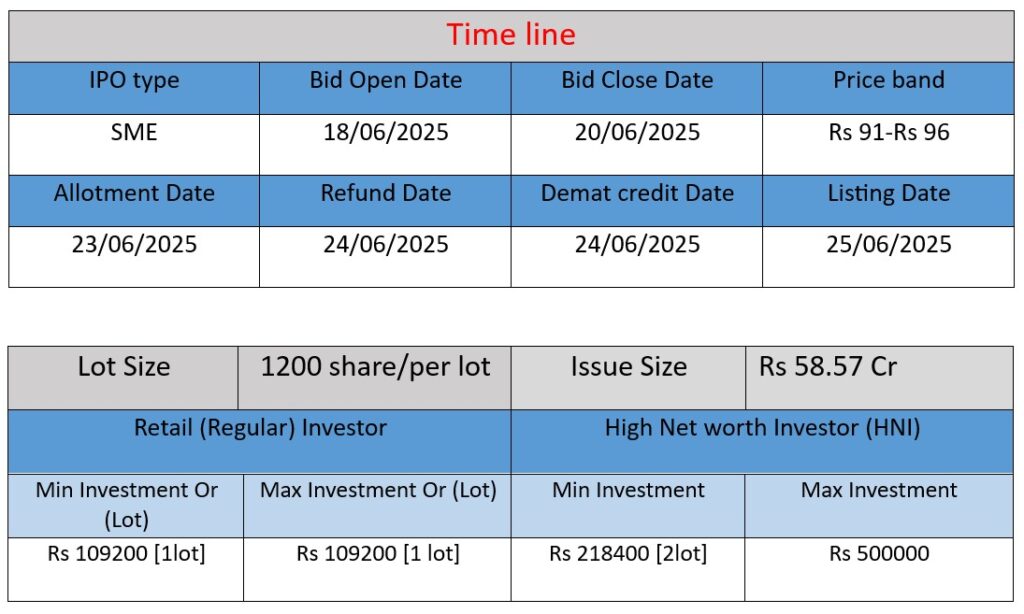

Influx Healthtech Limited launches its IPO on June 18, 2025, with an issue size of ₹58.57 crore. The company, a certified CDMO, operates in nutraceuticals, pharma, veterinary, cosmetics, and homecare. IPO proceeds will be used for capacity expansion, R&D, and working capital.

Company Overview & Core Operations

Influx Healthtech is a Mumbai-based contract development & manufacturing organization (CDMO). Founded 2020, it specializes in producing a wide array of products: nutraceuticals, pharmaceuticals, cosmetics, veterinary feed, sports nutrition, homecare, and even pet nutrition . With multiple GMP-, ISO-, HACCP-, Halal-, and US FDA-compliant facilities in Palghar, Maharashtra (spanning 6,500–14,000 sq ft each), the company handles everything from R&D and formulation to large-scale production—across formats like tablets, capsules, gummies, powders, creams, gels, oral films, and more .

Strengths

• Robust Diversification & Scale

Operating across multiple sectors—from human health and pets to homecare—Influx has diversified revenue streams and demonstrates the versatility of its CDMO model .

• Global Compliance & Quality Accreditation

They maintain WHO-GMP, ISO 22000:2018, ISO 14001:2015, HACCP, US-FDA, Halal, and Kosher certifications —crucial for exporting to North America, Europe, and beyond.

• R&D & Innovation Focus

The company invests heavily in research for high-bioavailability nutraceuticals, Ayurvedic formulations, sports nutrition, and advanced delivery systems (e.g., oral films, effervescent tablets) . They’ve also patented several formulations.

Risks & Considerations

• Execution Risk in Capacity Expansion

While plans are in place to scale manufacturing, any delays or cost overruns in setting up new facilities (funded by the IPO) may impact ROI and projected margins.

• Market Competition & Pricing Pressure

The CDMO and nutraceutical markets are increasingly crowded with domestic and international players offering comparable capabilities. Maintaining pricing power and quality differentiation may be challenging.

• Regulatory Compliance Demands

Though well-certified, increasing regulatory scrutiny—especially for exports—demands ongoing investment in quality control. Non‑compliance could risk bans or costly rejections.

• Dependence on Client Relationships

As a contract manufacturer, Influx relies heavily on winning and renewing private-label contracts. Losing key clients or failing to secure sufficient new contracts could impact capacity utilization and profitability.

Final Take

Influx Healthtech stands out as a well-diversified, vertically integrated CDMO with strong certifications, growing financials, and strategic R&D initiatives. The key to future upside lies in effectively executing its expansion plans, maintaining regulatory excellence, and deepening customer relationships—particularly important given rising competition. The IPO marks a pivotal moment: successful deployment of these proceeds could propel growth, but missteps may reduce the anticipated impact.

Here is a brief financial performance analysis across FY2023 to FY2025:

Revenue

- FY2025: ₹104.85 Cr

- FY2024: ₹99.96 Cr

- FY2023: ₹76.06 Cr

Analysis:

The company has shown consistent revenue growth over the last three years. Revenue increased by 31.3% from FY2023 to FY2024, and a moderate 4.9% growth from FY2024 to FY2025. This suggests a strong business foundation with a slight deceleration in growth—possibly due to capacity constraints or stabilization before expansion.

Profit (PAT)

- FY2025: ₹13.37 Cr

- FY2024: ₹11.13 Cr

- FY2023: ₹7.2 Cr

Analysis:

Profitability has improved year-on-year. PAT rose by 54.6% in FY2024 and 20.1% in FY2025. The growth in profit outpaced revenue in FY2024, indicating better cost control or operational efficiency. In FY2025, profit growth continued but slightly slowed, possibly hinting at higher investment costs in expansion or R&D.

Total Assets

- FY2025: ₹70.3 Cr

- FY2024: ₹41.1 Cr

- FY2023: ₹28.3 Cr

Analysis:

Assets more than doubled from FY2023 to FY2025. A significant 71% increase in assets in FY2025 indicates active capital deployment—likely linked to upcoming IPO investments in new plants, machinery, and technology infrastructure.

✅ Summary

- Consistent revenue growth, though pace slowed in FY2025.

- Profits have grown steadily, with strong margins.

- Asset base expansion reflects scaling operations and growth readiness.

- The company appears financially healthy and prepared for its next phase of growth via IPO.