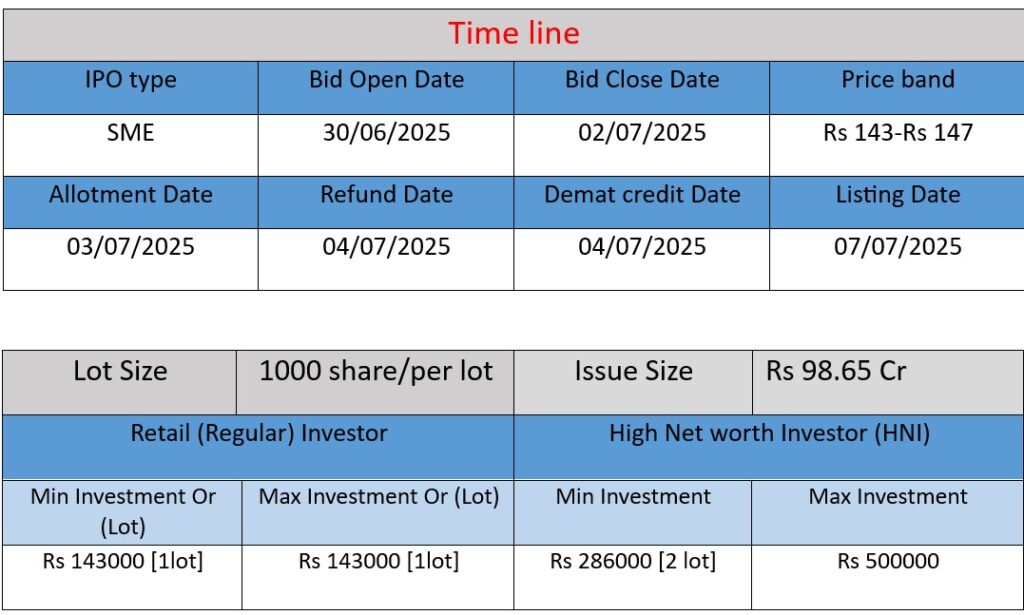

Pushpa Jewellers Ltd IPO opens on June 30 and closes on July 2, 2025, with an issue size of ₹98.65 crore. The price band is ₹143–₹147 per share. The IPO aims to fund working capital requirements and general corporate purposes. Listing is scheduled on NSE Emerge on July 7.

Company Overview

- Founded in June 2009 and converted to a public limited company in 2024, the company was originally established by Mridul Tibrewal and is headquartered in Kolkata, West Bengal.

- Specializes in lightweight 22‑karat gold jewellery, combining traditional Indian designs with modern aesthetics, manufactured using skilled karigars in Kolkata.

- Operates primarily as a B2B wholesaler, serving retailers across India and exporting to markets such as Dubai, the U.S., and Australia. It also runs three office-cum-showrooms in Hyderabad, Bangalore, and Chennai.

Strengths

- Asset-light with low debt: Known for low debt levels and improving EBIT margins in line with annual profit growth — a standout among peers .

- Innovations in design: Cutting-edge strike with stone-weightless, lightweight concepts that reduce gold usage by ≈30%, improving inventory turnover and retailer profitability.

- Robust operational efficiency: BIS hallmarking, technology-driven inventory control, stringent security, and brand identity helped cement relationships with over 500 retailers.

Risks

- Client concentration risk: Heavy reliance on key customers could significantly affect revenues if any client switches.

- Supply chain vulnerabilities: Dependence on a few raw-material suppliers and freelance karigars could disrupt production and inflate costs.

- Order execution issues: Changes or cancellations, especially with verbal orders, pose risks to cash flow and operational scaling.

- Logistics dependency: Reliance on third-party transport exposes them to infrastructure challenges and rising delivery costs.

- Gold price fluctuations: As a gold-intensive company, earnings are sensitive to bullion price swings .

Pushpa Jewellers has carved out a strong niche in the gold jewellery wholesale segment by innovating in lightweight, stone‑weightless designs that help retailers improve margins and inventory turnover. Its impressive financial track record and operational strengths make it a standout SME in the jewellery sector. However, it must navigate challenges like supply chain stability, customer concentration, and bullion price volatility.

Here is a brief financial performance analysis across FY2022 to FY2024:

Revenue

- FY2024: ₹255.34 crore

- FY2023: ₹165.80 crore

- FY2022: ₹107.66 crore

Analysis:

Revenue has grown consistently, with a 57% increase in FY2023 and a 54% rise in FY2024. This shows strong demand for the company’s lightweight gold jewellery, possibly driven by business expansion and improved market reach.

Profit

- FY2024: ₹13.58 crore

- FY2023: ₹8.14 crore

- FY2022: ₹6.17 crore

Analysis:

Net profit grew by 32% in FY2023 and 67% in FY2024, reflecting better operational efficiency and margins. Rising profits suggest improved cost control and pricing strategy.

Total Assets

- FY2024: ₹51.48 crore

- FY2023: ₹43.38 crore

- FY2022: ₹21.78 crore

Analysis:

The asset base more than doubled from FY2022 to FY2024, indicating capital infusion and business scale-up. This also shows the company’s readiness for handling larger operations post-IPO.

Summary

- Pushpa Jewellers has shown strong and consistent growth in revenue and profit over three years.

- The company has been scaling its operations with expanding assets and improved profitability.

- This financial trend supports its IPO ambitions and reflects a positive business outlook, though investors should still consider operational and market-related risks.