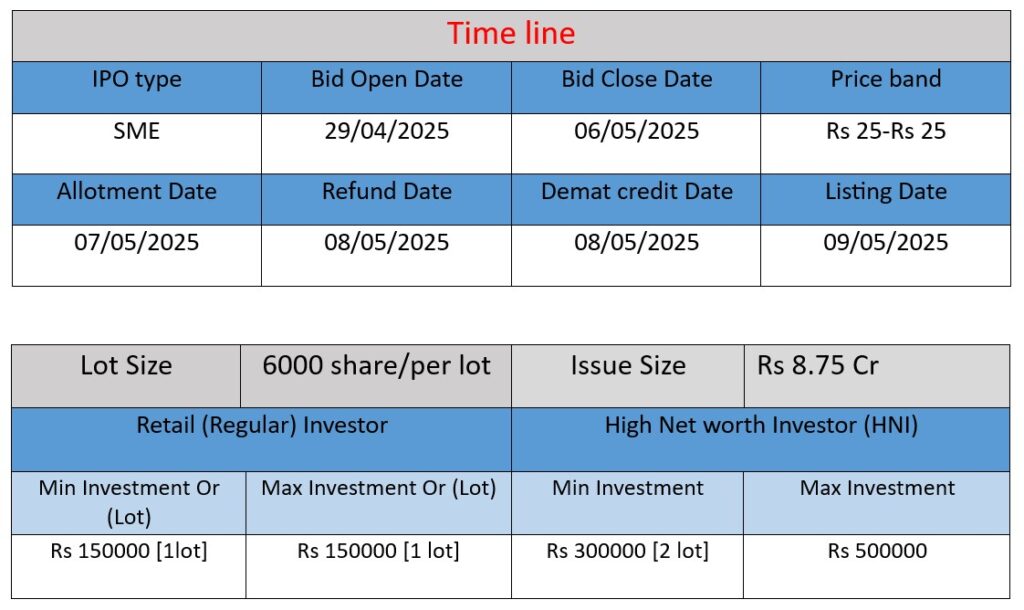

Kenrik Industries Limited IPO opens on April 29, 2025, to raise ₹8.75 crore. Price band is ₹25 per share. The issue aims to fund working capital requirements and general corporate purposes. Specializing in traditional gold jewelry, Kenrik Industries reported revenue of ₹70.97 crore in FY24. IPO to be listed on BSE SME platform on May 9, 2025.

Core Business Focus

Kenrik Industries Limited is an Indian company specializing in the manufacturing and trading of traditional Indian jewelry. Established in 2017 and headquartered in Ahmedabad, Gujarat, the company is currently launching its Initial Public Offering (IPO) on the BSE SME platform. Below is an analysis of the company’s operations, strengths, and risks based on information from multiple sources.

Kenrik Industries focuses on the design, manufacturing, and distribution of plain and studded gold jewelry. Their product range includes rings, bangles, necklaces, pendants, and wedding jewelry, often adorned with diamonds, rubies, or cubic zirconia. The company emphasizes traditional Indian designs and caters to various customer preferences and budgets.

Strengths

- Diverse Product Range: Kenrik offers a wide array of jewelry products catering to different tastes and budgets, enhancing its market appeal.

- Quality Assurance: The company maintains strict quality control measures, ensuring BIS-certified reliability in its products.

- Competitive Pricing: Through efficient manufacturing and sourcing, Kenrik achieves competitive pricing, making its products accessible to a broader customer base.

Risks

- Market Competition: The jewelry industry is highly competitive, with numerous players offering similar products, which could impact Kenrik’s market share and pricing power.

- Economic Sensitivity: Demand for jewelry is often influenced by economic conditions; downturns can lead to reduced consumer spending on luxury items.

- Raw Material Price Volatility: Fluctuations in the prices of gold and precious stones can affect production costs and profit margins.

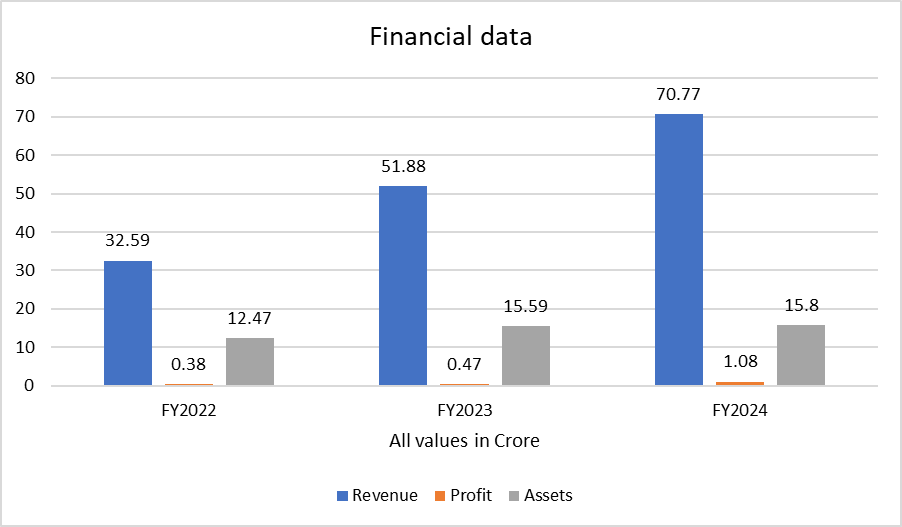

Financial Analysis of Kenrik Industries Limited (FY2022-FY2024)

Revenue

- FY2022: ₹32.59

- FY2023: ₹51.88

- FY2024: ₹70.77

Analysis:

Revenue has grown significantly year-over-year, increasing by 59.2% from FY22 to FY23 and 36.4% from FY23 to FY24. This shows a strong and consistent upward growth in business operations.

Profit

- FY2022: ₹0.38

- FY2023: ₹0.47

- FY2024: ₹1.08

Analysis:

Profit nearly tripled in FY24 compared to FY22. The margin improvement reflects better cost control or higher operational efficiency as revenue increased.

Assets

- FY2022: ₹12.47

- FY2023: ₹15.59

- FY2024: ₹15.8

Analysis:

Assets grew steadily till FY23 and remained almost flat in FY24. This suggests the company is managing its asset base efficiently while scaling revenue and profit.

Kenrik Industries shows strong financial growth, especially in revenue and profit. The consistent performance indicates solid business fundamentals ahead of its IPO.