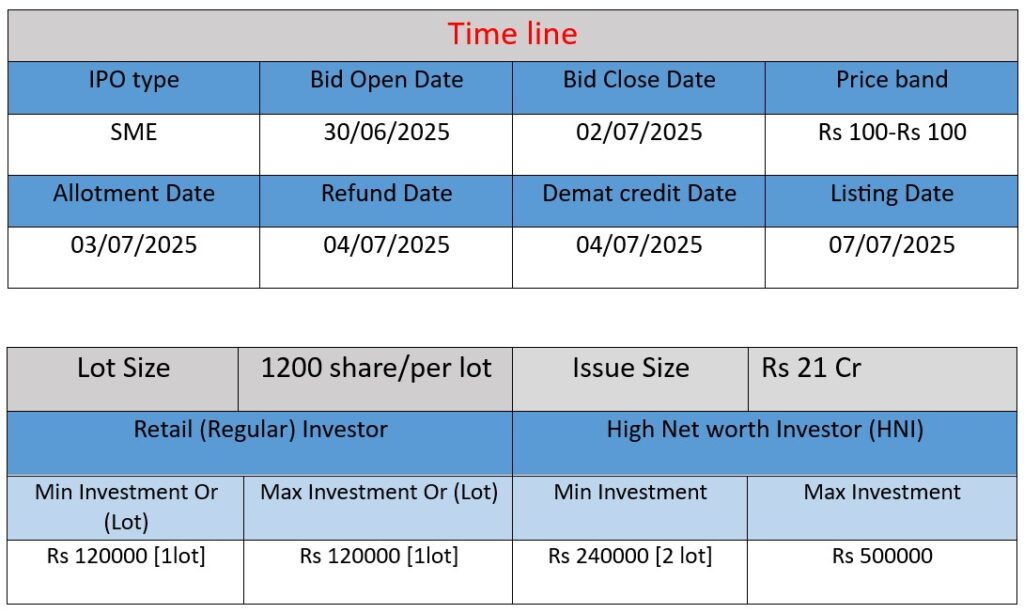

Marc Loire Fashions Ltd (“MARC LOIRE”), a Delhi-based women’s footwear brand with 800+ designs, is launching an SME IPO of ₹21 Cr via a fixed‑price issue of 21 lakh shares at ₹100 each (₹10 face value, ₹90 premium). The issue opens on June 30 and closes July 2, 2025, with listing expected on BSE SME by July 7. Proceeds will fund 15 new retail outlets, multi‑purpose racks, working capital, and general corporate needs

Core Business

- Premium women’s footwear: Founded in 2014 and headquartered in New Delhi, Marc Loire designs, manufactures, and retails fashion-forward shoes—ranging from ethnic sandals to athleisure sneakers, wedges, party heels, and winter boots—offering over 800 SKUs.

- Retail expansion: The company sells primarily through its own Exclusive Brand Outlets and online channels in India, with plans to add 15 more retail outlets using proceeds from its upcoming IPO.

Strengths

- Diverse product portfolio

Maintains a wide range of footwear options (classic, casual, and season-specific) with 800+ designs—helping cater to varied tastes and fashion trends . - Focused niche and brand positioning

Positioned as a stylish yet comfortable premium footwear brand for women, blending fashion with wearability. - Well-defined growth strategy

IPO proceeds (~₹21 cr) will fuel retail network expansion (15 new outlets), enhance working capital, and support general corporate needs, aligning with the company’s medium-term growth plan.

Risks

- IPO pricing risk

Shares are priced at ₹100 each (10× face value), with no prior public market price. Investors may face valuation volatility post-listing. - SME exchange limitations

Being listed on BSE’s SME platform can reduce liquidity and visibility compared to mainstream listings. - Growth execution risk

The expansion into new outlets demands capital discipline, operational capacity, and supply chain readiness—delays or cost overruns could hurt profitability. - Fashion industry volatility

Footwear trends change quickly; inventory risk and misaligned design cycles pose significant challenges. - Competitive landscape

Faces competition from established footwear brands in this crowded market, requiring strong brand differentiation and quality control.

Conclusion

Marc Loire Fashions Limited is an emerging player in India’s premium women’s footwear space, offering a broad and stylish range with a solid early financial track record. The upcoming SME IPO offers promising capital for scaling through new retail locations. However, investors should note valuation pressure from the new issue, liquidity constraints on the SME platform, and the execution challenges of physical expansion in a competitive, fast-moving consumer market. A cautious investment approach—balancing growth potential with these operational risks—is advisable.

Here is a brief financial performance analysis across FY2022 to FY2024:

Revenue

- FY2025: ₹42.26 crore

- FY2024: ₹40.20 crore

- FY2023: ₹37.42 crore

Analysis: Revenue has steadily grown over the last three years, rising by 13% from FY2023 to FY2025. The consistent increase indicates healthy demand for the company’s products and successful expansion of its retail and online presence.

Profit (PAT)

- FY2025: ₹4.70 crore

- FY2024: ₹4.08 crore

- FY2023: ₹0.66 crore

Analysis: Profit has grown significantly, particularly between FY2023 and FY2024, where it jumped over 6 times. This reflects improved cost control, better margins, and scaling of operations. FY2025 also shows a solid rise, though at a slower rate than the previous year.

Total Assets

- FY2025: ₹22.24 crore

- FY2024: ₹17.02 crore

- FY2023: ₹12.99 crore

Analysis: Assets have grown over 70% in two years, reflecting the company’s investment in infrastructure, inventories, and retail expansion ahead of the IPO. The increase supports their long-term growth strategy.

Summary

- Revenue and profit are showing sustained growth, indicating strong market acceptance and operational efficiency.

- Profit margin improvements suggest better cost control and scalability.

- Increase in assets aligns with planned retail expansion and business strengthening.

- Financials show readiness for IPO and inspire moderate investor confidence, with a watch on execution and competition post-listing.