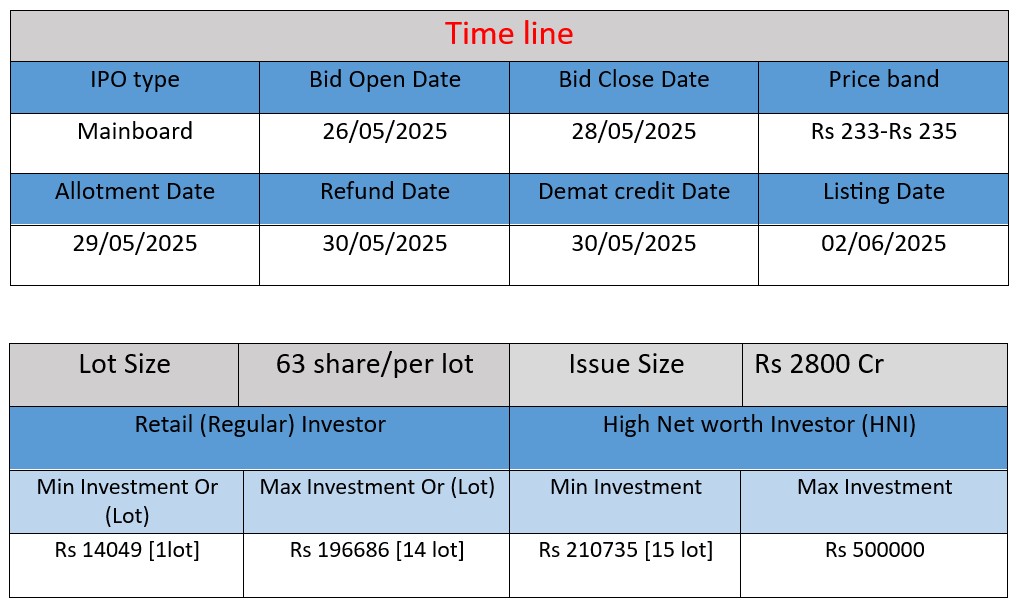

Aegis Vopak Terminals Limited plans to raise ₹2,800 crore through its IPO. The issue includes fresh issuance of shares to repay debt and fund capital expenditures, including acquiring a cryogenic LPG terminal in Mangalore. The IPO aims to strengthen the company’s financial position and support future growth in India’s energy storage sector.

Aegis Vopak Terminals Limited (AVTL) is a leading independent tank storage provider in India, specializing in the storage and handling of LPG and liquid products. Formed as a joint venture between Aegis Logistics Limited and Royal Vopak of the Netherlands, AVTL operates a network of strategically located terminals across major Indian ports. Below is an overview of the company’s operations, strengths, and potential risks.

Core Business Activities

AVTL provides storage and logistics solutions for a variety of products, including:

- Liquefied Petroleum Gas (LPG)

- Petroleum products

- Chemicals

- Vegetable oils

- Bitumen

The company operates 20 tank terminals across key Indian ports such as Kandla, Pipavav, Haldia, Kochi, and Mangalore. These facilities offer services like product storage, jetty connectivity, truck loading stations, and pipelines, ensuring efficient movement of products from ship to shore.

Recent Developments

AVTL is planning an Initial Public Offering (IPO) to raise ₹2,800 crore. The proceeds are intended for debt reduction and capital expenditure, including the acquisition of a cryogenic LPG terminal in Mangalore.

Strengths

1. Market Leadership

- AVTL is the largest third-party owner and operator of tank storage terminals for LPG and liquid products in India. As of June 30, 2024, the company contributes approximately 12.23% of the total national static capacity for LPG and approximately 26.64% of India’s third-party liquid storage capacity.

2. Strategic Terminal Locations

- The company’s terminals are strategically located across five key ports on India’s west and east coasts, handling approximately 23% of liquid and 61% of total LPG import volumes in the country.

3. Diversified Customer Base

- AVTL serves over 400 customers, including major national oil marketing companies. This diversified clientele reduces dependency on any single customer and enhances revenue stability.

