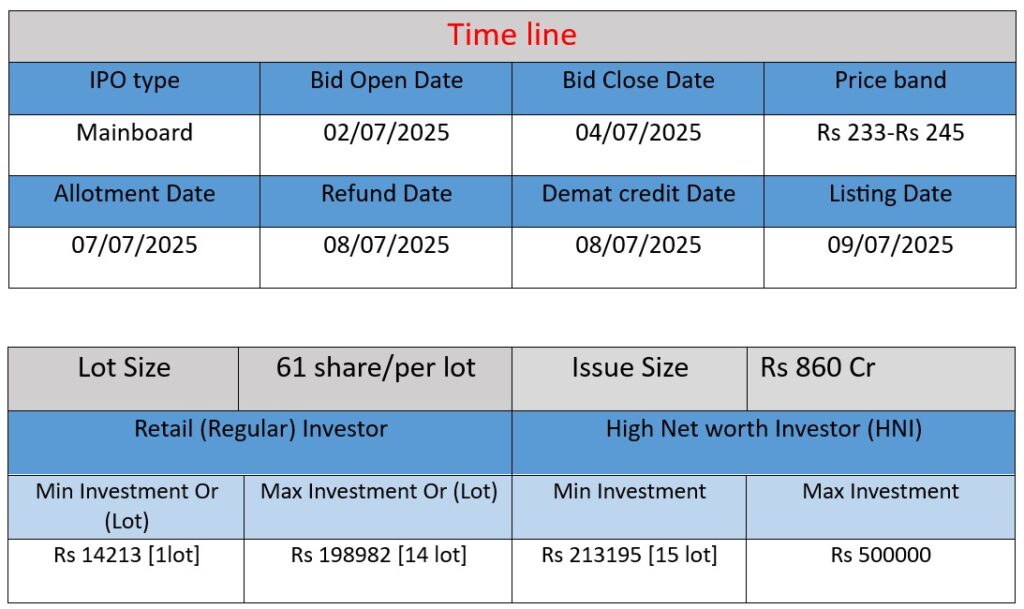

Crizac Limited’s ₹860 crore book-built IPO opens July 2, 2025 and closes July 4, 2025, offering 3.51 cr existing shares (OFS) at ₹233–245 per share (lot size: 61 shares; ₹14,213 minimum). Anchor bidding: July 1. Listing expected on BSE & NSE by July 9. Proceeds go to selling shareholders Pinky & Manish Agarwal only—Crizac receives no fresh capital

Core Business

- B2B Ed‑Tech Platform: Crizac operates a proprietary technology-driven platform connecting global student‑recruitment agents with higher‑education institutions across the UK, Canada, Ireland, Australia, and New Zealand.

- Scale and Reach: As of FY2025, it managed over 10,000 registered agents, 3,948 active agents in 39 countries, and processed roughly 711,000 student applications, serving 173 institutions worldwide

- Clientele & Subsidiaries: Strong ties with major UK universities and operating through overseas subsidiaries (Crizac UK, UCOL FZ) enhance regional presence.

Strengths

- Technology Platform Moat

- A proprietary, AI‑enabled platform seamlessly connects agents and institutions, offering real-time automation and analytics.

- Asset‑Light, Debt‑Free Business

- Almost no debt, high ROE (58%) and ROCE (93%) reflecting strong capital efficiency.

- Extensive Agent & Institutional Network

- Over 10,000 global agents; long-term partnerships with 20+ institutions; deep UK market presence.

- Valuation Similar to Listed Peers

- Trading near peer P/E multiples (Crizac P/E ~28 vs IndiaMART 29.5), supporting its position.

Risks & Weaknesses

- Client Concentration

- Top 3 clients ~85% of revenue, top 10 over 70%—loss of any could significantly impact income.

- Reliance on Agent Network

- Dependent on thousands of third-party agents; partnership failures, fraud, or performance issues could disrupt operations

- Regulatory Exposure

- Stringent visa policies and geopolitical changes, especially in UK, pose risks.

- Tech & Data Vulnerability

- Platform outages, cyberattacks, or security lapses could damage trust and halt operations.

- Geographic Concentration

- Heavy reliance on UK/ANZ markets; brand protection is weak (e.g., unregistered trademark in India).

- Valuation Concerns

- Fully priced IPO (P/E ~28); limited pricing margin relative to peers.

Conclusion

Crizac Limited presents a compelling case as a fast‑growing, asset‑light ed‑tech platform with scalable tech infrastructure, strong agent/institution ties, and superior capital efficiency. However, it carries notable risks—particularly client and geographic concentration, regulatory exposure, and dependency on an external agent network. Additionally, the IPO is priced at a premium relative to earnings history and peer comparables.

For medium to long‑term investors who believe in continued global education demand and trust Crizac’s strategy to diversify services (e.g., adding student loans, B2C direct channels), the company offers an attractive, high‑growth opportunity. Still, it’s important to evaluate the balance between growth potential and exposure to sector‑specific risks before investing.

Here is a brief financial performance analysis across FY2023 to FY2025:

| Metric | FY2023 | FY2024 | FY2025 |

| Revenue | ₹274.1 crore | ₹530.05 crore | ₹849.49 crore |

| Profit | ₹110.11 crore | ₹117.92 crore | ₹152.93 crore |

| Assets | ₹232.06 crore | ₹591.03 crore | ₹877.74 crore |

Revenue

- FY2023: ₹274.1 crore

- FY2024: ₹530.05 crore

- FY2025: ₹849.49 crore

Analysis:

Revenue has more than tripled in just two years, indicating rapid growth in Crizac’s operations, agent onboarding, and global student applications. This reflects strong business scalability and market demand.

Profit

- FY2023: ₹110.11 crore

- FY2024: ₹117.92 crore

- FY2025: ₹152.93 crore

Analysis:

Profit growth is slower compared to revenue growth, showing margin compression. This might be due to increased operational or expansion costs, but profitability remains strong and consistent.

Assets

- FY2023: ₹232.06 crore

- FY2024: ₹591.03 crore

- FY2025: ₹877.74 crore

Analysis:

Asset base has grown significantly, nearly quadrupling in two years. This may reflect investments in technology, global infrastructure, and agent networks. Strong asset growth indicates future scalability potential.

📌 Summary

- Crizac Limited is experiencing explosive revenue growth with a steady rise in profits.

- Despite a slight slowdown in profit margin expansion, the overall profitability and asset base remain strong.

- The company’s asset-light, tech-driven model seems to be scaling well, backed by solid fundamentals.