हिंदी में पढ़ने के लिए मेनू बार से हिंदी भाषा चयन करें।

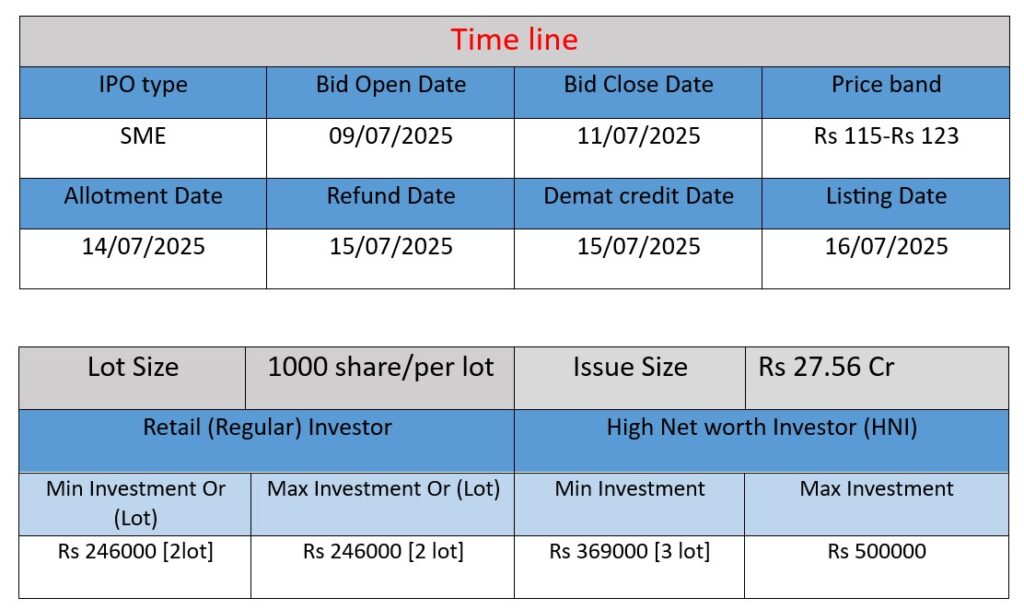

Asston Pharmaceuticals Ltd’s SME IPO opens July 9, 2025 (anchor from July 8) and closes July 11. It’s a 100% fresh issue of 22.41 lakh equity shares, raising ₹27.56 Cr at ₹115–₹123/share. Net proceeds will fund machinery capex , incremental working capital , repayment of borrowings and general corporate purposes. Listing expected on BSE‑SME around July 16, 2025.

Company Overview / Core Work

- Founded in 2019, headquartered in Navi Mumbai, Maharashtra, and incorporated under CIN U24304MH2019PLC324187.

- Business scope encompasses manufacturing and exporting pharmaceutical formulations (tablets, capsules, syrups, sachets, injectables) and nutraceutical products to domestic and international markets—especially South and West Africa and parts of Asia.

- Operates via WHO-GMP and NABL-accredited contract manufacturing partners and has its own regulatory and R&D support for dossiers, formulation development, and quality assurance.

Strengths

- Diverse and broad product portfolio – wide range of dosage forms (tablets, syrups, injectables, external preps) addresses multiple therapeutic and nutraceutical needs.

- Experienced leadership & formulation skills – Promoted by founders with 25+ years in pharma and strong formulation expertise.

- Export-oriented with global reach – Presence in over 10 countries, strong distribution in Africa supported by robust export infrastructure.

- Strong manufacturing and quality systems – WHO-GMP-certified units and accredited testing labs ensure compliance with global standards.

Lean, asset-light approach – Mix of in-house and contract manufacturing allows for flexibility and reduced capital burden.

Risks & Challenges

- Regulatory exposure – Highly regulated environment; non-compliance in GMP or dossier norms could threaten operations.

- Dependence on third-party manufacturers – Reliance on contract partners for certain product lines introduces quality and supply chain risks .

- Customer concentration – Significant revenue comes from a few key clients without long-term contracts (except two one-year agreements); losing one could impact financials.

- Funding & leverage risk – IPO proceeds will fund CAPEX and working capital but higher financial leverage (debt ₹7–8 Cr) could raise interest cost concerns if growth plateaus.

Asston Pharmaceuticals Ltd. is a fast-growing, export-focused MSME in the pharmaceutical and nutraceutical domain. Its strong formulation capabilities, experienced promoters, WHO-GMP compliance, and improving financial performance (with healthy margins and ROCE) position it well for further expansion. However, the company must manage regulatory compliance meticulously, reduce dependency on contract manufacturers and top clients, and ensure disciplined use of IPO proceeds to prevent financial strain and ensure scalable, sustainable growth.

Financial Performance Analysis (in ₹ Crore)

| Year | Revenue | Profit | Total Assets |

| FY 2023 | 6.53 | 1.06 | 13.69 |

| FY 2024 | 15.59 | 1.36 | 20.26 |

| FY 2025 | 25.04 | 4.33 | 28.12 |

Revenue

- 2023: ₹6.53 Cr

- 2024: ₹15.59 Cr (↑ 138.7%)

- 2025: ₹25.04 Cr (↑ 60.6%)

Analysis: The company’s revenue has shown strong growth over the years, with a consistent upward trend, indicating increasing market reach and demand.

Profit

- 2023: ₹1.06 Cr

- 2024: ₹1.36 Cr (↑ 28.3%)

- 2025: ₹4.33 Cr (↑ 218.4%)

Analysis: Profit growth is accelerating significantly, especially in FY 2025. This suggests better cost control, improved margins, or higher-value sales.

Total Assets

- 2023: ₹13.69 Cr

- 2024: ₹20.26 Cr (↑ 47.9%)

- 2025: ₹28.12 Cr (↑ 38.8%)

Analysis: Asset base is expanding steadily, indicating reinvestment in business infrastructure and growing operational capacity.

Conclusion

Asston Pharmaceuticals Ltd. has demonstrated strong revenue and profit growth from FY23 to FY25, with profits increasing at a faster pace than revenue in the latest year. The increasing asset base shows expansion and investment in future growth. The financials reflect a positive business trajectory, making it a potentially attractive prospect for investors.

How Can I Apply for an IPO?

1. Open a Demat Account

To apply for an IPO, having a Demat account is mandatory. You can open one through trading platforms like Zerodha, Groww, Angel One, or Upstox. For example, if you download the Groww app and complete your KYC, your Demat account usually gets activated within 24–48 hours.

2. Ensure You Have a UPI ID or Net Banking Access

While applying, you need either a valid UPI ID (like from Google Pay or PhonePe) or access to Net Banking with ASBA support from your bank. For instance, if you have an account in SBI, you can log in to your Net Banking portal and apply IPO through the IPO section.

3. Apply via App or Bank Portal

There are two ways to apply:

(1) Through trading apps like Zerodha or Groww – go to the IPO section, select Company enter the lot size and your UPI ID, then approve the request in your UPI app.

(2) Through your bank’s Net Banking – go to the ASBA or IPO section, select company, fill in the required details, and submit.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.