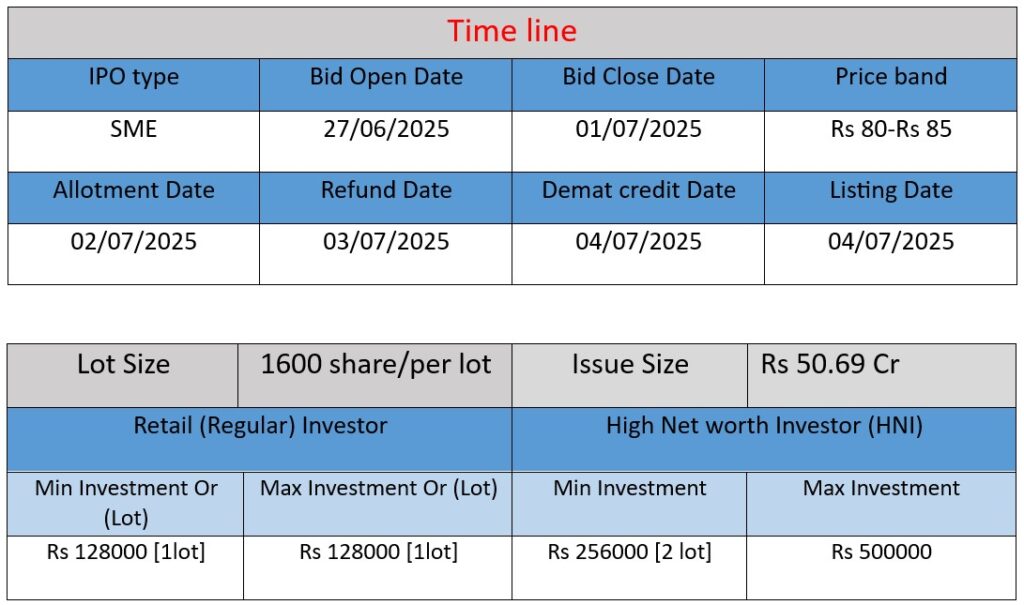

Adcounty Media India Limited has launched a ₹50.69 cr book-built IPO (59.63 lakh fresh shares) on BSE SME, priced between ₹80–85, open from June 27 to July 1, 2025, with allotment on July 2 and listing on July 4. Funds will support capital expenditure, working capital, potential acquisitions, and general corporate purposes. The BrandTech & AdTech company delivers performance-driven digital marketing and proprietary ad-tech globally.

Company Overview & Core Work

- BrandTech + AdTech specialist: Founded in 2017, serves as an end‑to‑end partner for brands—managing everything from SEO/SEM, social media marketing, programmatic advertising, to performance‑driven campaigns (CPL/CPS/CPA/CPI). Operates globally across ~47 countries with offices in India, UAE, Singapore, Indonesia, Malaysia, Philippines, Brazil, Germany, Romania.

- Proprietary technologies: Key tools include BidCounty (AI‑powered DSP for real‑time bidding, targeting, and analytics), Opsis for full‑funnel performance marketing, Genwin for lead generation, iSearch Ads, and SeeTV for shoppable CTV ads.

- Industry focus: Core target sectors include fintech/BFSI, e‑commerce, travel, FMCG, gaming, and automotive, serving marquee clients like Zepto, ShareChat, Fi.Money, PolicyBazaar, BankSathi, MUV, and Freshokartz.

Strengths

- Tech & data advantage

- Use of proprietary platforms ensures high viewability (95%+), strong automation, and analytics-driven optimization.

- ISO/IEC 27001:2022 certification underlines robust information security practices.

- Global presence & client diversity

- Operating in nearly 47 countries, mitigating currency/country risk.

- Sectoral diversification and strong agency partnerships (e.g., GroupM, Publicis) reduce concentration risk.

- Performance‑based billing model

- Aligns company incentives with client outcomes, fostering trust and repeat business.

Risks

- High client concentration

- Top 10 clients contribute ~59–77% of revenue, increasing dependency risk.

- Cash‑flow fluctuations

- Historically negative investing cash flows due to equipment investments and FDs, stressing liquidity.

- Macroeconomic exposure

- Client marketing budgets may be cut during economic slowdowns, affecting topline growth.

- Promoter & legal overhang

- First‑generation promoters; some legal/tax cases (~₹7.9 cr) and links to Innovana Thinklabs may raise governance concerns.

- Operational dependencies

- Relies on leased offices, with reliance on top suppliers and regular tech upgrades that could lead to capital strain.

Conclusion

AdCounty Media India presents a high-growth, asset-light, performance-metrics-driven digital advertising platform. Backed by proprietary ad-tech and strong financials, it is well-positioned to capitalize on booming digital ad spend. However, investors should note risks related to client dependency, cash-flow volatility, promoter experience, and legal encumbrances.

In essence: A financially disciplined, technology-forward AdTech player with global reach—and solid upside—though exposure to concentration and operational/legal risks requires cautious monitoring.

Here is a brief financial performance analysis across FY2022 to FY2024:

Revenue (₹ in crore)

- FY2022: ₹30.98

- FY2023: ₹53.56

- FY2024: ₹42.66

Analysis:

Revenue rose sharply by 73% in FY2023, indicating strong growth. However, FY2024 saw a decline of 20.3%, suggesting possible short-term business slowdown or strategic shift.

Profit (₹ in crore)

- FY2022: ₹2.00

- FY2023: ₹7.63

- FY2024: ₹8.28

Analysis:

Profit increased 281.5% in FY2023 and further rose by 8.5% in FY2024, despite the dip in revenue—implying improved margins and cost control.

Total Assets (₹ in crore)

- FY2022: ₹18.65

- FY2023: ₹26.84

- FY2024: ₹29.51

Analysis:

Assets have consistently grown over the years, showing stable asset base expansion to support operations and technology investments.

📌 Summary

- Strong profitability growth despite revenue volatility.

- Stable asset base with capital-efficient operations.

- FY2024 revenue dip requires monitoring, but margin expansion is a positive sign.