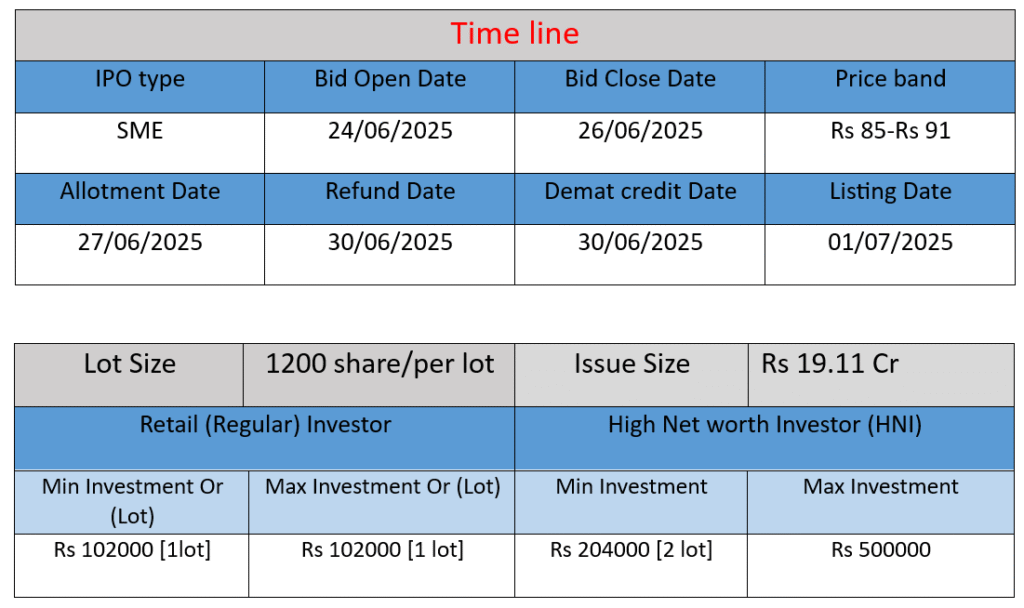

Icon Facilitators Limited is launching its SME IPO with a fresh issue of ₹19.11 crore (21 lakh shares at ₹85–91 each) from June 24–26, 2025, listing on BSE–SME on July 1. Approximately ₹16 crore will be allocated toward working capital, with the balance for general corporate purposes.

Work / Business Operations

- Core Services

Icon is a facilities management company offering a comprehensive range of technical services—Electrical System Management, Captive Power (DG set) Management, STP/ETP & Water Treatment, HVAC Management, Building Management Systems (BMS), Fire & Safety Equipment maintenance, Elevators & Escalators operations, Annual Maintenance Contracts, janitorial services and more. - Client Portfolio & Reach

The company serves industrial clients (Maruti Suzuki, ISGEC Heavy Engineering, Abbott), commercial sites (Vegas Mall, Eros Metro Mall, East Delhi Mall), residential developers (DLF Camellias, Tata Housing), and corporates like Macquarie, Deloitte, HCL. They also manage Bharat Mandapam, a high-profile venue. - Geographic Presence

Strong North India footprint: 72 sites in Haryana, 37 in UP, 18 in Delhi; plus operations in Rajasthan, Punjab, Himachal Pradesh. Recently launched Bengaluru office to enter Southern market - Contract Wins

In Dec 2024, secured ₹6 crore+ contracts with Indigo Airlines (four NCR facilities), NBCC (Civil Services Officers’ Institute), K1 Towers, and corporate offices like AMDOCS and Virtusa.

Strengths

- Revenue Growth & Ambitious Vision

- FY23–24 revenues rose from ₹42.96 cr to ₹49.84 cr (~16%).

- Targeting ₹100 cr revenue by FY27, backed by planned IPO and expansion.

- Diverse Service Portfolio

The breadth of services (hard + soft FM) across multiple sectors minimizes client dependency and enhances recurring revenue stability. - Credible Clientele & Strong Contracts

Having marquee clients across automotive, engineering, retail, and institutional venues reflects a strong reputation and execution capacity. - Scaling Geographic Footprint

North-based dominance plus Bengaluru expansion signals strategic scaling across India. - Skilled Workforce & Technology Adoption

Employing nearly 1,800 staff with technical expertise; recent investments in centralized monitoring and energy audits reinforce their operational quality.

Risks & Challenges

- Thin Profit Margins

FY24 PAT of ₹1.76 cr (down from ₹1.92 cr in FY23) on ₹49.84 cr revenues highlights tight margins and limited cushion for cost overruns. - Competitive Industry Landscape

The facility management sector is highly competitive, with integrated service providers and large FM players potentially challenging pricing and contract wins. - Geographic Expansion Complexity

Southern market entry demands new networks, compliance, and competition handling—execution missteps could erode margins or brand reputation. - Client Concentration & Contract Duration

Many services tied to limited contracts (e.g., Indigo for one year). Client attrition or failure to renew may affect revenue predictability. - Regulatory & Operational Dependencies

Success depends on strict adherence to safety, environmental standards (STP/ETP), and maintaining high operational efficiency across sites—non-compliance poses liabilities.

Summary

Icon Facilitators Limited is a growing FM player in India, with steady revenue growth, strong blue-chip clients, a robust service offering, and strategic expansion plans supported by an IPO. Strengths lie in their diversity, reputation, workforce, and tech focus. However, limited profitability, challenging fund requirements, competitive pressures, and execution risks—especially in southern regions—pose notable challenges.

Here is a brief financial performance analysis across FY2023 to FY2025:

Revenue

| Year | Revenue (₹ Cr) |

| FY2023 | 42.96 |

| FY2024 | 49.84 |

| FY2025 | 58.06 |

Analysis:

- FY2023 to FY2024: Revenue increased by ₹6.88 Cr (16.01%).

- FY2024 to FY2025: Revenue increased by ₹8.22 Cr (16.49%).

- Trend: Consistent revenue growth of ~16% annually shows the company’s expanding client base and new project wins across regions.

Profit (PAT)

| Year | Profit (₹ Cr) |

| FY2023 | 1.92 |

| FY2024 | 1.76 |

| FY2025 | 4.47 |

Analysis:

- FY2023 to FY2024: Profit declined by ₹0.16 Cr (-8.33%), possibly due to increased costs or one-time expenses.

- FY2024 to FY2025: Profit jumped by ₹2.71 Cr (153.98%), indicating strong margin improvement and efficient cost management.

- Trend: Despite a dip in FY24, FY25 saw a strong recovery and growth in profitability.

Total Assets

| Year | Assets (₹ Cr) |

| FY2023 | 14.93 |

| FY2024 | 17.66 |

| FY2025 | 23.95 |

Analysis:

- FY2023 to FY2024: Assets grew by ₹2.73 Cr (18.29%).

- FY2024 to FY2025: Assets rose significantly by ₹6.29 Cr (35.63%).

- Trend: Increasing asset base suggests investment in business infrastructure, technology, and geographical expansion.

Summary

- Consistent Revenue Growth: Around 16% YoY growth reflects steady operational expansion.

- Profit Surge in FY25: Strong profit rebound suggests better cost control and higher margin contracts.

- Asset Expansion: Nearly 60% growth in two years shows increased capacity to handle larger contracts and operations.

- Overall Outlook: The company has improved its financial position significantly in FY25, making it more attractive for investors ahead of its IPO.