Monarch Surveyors IPO Overview

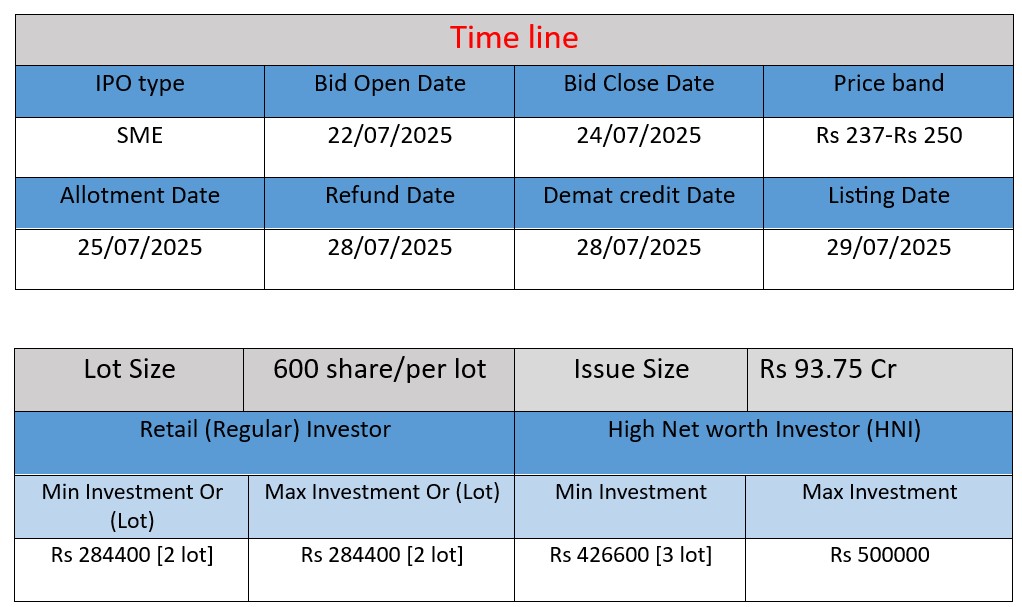

Monarch Surveyors & Engineering Consultants Ltd’s SME IPO opens on July 22, 2025 and closes on July 24, 2025. It comprises a fresh issue of 3,750,000 equity shares (₹93.75 cr) priced ₹237–₹250 each, with 1,240,800 shares reserved for retail investors, 708,000 for QIBs, and 532,800 for NIIs. Proceeds will fund capex (machinery), working capital, and general corporate purposes. Listing on BSE SME expected July 29, 2025.

Core Business & Overview

Monarch Surveyors & Engineering Consultants Ltd, founded in Pune on 20 July 1999, operates as a full-spectrum civil engineering consulting firm. Its core services include:

- Engineering & industrial surveying, including topographic surveys, 3D laser scanning, LiDAR, bathymetry, hydrographic mapping.

- Geotechnical investigations, soil testing, and hydrology services.

- Preparing DPRs, feasibility studies, design engineering, land acquisition support.

- GIS-based mapping and remote sensing, urban planning, traffic surveys, digital twins.

- Project management, inspection & assessment, environment & EIA studies, forest/diversion, web portal development.

They cater to sectors like road & rail, urban development, ports, oil & gas, water, energy, and buildings.

Strengths

- Multi‑disciplinary expertise across surveying, geotech, GIS, design, and PMC from concept to execution.

- Certified quality & standards compliance – ISO 9001, 14001, 27001, CMMI Level 3, CEAI accreditation.

- Strong client base highly regarded in government and prime infrastructure markets.

- Geographic reach and accent on innovation: dominant in Maharashtra (84% revenue), multiple state presence, including Navi Mumbai and Nagpur.

Potential Risks

- High geographic concentration: Over-reliance on Maharashtra (~84% FY25 revenue) raises regional risk.

- Client concentration: Heavy dependence on a few large government/private contracts poses revenue volatility if any major client pauses.

- Tender-based & regulatory exposure: Vulnerable to policy changes, project delays, and potential litigation or contingent liabilities.

- Working capital pressure: Infrastructure consulting requires significant capital outlay; delayed payments might stress liquidity.

Outcome

Monarch Surveyors has built a diverse, technically strong consultancy foundation with certifications, deep domain expertise, and robust project execution, evidenced by rapid financial growth and a solid client base. However, it faces tangible concentration and sectoral risks—especially geographic, client dependency, and regulatory/tender dynamics. Mitigating these via broader geographic diversification, client base expansion, and working capital optimization would enhance resilience and long‑term growth.

Financial Performance Analysis (in ₹ Crore)

| Metric | FY 2023 | FY 2024 | FY 2025 |

| Revenue | 71.68 | 139.49 | 154.14 |

| Profit (PAT) | 8.59 | 30.01 | 34.83 |

| Total Assets | 64.51 | 102.12 | 148.06 |

Revenue

- FY 2023: ₹71.68 crore

- FY 2024: ₹139.49 crore (95% growth YoY)

- FY 2025: ₹154.14 crore (10.5% growth YoY)

Analysis: The company has shown strong topline growth, more than doubling in two years. FY 2024 saw the highest jump, likely due to increased project wins. Growth continued in FY 2025, albeit at a slower pace, indicating a maturing revenue base.

Profit

- FY 2023: ₹8.59 crore

- FY 2024: ₹30.01 crore (249% growth YoY)

- FY 2025: ₹34.83 crore (16% growth YoY)

Analysis: Profits have surged over 300% in two years. This indicates not just increased revenues but also improved margins and cost efficiency. The company is becoming more profitable with scale.

Asset

- FY 2023: ₹64.51 crore

- FY 2024: ₹102.12 crore (58% growth YoY)

- FY 2025: ₹148.06 crore (45% growth YoY)

Analysis: A growing asset base shows expansion in infrastructure and capacity to handle larger projects. The balance sheet has strengthened steadily over time.

Summary

- Monarch Surveyors has delivered consistent and impressive growth in revenue, profit, and assets over the past three years.

- Profit margins are expanding, and the asset base is supporting business scale-up.

- The company appears financially sound, with strong fundamentals ahead of its IPO.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.