Kalpataru Limited IPO opens from June 24–26, 2025, with an issue size of ₹1,590 crore, including a fresh issue of ₹1,200+ crore. The primary purpose is to repay debts, improve financial health, and fund future real estate developments. Backed by Kalpataru Projects International (KPIL), the IPO reflects strong EPC business growth and a strategy to strengthen its real estate segment. Listing is scheduled for July 1, 2025.

WORK / BUSINESS SEGMENTS

1. Real Estate – Kalpataru Limited (Standalone)

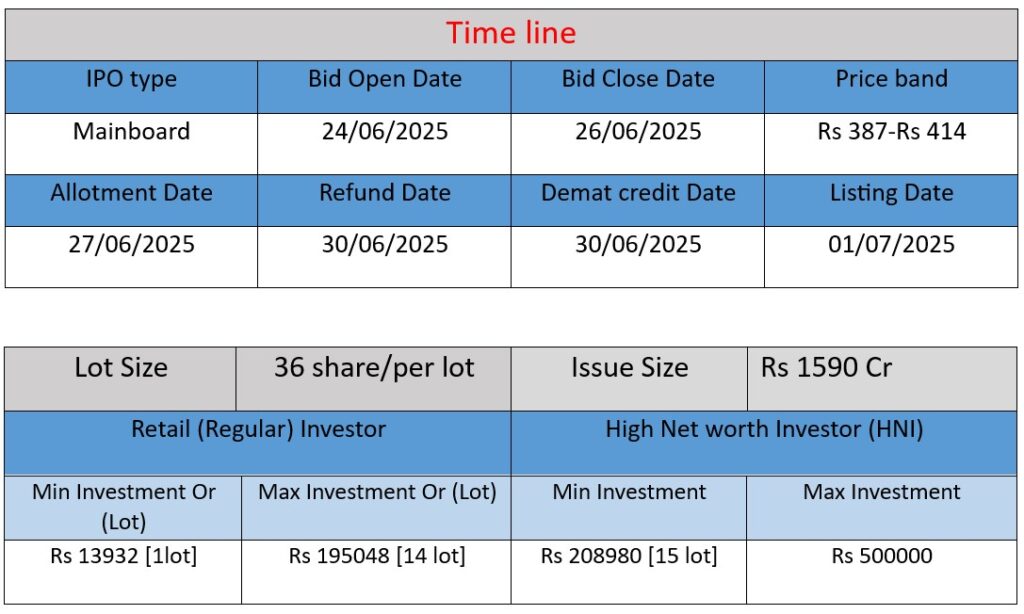

- The IPO is scheduled for June 24–26, 2025, with listing on July 1, 2025, and a price band of ₹387–414 per share.

- Revenue plummeted from ₹3,633 cr in FY23 to ₹1,930 cr in FY24—a drop of 47%, driven by lower sales and increased project costs.

- However, the nine months ending December 2024 show a return to profitability, supported by improved margins.

- Record-high order book of ~₹64,500 cr, with strong inflows in Transmission & Distribution (T&D) and Buildings & Factories (B&F) accounting for ~90%.

STRENGTHS

- Robust Order Book & Segment Diversification

KPIL’s ₹64.5 k cr order backlog spans T&D (~59%), B&F (~22%), and niche segments like water, oil & gas, and railways. - Strong Financial & Cash Flow Performance

KPIL delivered double-digit YoY revenue, improved margins, reduced debt, and working capital at ~94 days. - Strategic Exit from Non-Core Assets

KPIL is divesting Indore warehouses/real estate and VEPL (valued at ~₹775 cr) to focus on high-margin EPC. - Global & Institutional Counterparty Exposure

International EPC orders include multilateral agency-backed projects, mitigating default risks.

RISKS

- Standalone Real Estate Volatility

Revenue halved in FY24 and although there’s recent profit, the segment remains vulnerable to cost overrun and presale dependencies. - Water Segment Slowdown in KPIL

Execution delays and collection issues (~₹2,000 cr shortfall) have dragged down growth; FY25 guidance trimmed to 12–13%. - Macro and Commodity Risks

Weakening currencies (like BRL), supply chain bottlenecks, labor shortage, and rising interest costs pose margin risks . - Debt & Valuation Pressure Pre-IPO

Consolidated net debt is high (~₹10,120 cr), despite incremental repayment plans—valuation multiples remain rich compared to peers

RISK-REWARD BALANCE

- Upside: The combined strength of a growing EPC business, strategic asset sales, and debt reduction from IPO—along with strong order book—paints a positive outlook.

- Downside: The stress in the water segment, standalone real estate losses, and high leverage pre-profitability sustain execution risk.

FINAL TAKEAWAY

Kalpataru represents a play on India’s infrastructure growth, anchored by a thriving EPC business backed by global contracts and asset carve-outs. But the real estate arm needs a turnaround and debt remains a key watch-point. The IPO offers a meaningful de-leveraging opportunity—but also flags reliance on timely execution and cyclic real estate recovery.

Here is a brief financial performance analysis across FY2022 to FY2024:

Revenue

- FY2023 saw a sharp surge in revenue (263% growth from FY2022), likely due to higher project sales and recognition.

- However, in FY2024, revenue dropped by 46.9% compared to FY2023, indicating a slowdown in project execution or sales realization.

Analysis: Volatility in revenue shows dependence on project-specific recognition. FY2023 was a peak year, but sustainability remains a concern.

Profit / Loss

- The company has been loss-making for 3 consecutive years.

- Losses peaked in FY2023 (₹233.17 Cr), improving to a lesser loss of ₹115.07 Cr in FY2024, suggesting margin recovery or cost control.

Analysis: Despite recovery in FY2024, continued losses highlight challenges in profitability—possibly from high costs, delayed projects, or lower margins.

Total Assets

- Assets decreased from FY2022 to FY2023, possibly due to asset sales or impairments.

- In FY2024, total assets rose again to ₹13,879.43 Cr, indicating renewed project investment or asset buildup ahead of the IPO.

Analysis: Asset base recovery in FY2024 suggests capital deployment in new or ongoing real estate projects.

📝 Summary

- Revenue peaked in FY2023 but dipped sharply in FY2024.

- Losses have narrowed in FY2024 but remain negative for three years.

- Assets show improvement in FY2024, possibly ahead of IPO-led expansion.