हिंदी में पढ़ने के लिए मेनू बार से हिंदी भाषा चयन करें।

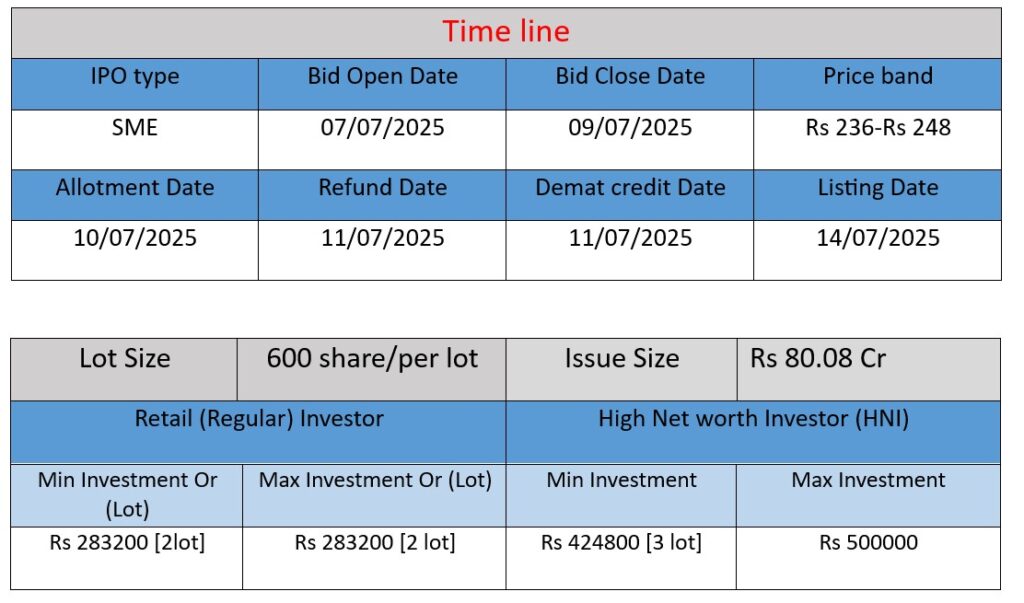

Chemkart India Ltd’s SME IPO opens on July 7 and closes on July 9, 2025, with an issue size of ₹80.08 crore. The price band is set at ₹236–₹248 per share. Proceeds will be used for setting up a new manufacturing subsidiary, repaying debts, and general corporate purposes. The IPO will list on the BSE SME platform, with expected listing on July 14. Investors should evaluate growth potential against supply chain and operational risks.

Company Overview and Core Work

- Founded in 2020 (private limited) and headquartered in Santacruz, Mumbai, Chemkart India Limited operates as a B2B importer, distributor, and processor of Food, Health & Nutraceutical ingredients.

- Specializes in a diverse product portfolio including amino acids, vitamins, herbal extracts, nucleotides, proteins, sweeteners, and sports nutrition ingredients.

- Operates a 28,259 sq ft facility in Bhiwandi (near Mumbai) offering in‑house hygienic blending, grinding, packaging, and warehousing, with ~1.8 MT/day grinding and 1.5 MT/day blending capacity.

Strengths

- Diverse Product Portfolio

Spanning seven core categories and over 150 ingredients, Chemkart offers flexibility to meet varied B2B client needs. - In‑house Processing & Warehousing

Maintaining quality control and operational efficiency with its own facility and trained workforce. - Strong B2B Customer Relationships

Long-term client ties in nutraceuticals/health ingredients boost recurring business and reliability.

Trend Detection & First-Mover Launches

Claims to swiftly identify global ingredient trends and bring them to market ahead of competitors

Risks

- Supplier Dependency & No Binding Contracts

Relies heavily on top 5–10 suppliers (mostly from China) without formal agreements, posing a risk to supply continuity. - Revenue Concentration by Geography

~57–78% of sales are from just Maharashtra, Gujarat, and Delhi – exposing it to regional disruptions. - Client Concentration

Top 10 customers account for ~45–55% of revenues, raising concerns about over‑reliance . - Limited Operating History

India presence since 2020; relatively young in navigating regulatory/market complexities. - Operational & Regulatory Risks

Includes lack of FSSAI registration for warehouse, possible lease expiry, related-party transactions, pending litigation, and regulatory filing discrepancies.

Chemkart India Limited presents a solid growth narrative in the expanding nutraceutical ingredients sector, supported by its diverse portfolio, quality processing infrastructure, and strong financial metrics. However, it faces notable operational and market risks—notably supplier and customer concentration, concentrated geography, a limited track record, and typical SME listing challenges.

For investors and stakeholders, the company appears well-positioned to capitalize on the wellness trend and B2B demand—if it effectively mitigates supply chain and diversification risks. Whether you’re evaluating it from a financial or strategic standpoint, balancing its strengths with these inherent vulnerabilities is key before participation or partnership.

Financial Comparison Table (₹ in Crore)

| Particulars | FY2023 | FY2024 | FY2025 |

| Revenue | 131.38 | 132.03 | 203.28 |

| Profit | 7.66 | 14.52 | 24.27 |

| Assets | 37.48 | 53.51 | 86.12 |

Revenue Analysis

- FY2023 to FY2024: Revenue remained almost flat, rising marginally from ₹131.38 Cr to ₹132.03 Cr.

- FY2024 to FY2025: Significant jump of ₹71.25 Cr (53.9%) indicating strong business growth and increased market demand.

Profit Analysis

- FY2023 to FY2024: Profit nearly doubled, growing from ₹7.66 Cr to ₹14.52 Cr (89.5% increase), reflecting better cost management or margin expansion.

- FY2024 to FY2025: Continued strong growth to ₹24.27 Cr (67.1% increase), suggesting improved operational efficiency and higher scalability.

Asset Analysis

- Assets grew steadily, showing:

- FY2023 to FY2024: 42.7% growth from ₹37.48 Cr to ₹53.51 Cr.

- FY2024 to FY2025: 60.9% rise to ₹86.12 Cr, possibly due to expansion in warehousing, infrastructure, or investments in new operations.

Conclusion

Chemkart India Ltd has shown consistent financial growth, especially between FY2024 and FY2025. Revenue surged by over 50%, and profit rose steadily, reflecting robust demand and operational strength. The asset base also expanded, indicating reinvestment into the business. Overall, the company demonstrates a healthy and scalable growth trajectory, especially attractive for investors looking at the nutraceutical and ingredients sector.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.