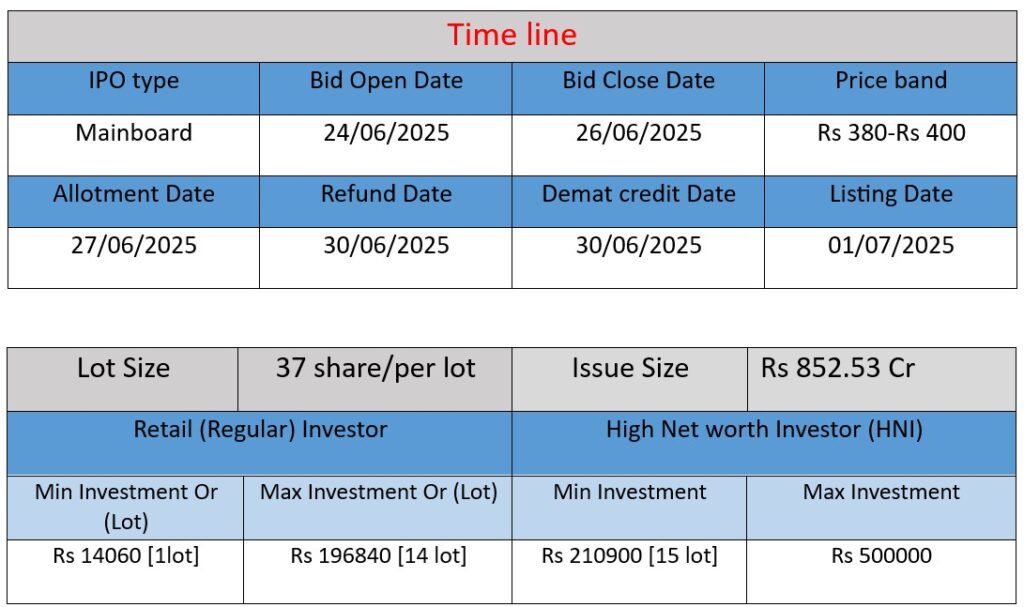

Ellenbarrie Industrial Gases Ltd has launched an ₹852.53 crore IPO (June 24–26, 2025) with a price band of ₹380–400 per share. The offer includes a fresh equity issue of ₹400 crore and an offer for sale by promoters totaling ~1.44 crore shares. Proceeds—₹176.8 cr toward debt repayment, ₹130 cr for a 220 TPD air‑separation unit at Uluberia-II, and the balance for general corporate purposes—will support growth and financial strength.

Work & Core Operations

EIGL is a leading 100% Indian-owned industrial gases manufacturer with over 50 years of legacy. As of FY 2024:

- It operates eight air separation units (ASUs) across East and South India, producing a wide range of gases—oxygen, nitrogen, argon, helium, hydrogen, CO₂, nitrous oxide, acetylene, as well as specialty gases like synthetic air.

- Its installation capacity includes one of India’s largest oxygen plants (1,250 TPD). Its distribution fleet (cryogenic tankers, cylinders) is among the largest in India.

- EIGL caters to a diverse customer base: >1,800 across industries—steel, pharma, healthcare, aerospace, defence, coal mining, food packaging, electronics—providing both bulk and packaged gases.

- The company is developing solutions beyond gases—project engineering, medical gas pipelines, and is expanding into specialty and electronic-grade gases, green hydrogen/ammonia, and ultrahigh purity gases for semiconductors.

Strengths

- Strong market position & legacy

The largest Indian-owned gases firm by capacity, revenue, and profits in FY 2024; market leader in several states. - Diverse & sticky customer base

Over 1,836 customers, with long-term bulk contracts generating ~75%+ revenue; high customer retention due to reliability and infrastructure stickiness. - Robust infrastructure

Multiple delivery modes (pipeline, liquid, cylinders), one of the largest tanker fleets, and dedicated engineering and on‑site ASU capabilities. - According to CRISIL, gearing & leverage remain comfortable (<1×), interest coverage >5×, and net cash accrual to debt ~0.3×.

- Critical public role

Vital contribution during COVID-19 for medical oxygen supply; active in space and defence programs

Risks & Challenges

- Capital intensity & capex exposure

Gases industry requires heavy capex and long gestation. EIGL plans ~₹385 Cr in capex through FY2026, financed with ~2.6× debt/equity. Delays or demand shortfalls could impact returns. - Commoditization & competition

Faces intense competition from multinational and unorganized players. Product commoditization limits pricing power; demand cyclicality in sectors like steel adds volatility. - Input & regulatory exposure

Sensitive to macroeconomic cycles, regional imbalances, raw material & energy cost fluctuations. Also subject to stringent environmental and safety regulations—mitigation via proactive policies. - Forex & financing

Some financing in foreign currency adds currency risk; capex may increase leverage.

🔎 Final Take

EIGL is a mature, well-diversified Indian player with strong infrastructure, loyal clients, and solid financials. Its strategic shift toward specialty, green hydrogen, and semiconductors aligns with growth trends. However, capex stress, cyclical end‑markets, and commodity sensitivities remain concerns.

Here is a brief financial performance analysis across FY2022 to FY2024:

Revenue

- FY2024: ₹269.47 crore

- FY2023: ₹205.11 crore

- FY2022: ₹244.58 crore

Analysis:

Revenue increased significantly in FY2024 by 31.4% compared to FY2023, recovering from the previous year’s dip. This growth is likely driven by higher demand for industrial and medical gases, improved capacity utilization, and stronger client contracts. FY2023’s drop may have been due to raw material or supply-side pressures.

Profit

- FY2024: ₹45.29 crore

- FY2023: ₹28.14 crore

- FY2022: ₹67.15 crore

Analysis:

Profit grew 60.9% YoY in FY2024, showing operational efficiency and possibly better pricing power. However, FY2022 profit was unusually high, possibly due to COVID-led oxygen demand. FY2023 decline may reflect normalizing margins or higher input costs.

Total Assets

- FY2024: ₹672.54 crore

- FY2023: ₹551.27 crore

- FY2022: ₹414.06 crore

Analysis:

Asset base has been steadily increasing, showing long-term investment in infrastructure, plant capacity, and expansion (likely including the upcoming ASU project). A 64% rise in assets over two years reflects aggressive growth strategy ahead of IPO.

Summary

- FY2024 marks a strong recovery in both revenue and profit.

- Rising asset base indicates planned expansion and increased production capacity.

- The company is financially growing and preparing for future scale, which aligns with its ₹852 crore IPO.