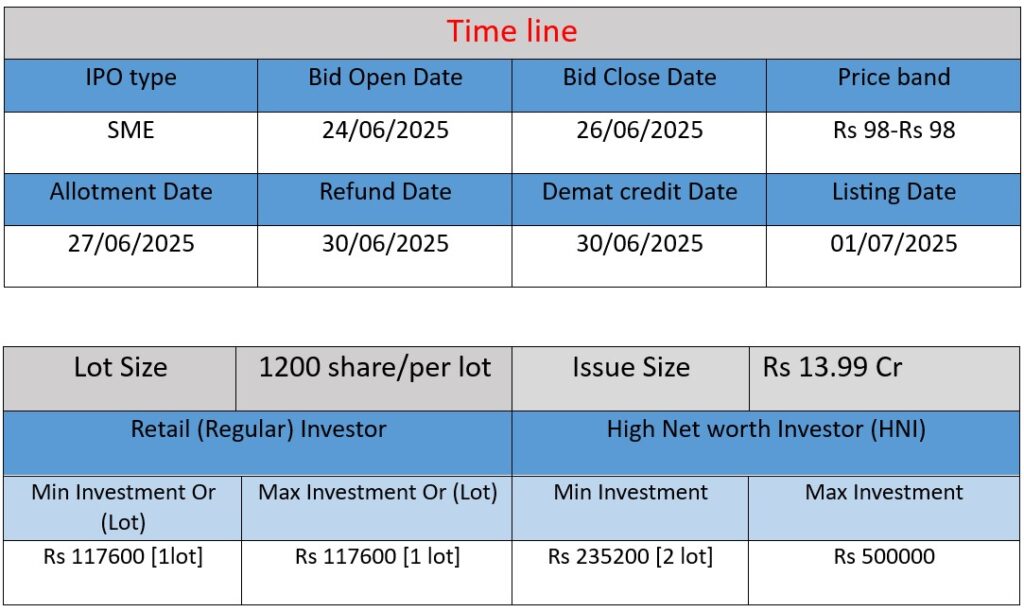

Abram Food Limited IPO opens with an issue size of ₹13.99 crore at ₹98 per share. The company aims to utilize the proceeds for setting up new machinery, meeting working capital needs, and general corporate purposes. Focused on food processing and distribution under the ‘Kherliwala’ brand, Abram Food serves markets in Rajasthan, Delhi-NCR, and UP. Investors should weigh growth potential against risks like low capacity use and client concentration.

What Abram Food Does (Work / Operations)

Abram Food Limited, incorporated in 2009 and headquartered in Alwar, Rajasthan, operates in the food processing and trading sector. The company manufactures and sells a diverse range of products under its flagship brand Kherliwala, including chana dal, chakki atta, besan, multigrain atta, maida, sooji, spices, edible oils, and cattle feed.

Their in-house facility boasts significant production capacities: ~4,366 MT of pulses, 507 MT of flour, and spices annually, supported by standardized machinery and quality-control systems. Sales are primarily concentrated in Rajasthan, Delhi-NCR, and Uttar Pradesh, marketed through around 80 distributors.

Strengths

Quality-Focused, Diverse Product Base:

- They emphasize natural, preservative-free processing to preserve freshness and nutrition.

- A broad product portfolio covers over seven categories tailored to regional tastes.

Robust Infrastructure & Market Reach:

The Alwar manufacturing facility is well-equipped, and distribution spans across key northern states via 80 distributors.

Strong Leadership & Cost Discipline:

Promoters and senior management bring decades of FMCG experience, enhancing industry relations and operational efficiency.

Risks

Low Capacity Utilization:

FY25 utilization stood at ~69.4% for flour and a strikingly low 1.1% for spices. In FY24, flour utilization was just 29.3%, suggesting potential inefficiencies and elevated per-unit costs.

Client Concentration:

Reports indicate that 74% of revenues came from just 10 clients, signaling a risk if key customers reduce orders or shift to competitors.

SME/SME-IPOs’ Low Subscription Risk:

The IPO—priced at ₹98 per share with a size of ₹13.99 cr—has seen lukewarm initial subscription (14% overall by June 24), with only 20% retail and 8% NII uptake.

Market & Operational Constraints:

- As an SME on BSE, the listing may face liquidity issues.

- Heavy reliance on select regions (Rajasthan, UP, Delhi-NCR) limits scalability unless they expand geographically.

Bottom Line

Abram Food Limited presents an attractive case on paper—rapid financial growth, quality-driven product lines, and a strong distribution network. However, key risks remain: notably underutilized production capacity, reliance on a handful of clients, and early-stage IPO interest that has been lukewarm.

Here is a brief financial performance analysis across FY2023 to FY2025:

| Particulars | FY2022 | FY2023 | FY2024 |

| Revenue (₹ Cr) | 21.81 | 33.16 | 36.01 |

| Profit (₹ Cr) | 0.12 | 0.48 | 1.02 |

| Assets (₹ Cr) | 5.26 | 7.72 | 10.62 |

Revenue

- FY2022: ₹21.81 crore

- FY2023: ₹33.16 crore

- FY2024: ₹36.01 crore

🔍 Analysis:

Revenue has shown consistent growth, rising ~51.9% in FY23 and ~8.6% in FY24. While growth has slowed in FY24, it still reflects strong demand and market expansion.

Profit

- FY2022: ₹0.12 crore

- FY2023: ₹0.48 crore

- FY2024: ₹1.02 crore

🔍 Analysis:

Net profit has increased sharply—4x in FY23 and 2.1x in FY24—indicating strong improvement in operational efficiency and cost management.

Total Assets

- FY2022: ₹5.26 crore

- FY2023: ₹7.72 crore

- FY2024: ₹10.62 crore

🔍 Analysis:

Assets have doubled in two years, showing reinvestment into the business—possibly for capacity expansion, warehousing, or machinery.

Summary

- Revenue and profit growth is steady and positive, with profit growing faster than revenue.

- The increasing asset base suggests proactive scaling of operations.

- These trends make Abram Food Limited financially stronger year-over-year, boosting investor confidence ahead of its IPO.