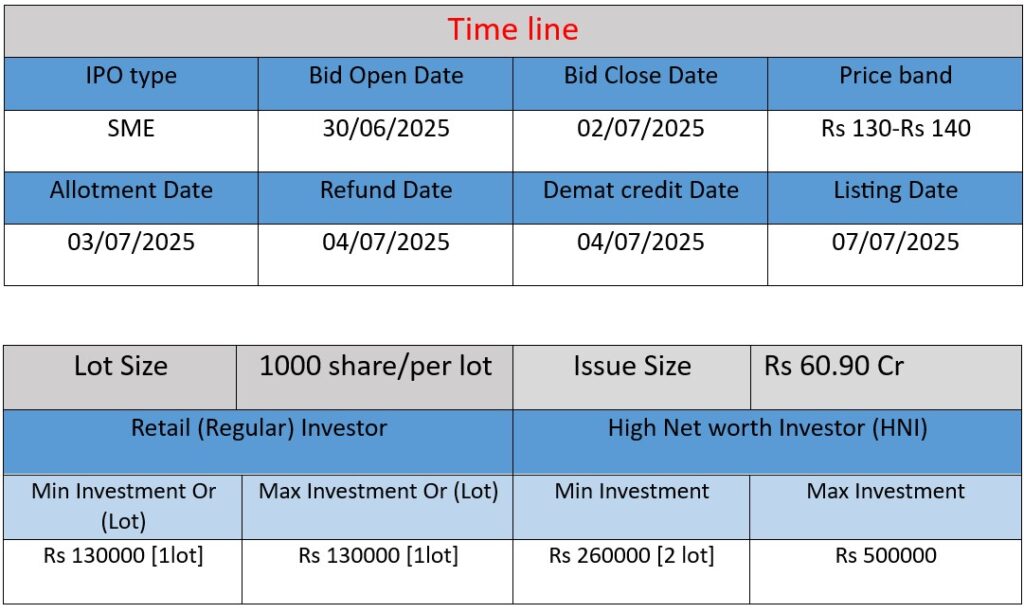

Cedaar Textile Limited’s SME IPO opens on June 30, 2025, and closes on July 2, 2025, raising ₹60.90 cr via a fresh issue of 43.5 lakh shares at ₹130–₹140 per share. Proceeds will fund grid‑tied solar rooftop installation (₹8 cr), machinery modernization (₹17 cr), working capital (~₹24.9 cr), plus general corporate and issue expenses

Company Core Work

Product Portfolio & Manufacturing

Cedaar Textile produces a wide range of yarns—melange, top-dyed, fancy, sweater, cone-dyed, and raw white—using materials like cotton, polyester, acrylic, viscose, Tencel, and modal. Further, the company is venturing into specialty and technical textiles (e.g. flame-retardant IFR yarns), as well as fabric manufacturing such as jersey, interlock, and rib knits.

Business Integration & Sustainability

Operating an integrated plant in Sangrur (Ahmedgarh), Punjab, it sources raw fibers and completes processing in-house. It emphasizes green initiatives like rooftop solar, recycled & organic fibers, digital tools (ERP), and tech upgradation.

Market & Clients

Founded in 2020, it supplies high-quality yarns to both domestic and international garment manufacturers, including those catering to recognized fast-fashion brands like H&M, M&S. The group’s woven garment arm in Bangalore generates ~USD 30 million annually.

2. Strengths

- Diverse & Technical Product Line

From basic to specialty yarns (melange, IFR, sweater yarns), addressing varied textile segments. - Backward Integration & Efficiency

Owning the spinning unit enhances supply chain control, resiliency, and cost efficiency. - Sustainability-Focused

Incorporation of organic/recycled fibers, solar energy adoption, and R&D investments strengthen ESG credentials. - Strong Financial Momentum

FY24 revenues at ₹189.7 Cr with PAT of ₹11.05 Cr and 13.8% EBIT margin; successive growth in revenues, profits, RoE (~44%) and net worth indicates solid financial health.

Key Risks

- Commodity Price Fluctuation

Input fibers (cotton, polyester) are volatile, impacting margins. - Heavy Debt Load

FY24 debt stands at ₹146 Cr versus net worth ₹25 Cr, suggesting high gearing that could strain finances. - Execution & Expansion Risk

Plans for tech upgrades, solar setup, and technical textiles hinge on execution capacity and may impact short-term profits. - Dependence on Major Buyers

Serving brands like H&M, M&S may expose it to demand fluctuations or renegotiations. - Market Competition

Textile is a competitive landscape with risks from overcapacity and price wars.

Conclusion

Cedaar Textile demonstrates a strong integrated model with a diversified product mix, sustainability emphasis, and robust financials. Institutional support ahead of its SME IPO reinforces confidence in growth potential. On the flip side, high debt and commodity volatility are risks. The company’s upcoming structural upgrades and scaling into technical textiles will be critical—if executed well, these could position Cedaar as a compelling mid-tier yarn manufacturer with solid ESG credentials.

Here is a brief financial performance analysis across FY2022 to FY2024:

Revenue

- FY2024: ₹189.68 crore

- FY2023: ₹160.25 crore

- FY2022: ₹217.4 crore

Analysis:

Revenue dipped in FY2023 due to possible market challenges or production constraints but rebounded strongly by FY2024 (up 18.4% YoY). However, it hasn’t yet reached the FY2022 peak, suggesting recovery is in progress.

Profit (PAT)

- FY2024: ₹11.05 crore

- FY2023: ₹4.59 crore

- FY2022: ₹7.99 crore

Analysis:

Despite revenue fluctuations, profit has grown consistently—FY2024 profit jumped 140.7% over FY2023, reflecting stronger operational efficiency, better margins, or cost control initiatives.

Total Assets

- FY2024: ₹198.22 crore

- FY2023: ₹175.84 crore

- FY2022: ₹154.45 crore

Analysis:

Steady asset growth (28% over two years) signals continued investment in capacity, modernization, or infrastructure—aligned with the company’s future growth and IPO objectives.

📌 Summary

- Revenue is stabilizing post a dip in FY2023.

- Profit shows strong growth and improved efficiency.

- Assets are expanding steadily, indicating strategic reinvestment.

- The company appears to be financially strengthening ahead of its IPO, with rising profitability and investment in long-term growth.