हिंदी में पढ़ने के लिए मेनू बार से हिंदी भाषा चयन करें।

In the face of growing economic uncertainty, global investors are once again turning to U.S. Treasuries—widely regarded as one of the safest investment options in the world. Heightened trade tensions, rising fiscal deficits, and concerns over future interest rate policies have prompted a noticeable shift away from riskier assets toward government-backed bonds.

What’s Happening?

1. Flight to U.S. Treasuries

Over the past few days, investors have shown a strong appetite for U.S. government bonds. This behavior reflects what is commonly known as a “flight to quality”—when markets become volatile or uncertain, investors move capital into safe assets such as U.S. Treasuries.

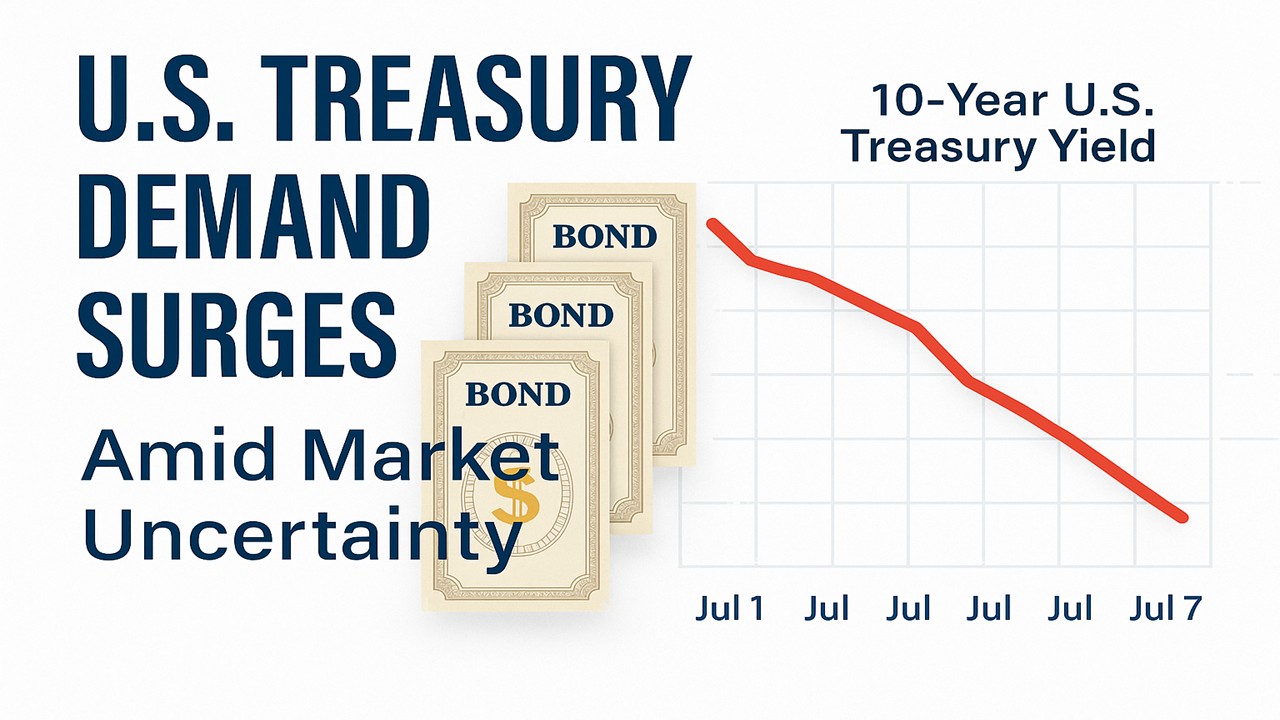

2. Yields Decline as Demand Surges

As demand for bonds increases, prices rise and yields fall. The 10-Year U.S. Treasury yield has dropped to around 4.29%, reflecting increased investor confidence in safer government-backed securities during uncertain times.

Why Are Investors Flocking to Treasuries?

🇺🇸 1. Trump’s Tariff Threats

Former President Donald Trump has proposed new trade tariffs, some as high as 70%, on a range of imported goods. These aggressive policies have reignited fears of a global trade war, leading investors to reposition their portfolios defensively.

💼 2. Concerns Over U.S. Fiscal Deficit

Trump’s proposed tax reforms and subsidies could potentially add over $3 trillion to the national debt. A rising deficit fuels uncertainty about the long-term stability of the U.S. economy, making Treasuries a preferred short-term refuge.

🌍 3. Decline in Foreign Bond Purchases

Major international holders of U.S. debt—like China and Japan—have recently reduced their purchases of Treasuries. This vacuum is increasingly being filled by domestic investors, including mutual funds, banks, and households.

What Does Falling Yield Indicate?

| Indicator | Meaning |

| Lower Yields | Investors expect slower growth or potential interest rate cuts. |

| High Demand | Sign of caution or fear in the broader markets. |

| Debt Load Rising | Long-term yields could spike if investor confidence weakens. |

What Comes Next?

- If tariffs are implemented, trade may slow, further driving demand for Treasuries.

- If the Federal Reserve cuts rates or signals a dovish stance, Treasury prices may rise further.

- However, rising national debt could eventually reverse investor sentiment, pushing long-term yields higher and impacting bond prices negatively.

Today’s sharp movement toward U.S. Treasuries signals a classic defensive posture from global investors. While this move provides short-term safety, it also reflects deep-seated concerns about trade policy, rising debt, and uncertain monetary direction. The coming weeks—especially with tariff decisions, Fed minutes, and earnings reports—will be critical in determining whether this flight to safety is temporary or a long-term trend.

Sources: Reuters, Investopedia,Barron’s