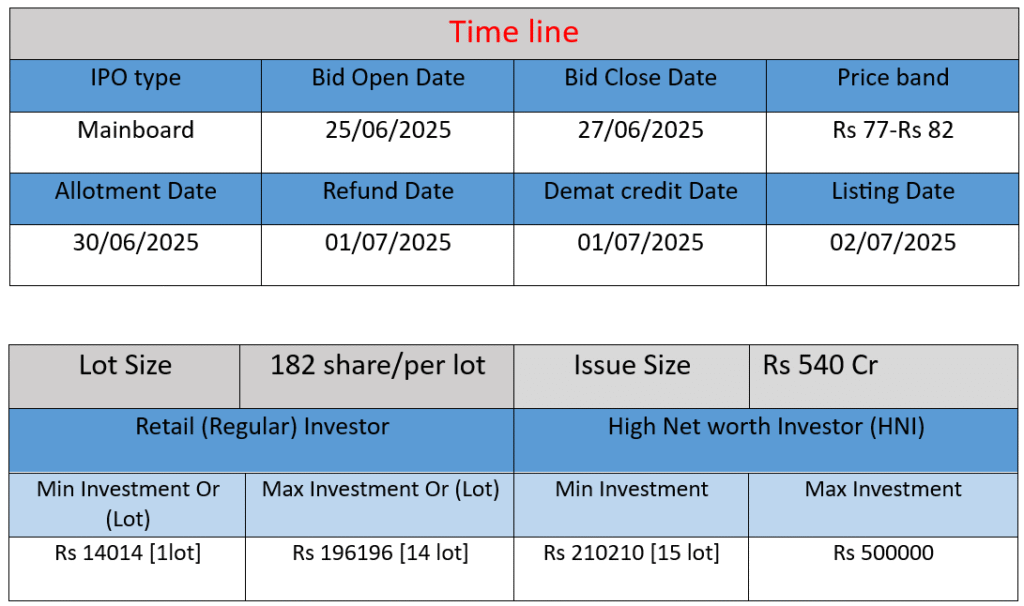

Sambhv Steel Tubes Ltd. has launched a ₹540 crore IPO from June 25–27, 2025, with a ₹77–₹82 price band. The issue includes ₹440 cr fresh equity (mostly to repay ₹390 cr debt and for general corporate/work‑capital purposes) and ₹100 cr Offer for Sale, reducing promoter stake from ~71.9% to ~56%. The fully backward‑integrated ERW pipe maker serves diverse industrial sectors—potentially attractive for medium‑to‑long‑term, high‑risk investors.

WORK & STRENGTHS

Backward Integration & Factory Setup

- Only single‑location backward-integrated plant in India: Sambhv handles the full steel pipe/tubes value chain under one roof—from sponge iron to hot-rolled coils to final ERW pipes and GI pipes, based at Sarora, Tilda, Chhattisgarh.

- In‑house narrow-width HR coil production: A rare capability beyond its ERW focus, reducing raw-material costs and boosting margins.

Production & Operational Capacity

- 1 MMTPA installed capacity achieved within six years; producing ~600,000 MT annually, including stainless products .

- Captive 25 MW power plant with waste-heat recovery ensures power security, cost & emission control.

Market Reach & Innovation

- Strong distribution network: 33 distributors and over 600 dealers across 15+ states.

- Industry recognition: Participated in METEC India 2024, showcasing its full product range and commitment to sustainable innovation.

FINANCIAL STRENGTH & PERFORMANCE

Improved Leverage & Ratios

- Debt‑equity ratio improved from 1.35 (FY23) to ~0.8 (FY24).

- Current ratio down slightly (1.33 → 1.06), still adequate .

- ROE ~25%, ROCE ~18%, healthy profitability margins.

Liquidity & Credit Outlook

- According to Acuité, liquidity is “adequate” with low WC utilization (~43%), stable net cash flows, and a “Stable” rating.

RISKS & CHALLENGES

Sectoral & Raw Material Exposure

- Cyclical steel demand: Susceptible to infrastructure spending fluctuations; IPO advisors flag high-risk nature .

- Raw material dependencies: Volatile coal, iron ore, sponge iron supplies and prices could squeeze margins.

Execution, Geographic & Utility Risks

- Critical execution risk: Plans require flawless strategy following IPO.

- Geographic concentration: Sales focus in North & West India—lack of diversification could hamper growth .

- Utility reliability: Interruptions in power or utilities despite captive plant could disrupt operations .

Financial Obligations

- Borrowings growth: Debt rose from ₹2,828 M to ₹3,469 M in FY24; though manageable, still a concern .

- DSCR slip: From 1.24 (FY23) to 0.97 (FY24)—under the ideal benchmark → suggests tighter interest coverage.

Verdict: Sambhv Steel is a high-potential, well-structured mid-cap steel tube player. Its operational backbone and growth record are strong, yet cyclical pressures, geographical concentration, and execution hurdles remain. The ongoing IPO is pivotal: debt deleveraging is a plus, but execution post-listing will be critical.

Here is a brief financial performance analysis across FY2022 to FY2024:

| Year | Revenue (₹ Cr) | PAT (₹ Cr) | Assets (₹ Cr) |

| FY2022 | 819.35 | 72.11 | 458.51 |

| FY2023 | 937.22 | 60.38 | 552.14 |

| FY2024 | 1,285.76 | 82.44 | 940.13 |

Growth Trends

- Revenue climbed 48% over two years, accelerating from ₹819 Cr to ₹1,285 Cr; YoY growth was ~14% (FY23) followed by ~37% (FY24) .

- Profit After Tax dipped ~16% in FY23, then surged ~37% in FY24 .

- Total Assets nearly doubled in two years—from ₹459 Cr to ₹940 Cr—reflecting aggressive capex expansion.

Margin & Profitability

- PAT margin remained consistent: FY22: 8.8%, FY23: 6.4%, FY24: 6.4%.

- EBITDA improved from ₹125 Cr (FY22) → ₹117 Cr (FY23) → ₹160 Cr (FY24); margin hovered around 12–15% .

- Gross Profit rose ₹200 Cr → ₹366 Cr during FY22–24.

Leverage & Ratios

- Debt-to-equity ratio improved markedly: FY22: ~1.62 → FY23: ~1.35 → FY24: ~0.80 .

- ROE declined from 63.7% (FY22) to 25.4% (FY24); ROCE eased from 28.9% → 17.7% over same period .

Cash Flow & Capex

- Operating cash flow rose from ₹34 Cr (FY22) → ₹65 Cr (FY23) → ₹142 Cr (FY24) .

- Investing outflows: significant capex, with ₹311 Cr in FY24 .

- Financing inflows of ₹177 Cr in FY24, bolstering growth and lowering leverage .

Key Takeaways

- Strong top-line acceleration, driven by capacity expansions and volume growth.

- Profit volatility, with margins under pressure in FY23 but recovering in FY24.

- Improving leverage, thanks to strategic fund allocation and capex funding.

- Diluted ROE/ROCE, linked to recent equity infusion and asset scaling.

- Robust cash flow, enabling sustainable operations despite large investments.

📌 Bottom Line: Sambhv Steel Tubes demonstrates solid growth momentum and strategic deleveraging. While profitability metrics and ROE have moderated due to capex and equity dilution, the expanding asset base and cash flows position it well for future scaling. Let me know if you’d like a peer comparison or deep dive into margins!