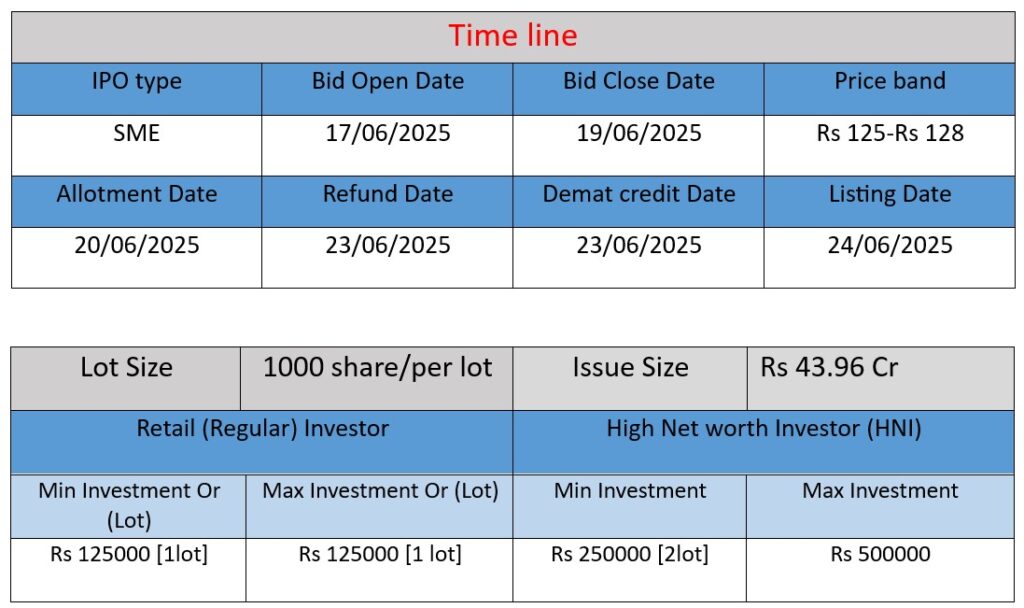

Eppeltone Engineers has launched a ₹43.96 crore SME IPO on NSE EMERGE, open June 17–19, 2025, with shares set to list June 24. Funds will support working capital, additional machinery, and general corporate purposes. A veteran in energy metering and power systems since 1977 and ISO‑certified, Eppeltone targets government DISCOMs and industrial clients.

Work & Business Overview

Eppeltone, founded in 1977, began by manufacturing Switch-Mode Power Supplies (SMPS) and later expanded into AVRs, UPS systems, MCBs, transducers. From 1998–99, it strategically broadened into static energy meters, and now produces smart meters, industrial meters, solar meters, and full Automatic Metering Infrastructure (AMI) solutions.

Manufacturing & Certifications

Operating a 36,000 sq ft plant in Greater Noida, supported by labs in Noida & Delhi, the company maintains ISO 9001/14001/27001, CMMI Level III, and NABL accreditations—highlighting its focus on quality, R&D, and innovation.

Clientele & Market Segment

Primarily B2B-focused, it serves government DISCOMs, central public undertakings, private contractors, and industrial customers across India .

Strengths

- Rich Product Mix

From smart meters to UPS and LED luminaires, its wide portfolio addresses multiple energy management needs—backed by in-house R&D and advanced manufacturing. - Strong Brand & Government Ties

With over 45 years of operation and approvals from 30+ state utilities, the company enjoys strong credibility and stable project flow. - Financial Turnaround

FY2024 saw revenue at ₹78.46 cr (+8% YoY) and PAT surge to ₹8.43 cr from previous ₹1.09 cr, largely driven by robust margins (PAT ~10.7%, ROE ~40.8%). - Solid Manufacturing Setup

Large facility, multiple certifications, and emphasis on automation and testing improve competitiveness and product quality.

Risks & Challenges

- Customer Concentration

Heavy dependence on government tenders and select large clients—project volatility may impact revenue continuity. - Supplier & Working Capital Risk

Lack of long-term raw material supply contracts raises procurement uncertainty; IPO plans to allocate ₹30 cr for working capital. - Geographic Concentration

Focus on specific Indian states and DISCOMs restricts diversification, risking revenue dip if policies or budgets shift. - Asset Ownership & Liabilities

Doesn’t outright own its registered premises; carries bank guarantees and contingent liabilities (e.g., tax inquiries). - Credit Rating & Transparency

Rated B/Stable / A4 by CRISIL and Infomerics, though flagged as “Issuer Not Cooperating”—indicating limited forward-looking visibility.

Eppeltone Engineers showcases a resilient resurgence, with an impressive financial trajectory and enhanced operational capability. Yet, its dependence on government clients, supplier uncertainty, and moderate transparency pose notable risks. Stakeholders should balance the strong turnaround and robust portfolio with pockets of vulnerability in governance and market stability.

Here is a brief financial performance analysis across FY2022 to FY2024:

Revenue

- FY2022: ₹82.61 crore

- FY2023: Dropped to ₹72.64 crore (−12.1%)

- FY2024: Recovered slightly to ₹78.45 crore (+8% YoY)

📌 Insight: After a dip in FY23, revenue shows signs of recovery in FY24, but hasn’t yet reached FY22 levels.

Profit

- FY2022: ₹0.24 crore

- FY2023: ₹1.09 crore (+354%)

- FY2024: ₹8.43 crore (+673%)

📌 Insight: Profits have grown exponentially, suggesting better margin control, improved pricing, or operational efficiency.

Total Assets

- FY2022: ₹33.93 crore

- FY2023: ₹43.73 crore (+28.9%)

- FY2024: ₹69.82 crore (+59.6%)

📌 Insight: The company is expanding its asset base aggressively, likely through investments in infrastructure and machinery.

Conclusion

Eppeltone Engineers has demonstrated strong profitability growth and asset expansion, despite a temporary revenue dip in FY23. FY2024 stands out with a sharp rise in profits and assets, indicating a robust operational turnaround. This financial trend supports its IPO timing and future scalability.