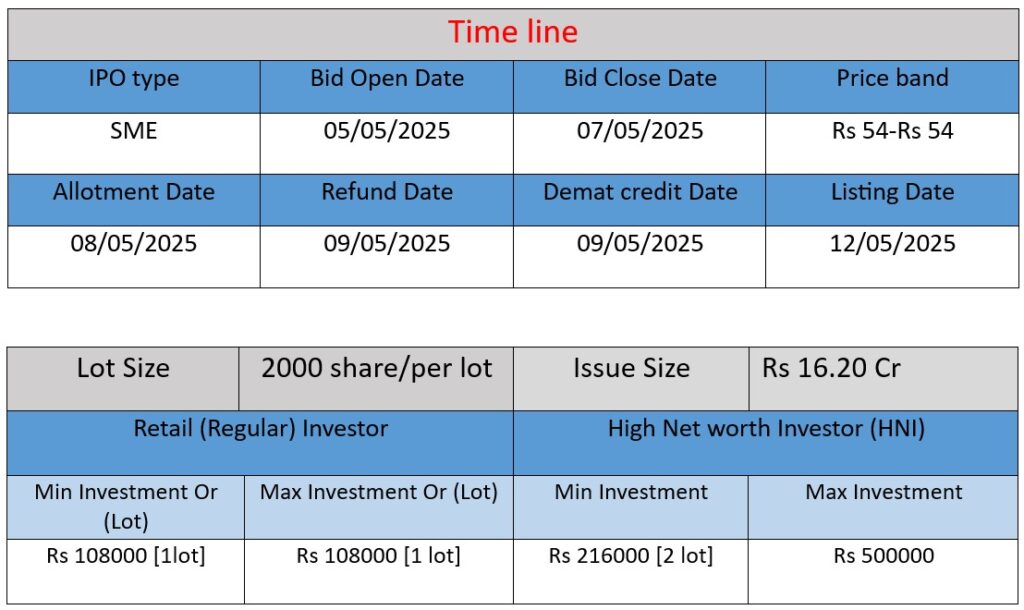

Manoj Jewellers Limited’s SME IPO opens on May 5, 2025, aiming to raise ₹16.20 crore through a fresh issue of 30 lakh shares at ₹54 each. Proceeds will be utilized for repaying certain borrowings and general corporate purposes.

Core Business Focus

Manoj Jewellers Limited is a Chennai-based jewellery company with over three decades of experience in the gold and diamond jewellery industry. Established in 1991 as a small retail outlet, the company has grown into a boutique jewellery brand and expanded into e-commerce with the launch of Zullry.com in 2021. In 2022, it was restructured as Manoj Jewellers Limited, aiming to become a leading designer jewellery brand in India.

Business Model & Operations

Product Portfolio:

- Gold and silver jewellery

- Gold coins

- Diamond-studded ornaments

Retail Presence:

- Physical store located on NSC Bose Road, Sowcarpet, Chennai, a major wholesale gold hub.

- E-commerce platform Zullry.com launched in 2021 to reach a broader customer base.

Mission & Vision:

- To provide unique, hallmarked, and modern jewellery with a touch of tradition.

- Aim to be the most trusted and preferred designer jewellery brand nationally.

💪 Strengths

1. Robust Financial Growth:

- Revenue increased from ₹13.64 crore in March 2023 to ₹43.38 crore in March 2024, marking a 218.03% growth.

- Profit After Tax (PAT) rose from ₹0.62 crore to ₹3.24 crore in the same period, a 422.58% increase.

2. Strategic Location:

- Situated in Chennai’s Sowcarpet area, providing access to South India’s largest wholesale gold market.

3. Diversified Sales Channels:

- Combines traditional retail with online sales through Zullry.com, catering to a wide range of customers.

4. Strong Promoter Holding:

- Promoters held 94.99% of shares pre-IPO and 63.28% post-IPO, indicating strong confidence in the company’s future.

⚠️ Risks

1. High Debt Levels:

- Debt increased from ₹5.67 crore in March 2023 to ₹15.38 crore in March 2024, which could impact financial stability.

2. Inventory Management Challenges:

- Failure to manage inventory effectively could adversely affect net sales, profitability, and liquidity.

3. Dependence on Key Personnel:

- The company’s success is closely tied to its promoters and senior management; any attrition could affect growth.

4. Market Competition:

- Faces intense competition from both organized and unorganized players in the jewellery sector, which could impact market share.

5. Regulatory and Legal Risks:

- Involvement in legal proceedings without provisions for potential liabilities could pose financial risks.

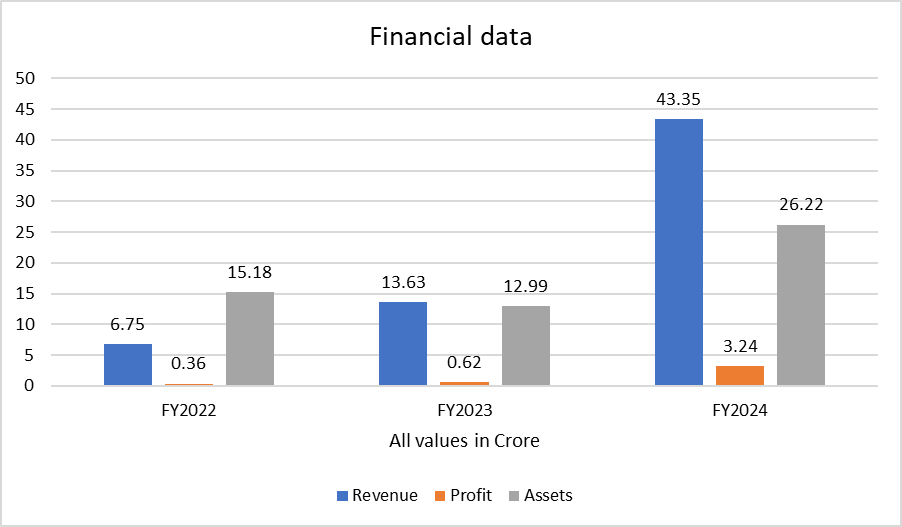

Financial Analysis of Manoj Jewellers Limited (FY2022-FY2024)

📈 Revenue

- FY2022: ₹6.75 crore

- FY2023: ₹13.63 crore

- FY2024: ₹43.35 crore

Analysis:

Revenue has shown robust growth over the past three years. It doubled from FY2022 to FY2023 (101.93% growth), and then grew by 218% in FY2024. This sharp increase indicates strong business expansion and improved market reach.

💰 Profit

- FY2022: ₹0.36 crore

- FY2023: ₹0.62 crore

- FY2024: ₹3.24 crore

Analysis:

Profit has multiplied nearly 9 times from FY2022 to FY2024. This suggests improved margins and operational efficiency. FY2024’s performance, in particular, reflects strong cost control and higher profitability.

🏦 Total Assets

- FY2022: ₹15.18 crore

- FY2023: ₹12.99 crore

- FY2024: ₹26.22 crore

Analysis:

There was a slight dip in FY2023, but total assets more than doubled in FY2024. This jump shows significant reinvestment or capital inflow, possibly aligned with expansion strategies or IPO preparation.

📌 Summary

- Revenue and profit growth has been exceptional over the last 3 years.

- FY2024 marked a breakthrough in profitability and asset base.

- This financial momentum supports the company’s IPO strategy and market confidence.