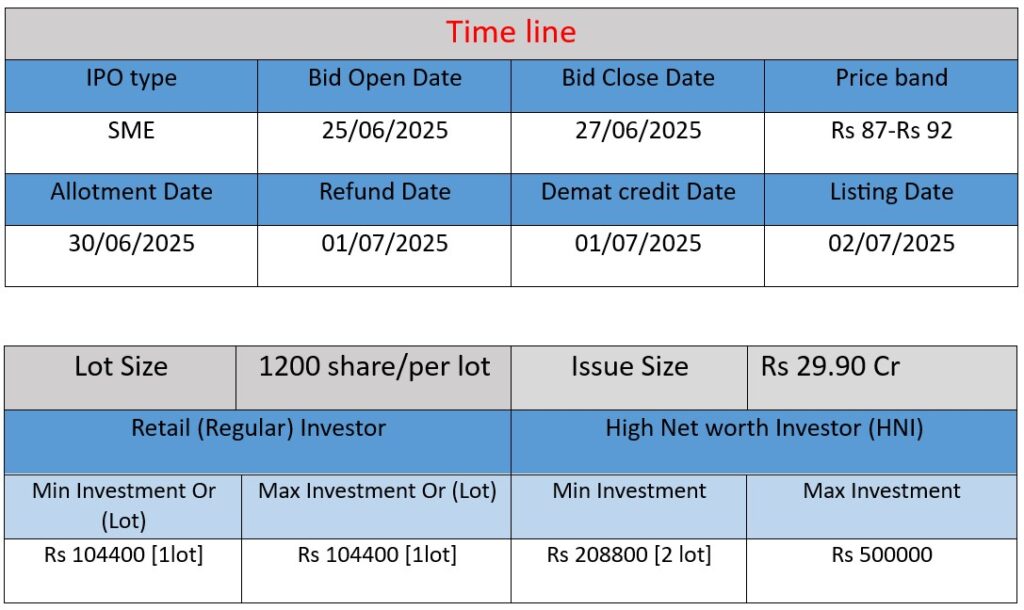

Supertech EV Ltd is launching its SME IPO from June 25–27, 2025, offering 32.5 lakh shares at ₹87–₹92 each, aiming to raise ₹29.9 crore. The proceeds will fund working capital needs (₹16.5 cr), repay borrowings (₹3 cr), and support general corporate purposes. The company, a manufacturer of electric two-wheelers and e-rickshaws, operates with 445 dealers across 19 states and plans to list on the BSE SME platform by July 2, 2025.

Company Overview & Operations (Work)

- Business model & capacity

Established in 2022 (with precursor operations since 2010), Supertech EV manufactures electric two‑wheelers and e‑rickshaws in Bahadurgarh, Haryana. Its in‑house plant has a capacity of about 36,000 chassis sets annually, supplemented by a vendor network. - Product and distribution reach

Offers 12 EV models (8 e‑scooter variants, 4 e‑rickshaw), including commercial and passenger vehicles. It has a distribution network of ~445 dealers across 19 Indian states.

Strengths

- Diversified EV portfolio

With 12 models spanning commercial and personal segments, the company can target multiple market niches. - Expansive dealer network

445 distributors across 19 states enable strong market reach. - Strong margin metrics

Financials show robust Return on Equity (~37%) and EBITDA margin (~12.6%), indicating operational efficiency. - Experienced management & manufacturing synergy

Backed by sheet‑metal expertise since 2010 and certifications from ICAT, the leadership brings manufacturing and technical credibility.

Risks & Weaknesses

- Early-stage business and financial track record

Incorporated in 2022 with limited historical data — as noted in the Red Herring Prospectus risk section. - Increasing leverage and cash burn

Borrowings doubled year-over-year, with negative operating cash flow in FY25, reflecting liquidity pressure. - Regulatory, supplier & execution dependencies

Risks include dependency on third-party suppliers, potential delays in new product development, possible issues with statutory approvals, and an unregistered trademark. - Competitive and technological landscape

Faces stiff competition from established EV players and must continuously innovate. The broader EV ecosystem also presents cybersecurity and infrastructure challenges.

Final Take

Supertech EV is an aggressive entrant in India’s SME‑level EV manufacturing space, showing early signs of strong operational performance. The IPO provides crucial capital to support scaling efforts and debt repayment. Key factors to monitor post-IPO: liquidity improvement, supply-chain stability, product rollout execution, and market response against bigger EV competitors.

Here is a brief financial performance analysis across FY2023 to FY2025:

Revenue

- FY2023: ₹2.37 crore

- FY2024: ₹65.03 crore

- FY2025: ₹75.10 crore

Analysis:

Revenue grew over 26 times from FY2023 to FY2024, reflecting the company’s shift from setup to active operations. The FY2025 growth (15.5%) indicates continued market expansion, though at a more moderate pace, which is common after an initial scale-up.

Profit (PAT)

- FY2023: ₹0.06 crore

- FY2024: ₹5.02 crore

- FY2025: ₹6.19 crore

Analysis:

Profit margins improved significantly post-operations in FY2024. FY2025 saw ~23% growth in profit, showing operational efficiency. The net profit margin in FY2025 stands at 8.2%, a healthy figure for a relatively new manufacturing company.

Total Assets

- FY2023: ₹4.81 crore

- FY2024: ₹24.8 crore

- FY2025: ₹44.19 crore

Analysis:

Total assets nearly doubled from FY2024 to FY2025, showing investments in infrastructure, inventory, and receivables. This expansion aligns with revenue growth and prepares the company for higher production volumes.

Summary

- Supertech EV Limited has shown rapid scaling post-incorporation.

- Revenue and profit growth demonstrate increasing market presence and better cost control.

- Asset growth supports its expansion plans, although it comes with rising debt and cash flow risks.

- Positive financial indicators support investor interest in the SME IPO.