, backed by a strong brand and distribution network. However, potential investors should consider the company’s debt levels, limited workforce, and the competitive nature of the industry when evaluating its future prospects.

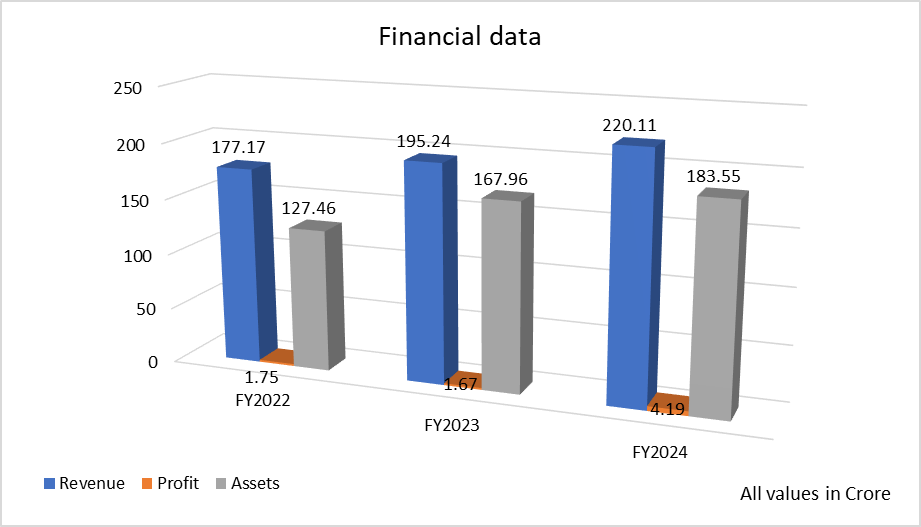

Based on the data provided for N R Vandana Tex Limited, here is a brief financial performance analysis across FY2022 to FY2024:

1. Revenue Analysis

- The revenue has shown steady growth over the three years.

- From FY2022 to FY2023, revenue increased by approximately 10.18%, indicating healthy business expansion.

- Growth accelerated slightly from FY2023 to FY2024 with a 12.74% increase, reflecting growing market demand and better sales.

- This consistent upward trend suggests that the company is successfully increasing its sales volume or expanding its product reach.

2. Profit Analysis

- Profit decreased slightly by 4.57% from ₹1.75 crore in FY2022 to ₹1.67 crore in FY2023, possibly due to increased costs or operational challenges.

- However, from FY2023 to FY2024, profit surged impressively by 150.30% to ₹4.19 crore.

- This sharp rise indicates improved operational efficiency, better cost management, or higher-margin product sales in FY2024.

- The jump in profit despite a moderate revenue growth suggests the company has enhanced its profitability significantly.

3. Assets Analysis

- Total assets increased substantially by 31.74% from FY2022 to FY2023, from ₹127.46 crore to ₹167.96 crore.

- This significant asset growth might reflect investments in plant, machinery, inventory, or expansion activities.

- From FY2023 to FY2024, assets grew by a further 9.28%, indicating continued but moderated capital investment.

- The asset growth supports the company’s revenue increase and may signal preparation for scaling production or entering new markets.

Summary & Insights

- Growth Trajectory: N R Vandana Tex Industries Limited shows a positive growth trend in revenue and assets, indicating steady expansion.

- Profitability Improvement: Despite a small dip in FY2023, the company significantly improved profitability in FY2024, which is a strong positive sign for investors.

- Asset Utilization: The growth in assets supports business expansion and may help sustain revenue growth.

- Operational Efficiency: The sharp profit increase in FY2024 hints at better cost control or product mix improvements.