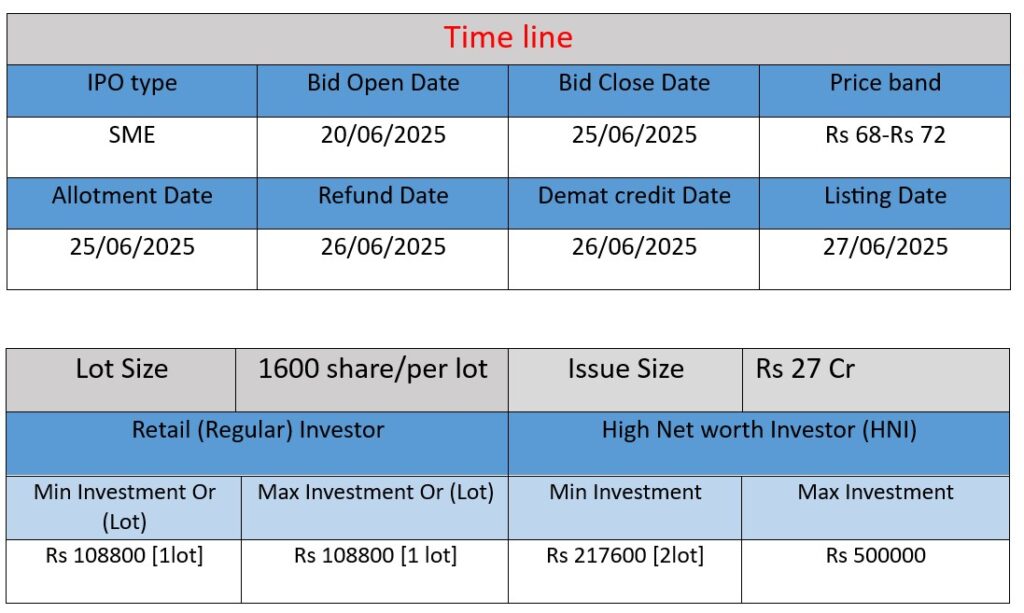

Aakaar Medical Technologies IPO opens on June 20, 2025, with an issue size of ₹27crore. The company plans to list on NSE SME. IPO proceeds will be used for working capital needs, repaying debts, and general corporate purposes. Aakaar specializes in aesthetic medical devices and biotech-based skincare solutions. Investors eye this IPO for the company’s strong growth, innovation, and expanding healthcare presence.

Work & Business Scope

Product portfolio & operations:

- Aakaar develops and markets aesthetic healthcare and medical‑grade skin/hair devices and consumables, including lasers (e.g., YAG, diode), microneedling pens, skincare cosmeceuticals, and exosome-based medifacial kits.

- They hold ISO, GMP certifications, CE marking, and FDA approvals for many products, ensuring compliance with global safety and performance standards.

- The company distributes across India with ~20+ years in business and a network of sales/service teams in multiple major cities.

- At the AMI 2025 conference, Aakaar showcased its Lytec® skincare line and the EXOLUXE exosome‑powered medifacial kit, underlining its focus on R&D and premium product innovation.

Strengths

1. Strong regulatory compliance & quality standards

Maintains ISO/GMP facilities, CE, FDA approvals, and clinical-trial backing—solidifying trust in product safety and efficacy .

2. Diversified, innovative product range

From lasers and microneedling to biotech-driven skincare and exosome therapies, they cater to a wide aesthetic and dermatology market .

Risks & Challenges

1. Dependence on SME segment

IPO is on the NSE SME board, which may carry lower liquidity and higher volatility than the main board .

2. Debt obligations

The company has open charges of ₹21 crore (₹16 cr ‘others’ + ₹5 cr Citi Bank loan), indicating leveraged operations.

3. Intense competition & tech evolution

The aesthetic healthcare market is crowded with domestic and international firms; ongoing innovation is essential to stay competitive.

4. Regulatory risks

While current approvals exist, future products may need additional approvals (e.g., for AI/ML-enabled devices), which can be time‑consuming and risk delays.

5. Workforce consistency & cost management

AmbitionBox ratings show average employee satisfaction (~3.3–3.7/5) and room for bolstering talent retention, which could impact quality or growth.

Bottom line:

Aakaar Medical combines regulatory rigor, diverse innovation, and strong financial growth with expanding visibility via its SME IPO. However, investors should monitor SME-liquidity risk, leverage levels, and competitive pressure in the evolving med-tech and aesthetics landscape.

Here is a brief financial performance analysis across FY2023 to FY2025:

Revenue

- FY2023: ₹32.78 crore

- FY2024: ₹46.11 crore

- FY2025: ₹61.58 crore

Analysis:

Revenue grew significantly over the three years.

- FY2024 saw a 40.6% increase over FY2023

- FY2025 saw a 33.6% increase over FY2024

This reflects strong and consistent business expansion, likely due to increased product demand and broader market reach.

Profit

- FY2023: ₹2.15 crore

- FY2024: ₹2.87 crore

- FY2025: ₹6.04 crore

Analysis:

Profit growth is robust and accelerating.

- FY2024 grew by 33.5%

- FY2025 nearly doubled with 110.4% growth

Indicates effective cost control and higher profit margins, possibly from scaling operations or premium product sales.

Assets

- FY2023: ₹23.23 crore

- FY2024: ₹34.01 crore

- FY2025: ₹54.10 crore

Analysis:

Total assets rose rapidly, reflecting reinvestment of earnings and asset expansion.

- FY2024 saw a 46.4% increase

- FY2025 jumped by 59.0%, which may support upcoming IPO goals, such as infrastructure growth or product development.

Summary

- Consistent revenue growth of over 30% YoY

- Profit more than doubled in FY2025

- Asset base more than doubled in just two years

- The financial trend signals strong financial health, operational efficiency, and a growth-ready company—making its IPO promising for investors.