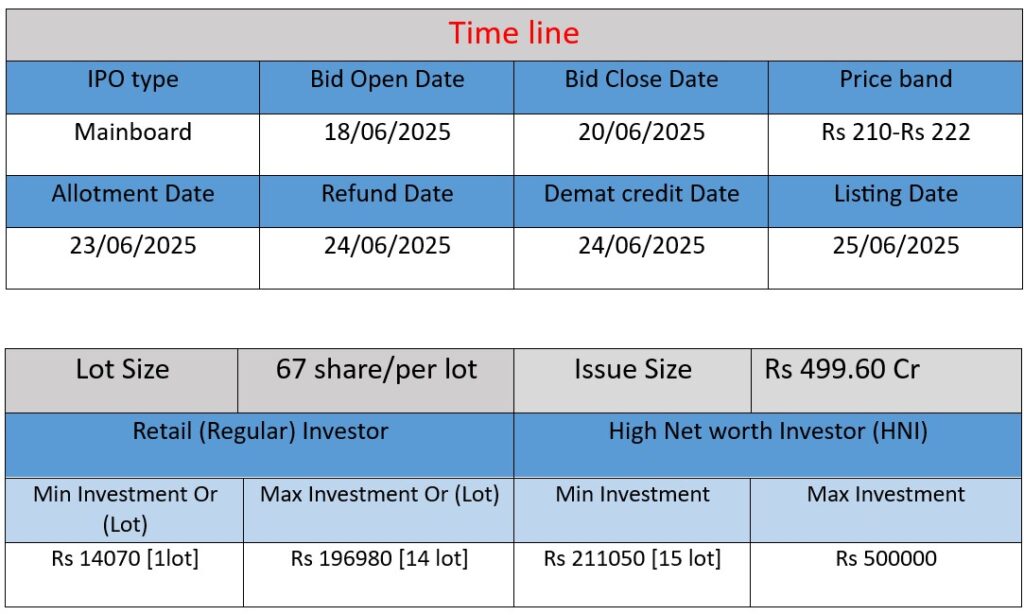

ArisInfra Solutions Ltd IPO opens on June 18 and closes on June 20, 2025, with an issue size of ₹500 crore (fresh issue only). The price band is ₹210–₹222 per share. The IPO aims to repay borrowings, fund working capital, invest in a subsidiary, and cover general corporate expenses. A tech-driven construction supply platform, ArisInfra is rapidly expanding across India’s infrastructure sector

Business model & operations

ArisInfra is a B2B, technology-driven platform specializing in procurement and supply of bulk construction materials—such as aggregates, ready-mix concrete, steel, cement, chemicals, and walling solutions—across India. Founded in 2021, it has delivered over 10 million metric tonnes via 1,458 vendors to 2,133 customers across 963 postal codes, leveraging its proprietary tech stack for real-time quotes, delivery tracking, and credit-risk analysis

Strengths

- Tech-first model: Utilizes AI/ML for streamlined procurement, reducing intermediaries, ensuring faster deliveries, and improving vendor communication

- Rapid scale: Expanding delivery geography and customer base aggressively, including growth in third‑party manufacturing, which improved margins and quality control

- Network & ecosystem: Large vendor base, strong relationships with major developers (Capacit’e, Afcons, J Kumar etc.) and robust credit risk framework

- IPO momentum: Backed by PharmEasy co‑founder Siddharth Shah, IPO set at ₹210–222 per share (~₹500 Cr issue) with a strong grey‑market premium hinting at ~18% listing rise

Risks

- Customer & product concentration: FY2024 revenue heavily dependent on aggregates (31%), RMC (21%), steel (16%)—a downturn would dent performance

- Geographical concentration: 80–92% revenues stem from Maharashtra, Karnataka & Tamil Nadu. Regional slowdowns or regulatory disruptions could impact outcomes

- Customer dependency: Top 10 customers contributed ~45% of revenue; no long‑term agreements increase revenue uncertainty

- Working capital pressures: High dependence on vendor and customer credit cycles; further financing needs may arise

- Operational/tech vulnerability: Risks include third‑party manufacturing partners, tech outages, and data security breaches .

IPO Snapshot

| Item | Detail |

| IPO Size | ₹500 Cr (fresh), anchored by QIBs/NIIs/retail |

| Price Band | ₹210–222 per share |

| Grey Market Premium | +10.8% to +18% signals interest |

| Use of funds | Repay borrowings ( |

| Lead Managers | JM Financial, IIFL, Nuvama; Registrar: Link Intime |

Verdict:

ArisInfra brings powerful tech-led disruption to a fragmented market, supported by strong growth, investor enthusiasm, and a positive internal culture. However, this growth comes with exposure to regional and customer concentration, as well as short-term financial stress. Investors may find it compelling—with caution toward its execution and profitability path.

Here is a brief financial performance analysis across FY2022 to FY2024:

Revenue

| Year | Revenue (₹ Cr) |

| FY2022 | 452.35 |

| FY2023 | 746.07 |

| FY2024 | 695.84 |

Analysis:

- Revenue grew 65% from FY2022 to FY2023 (₹452.35 Cr → ₹746.07 Cr), showing strong initial scaling.

- However, in FY2024, revenue declined by 6.73%, possibly due to slowdowns in construction activity or regional dependence.

Profit (Loss)

| Year | Profit/Loss (₹ Cr) |

| FY2022 | -6.49 |

| FY2023 | -15.39 |

| FY2024 | -17.30 |

Analysis:

- Losses have widened over the years:

• FY2022: ₹-6.49 Cr

• FY2023: ₹-15.39 Cr (>2x jump)

• FY2024: ₹-17.30 Cr - Despite revenue increase in FY2023, losses more than doubled, indicating high operational and interest costs.

- FY2024 saw reduced revenue but continued rise in losses, suggesting increasing cost pressure or inefficient spending.

Total Assets

| Year | Assets (₹ Cr) |

| FY2022 | 334.22 |

| FY2023 | 394.95 |

| FY2024 | 492.83 |

Analysis:

- Asset base has grown consistently:

• FY2022 → FY2023: +18.2%

• FY2023 → FY2024: +24.8% - Suggests ongoing investments in infrastructure, platforms, and working capital—though possibly debt-driven, as net losses persist.

📌 Conclusion

- Growth Stage: The company is in a high-growth, high-burn phase, expanding operations and asset base.

- Financial Risk: Despite asset growth, widening losses and a recent dip in revenue raise red flags for financial sustainability.

- IPO Relevance: The upcoming IPO could provide essential funding to reduce debt and support operations, but profitability remains a challenge.