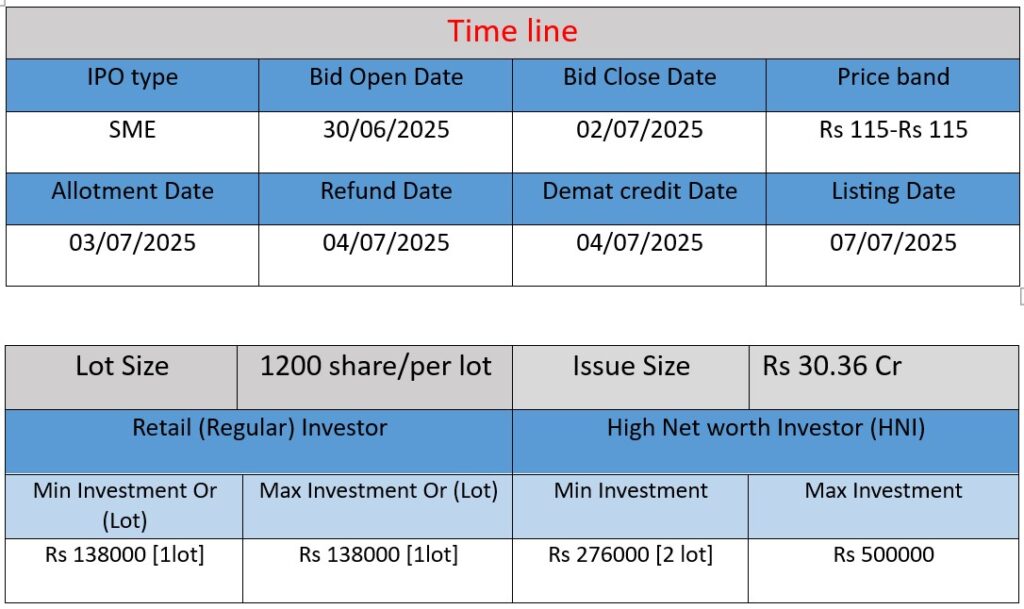

Vandan Foods Limited’s IPO (BSE – SME): A fixed-price public issue of 26.4 lakh shares at ₹115 each to raise ₹30.36 crore. The proceeds will be used for debt repayment, working capital

Company Core Work

- Established & Focus: Incorporated in December 2015 and converted to a Public Limited Company in December 2023, Vandan Foods operates from Gujarat, with manufacturing facilities in Dhinoj, Patan. It specializes in producing Refined First‑Stage Grade Castor Oil and Castor De‑Oiled Cake, serving both B2B and B2C segments.

- Product Applications: Its castor oil is used across pharmaceutical, paint, textile, lubricant, cosmetic, resin, and agricultural industries.

- Quality & Distribution: The company maintains ISO-certified quality control and distributes products across several Indian states—including Gujarat, Haryana, Telangana, Delhi, Andhra Pradesh, Rajasthan, and Bihar .

Strengths

- Experienced Leadership & Industry Expertise

- Promoters have strong agrarian and castor-processing experience, enabling efficient operations and growth.

- Quality Assurance

- ISO certification plus lab-tested raw materials ensures consistent product quality.

- Product & Customer Diversification

- It offers both castor oil and de-oiled cake, catering to multiple industries and reducing dependency on a single revenue stream.

- Scalable & Order‑Driven Model

- Low capital intensity with room for expansion; IPO proceeds include CAPEX for facility expansion at Dhinoj.

- Stable Supply and Demand Links

- Long-term supplier relationships and repeat clients underpin operational stability.

Risks & Challenges

- Customer Concentration

- Dependence on key clients could expose operations to demand fluctuations if clients’ financial health deteriorates .

- Raw Material Risk

- Heavy reliance on select suppliers could lead to quality, cost, or supply disruptions, affecting margins.

- Regional Dependency

- A substantial portion of business is based in Gujarat; adverse developments (e.g., climatic or regulatory) in that region may impact overall performance .

- Litigation Exposure

- The company and its promoters face legal cases; unfavorable outcomes could bring financial penalties or reputational damage.

- Cash‑Flow & Seasonal Variability

- The company has reported negative cash flows in operations, investing, and financing in recent periods, with business exhibiting seasonality.

- Growth & Utilization Risk

- Expansion hinges on successful deployment of IPO proceeds. Underutilized capacity or weaker-than-expected demand may dilute returns.

Vandan Foods Ltd is a niche, mid‑size castor‑oil specialist with solid financial metrics, quality systems, and diversified customers. Its strengths lie in operational scalability, robust profitability, and a multi-industry presence. However, risks include customer or supplier dependence, regional concentration, legal proceedings, and cash-flow volatility.

For investors, the company presents potential upside through IPO-fueled expansion and stable demand-supply dynamics. Yet, these positives must be weighed against concentration risks and financial flexibility challenges. Careful monitoring of execution on facility expansion, client diversification, and cash-flow improvements will be critical in determining long-term value.

Here is a brief financial performance analysis across FY2022 to FY2024:

Revenue

- FY2024: ₹48.73 crore

- FY2023: ₹11.59 crore

- FY2022: ₹1.47 crore

Analysis:

Revenue has grown exponentially over three years—more than 4x growth from FY23 to FY24, and over 30x from FY22 to FY24. This reflects strong demand for the company’s products and possibly increased production capacity or better market reach.

Profit (PAT)

- FY2024: ₹2.64 crore

- FY2023: ₹0.64 crore

- FY2022: ₹(0.11) crore (loss)

Analysis:

The company turned profitable in FY23 and further strengthened in FY24 with a 4x jump in profit. This indicates improving operational efficiency, economies of scale, and better cost management.

Total Assets

- FY2024: ₹12.12 crore

- FY2023: ₹4.74 crore

- FY2022: ₹4.2 crore

Analysis:

Assets tripled in FY24, suggesting significant reinvestment in infrastructure, possibly in anticipation of expansion. This supports the company’s IPO plan to scale operations further.

📌 Summary

- Revenue and profit have seen strong and consistent growth, especially in FY24.

- The company has moved from losses to profitability in just 2 years.

- Asset base expansion reflects readiness for future capacity enhancements.

- These trends indicate robust business momentum, making the IPO attractive for growth-focused investors.