4. Strong Promoter Support

- The joint venture benefits from the combined expertise of Aegis Logistics and Royal Vopak. Aegis brings experience in capacity expansion and cost-effective procurement, while Vopak contributes global best practices in tank storage operations.

Risks

1. High Debt Levels

- As of September 2024, AVTL had total borrowings of ₹2,546.7 crore. The IPO aims to reduce this debt burden, but high leverage remains a concern until the proceeds are effectively utilized.

2. Customer Concentration

- While the company has a broad customer base, the top five customers accounted for approximately 30.72% of revenue in FY24. Any significant loss of these customers could adversely affect the company’s financial performance.

3. Regulatory and Environmental Compliance

- Operating in the storage and handling of hazardous materials, AVTL is subject to stringent environmental and safety regulations. Non-compliance could lead to legal penalties and reputational damage.

4. Market Volatility

- The company’s performance is influenced by global commodity prices and demand-supply dynamics in the oil and gas sector. Market volatility can impact storage volumes and revenue.

In summary, Aegis Vopak Terminals Limited holds a strong position in India’s tank storage industry, backed by strategic partnerships and a diversified customer base. However, potential investors should consider the company’s debt levels and market risks before making investment decisions.

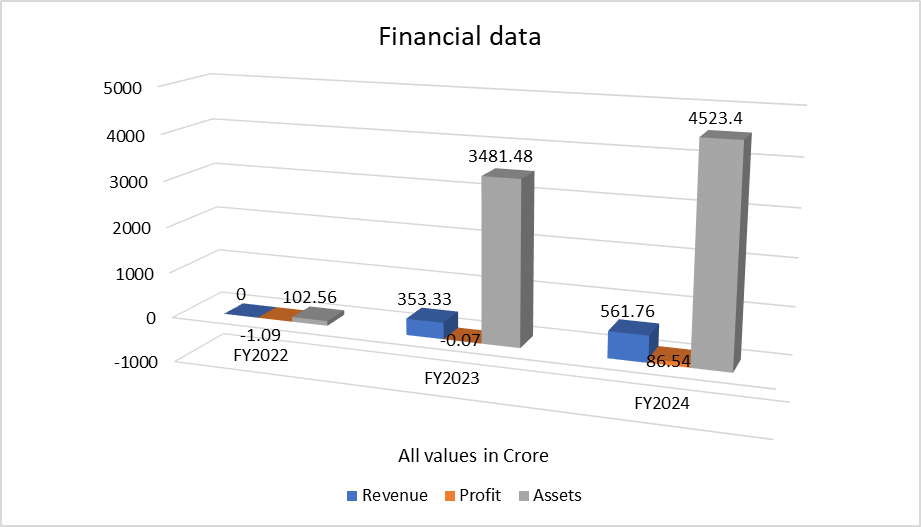

Based on the data provided for Aegis Vopak Terminals Limited, here is a brief financial performance analysis across FY2022 to FY2024:

Financial Performance Summary

| Financial Year | Revenue (₹ Cr) | Profit (₹ Cr) | Total Assets (₹ Cr) |

| FY2022 | 0.00 | -1.09 | 102.56 |

| FY2023 | 353.33 | -0.07 | 3481.48 |

| FY2024 | 561.76 | 86.54 | 4523.40 |

Analysis

1. Revenue Growth

- FY2022 to FY2023: From ₹0 to ₹353.33 Cr — Company started operations.

- FY2023 to FY2024: 59% increase in revenue — strong upward trend showing business expansion.

2. Profitability

- Losses in FY2022 and FY2023 indicate early-stage operations.

- Turned profitable in FY2024 with ₹86.54 Cr profit — shows successful operational scaling and efficiency.

3. Asset Growth

- FY2022 to FY2023: Assets jumped from ₹102.56 Cr to ₹3481.48 Cr — major capital investment.

- FY2023 to FY2024: Further increased to ₹4523.40 Cr — reflects continued infrastructure buildup.

Conclusion

Aegis Vopak Terminals Limited has demonstrated rapid growth, moving from zero revenue and losses to substantial income and profit in FY2024. The asset base expansion supports its long-term infrastructure play. The IPO appears well-timed to leverage this momentum.