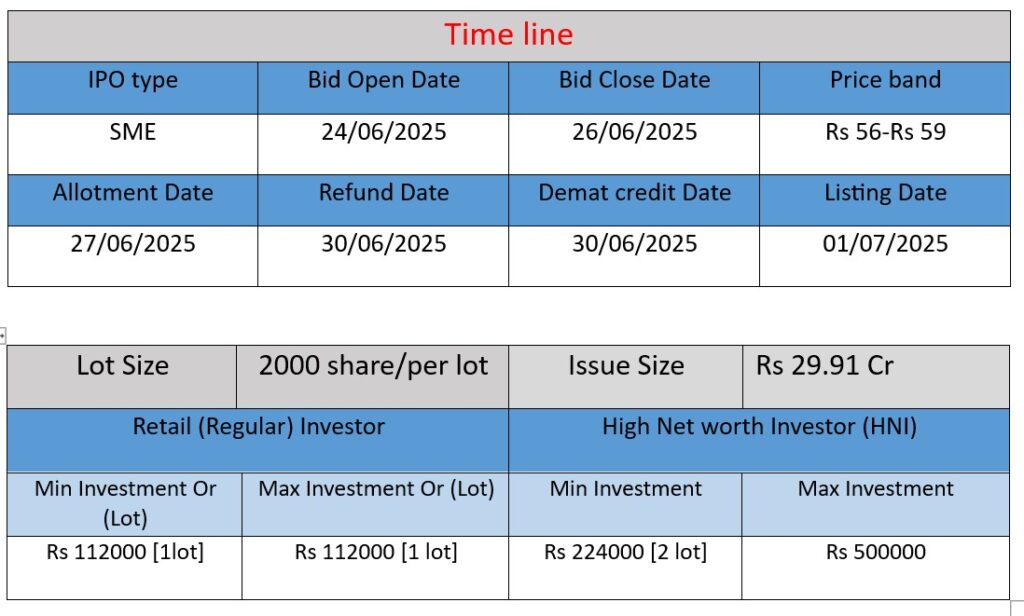

Shri Hare Krishna Sponge Iron Limited is launching an SME IPO to raise ₹29.91 crore through a fresh issue of 50.7 lakh equity shares. The funds will be used for setting up a 5 MW captive power plant, supporting working capital, and general corporate purposes—boosting operational efficiency and enabling future expansion in steel manufacturing.

Business Overview & Operations

- Incorporated in May 2003, the company is a public limited entity specializing in sponge iron, steel melting, rolling, and allied products.

- Facilities near Raipur include a 36,050 TPA sponge iron kiln, 21,600 MTPA steel melting shop, and a rolling mill producing re‑rolled sections.

- The company is expanding with a new 5 MW captive power plant and a cast iron unit (12,000 MTPA) by end‑2025; further plans include grinding media and alloy steel castings in FY 2026‑27.

Strengths

a) Experienced & Integrated Setup

Over 20 years in the steel sector with robust integration—from sponge iron production to finished products—provides operational efficiency and market resilience.

b) Financial Prudence

As of Mar 2023, current ratio ~4x, moderate bank limit utilization (82%), liquid investments around ₹25 Cr, and low gearing (~0.19x). CRISIL labels liquidity as “adequate” and outlook “stable.”

c) Quality & Compliance

Employs closed-loop cooling to ensure zero effluent discharge, adheres to environmental norms, and maintains extensive green cover and pollution controls.

Risks & Challenges

a) Sectoral Cyclicality

The steel sector is vulnerable to macroeconomic cycles. A downturn in infrastructure or real estate could dent demand and margins.

b) Expansion Funding

Growth plans (power plant, cast iron unit) may stress liquidity if funded through debt instead of internal accruals. CRISIL warns that accruals under ₹12 Cr or debt-funded capex poses a downgrade risk.

c) Geographical & Raw‑Material Concentration

Operations centered in Raipur and Sundergarh rely heavily on local iron ore, coal, and dolomite supply. Disruptions in any raw material source could affect production continuity.

Employee Sentiment & Corporate Culture

Rated 4.0/5 on AmbitionBox (2 reviews). Work-life balance scores high (4.3/5), but company culture and job security are moderate (3.3/5). Detailed insights reflect a generally positive work environment with room for cultural enhancement.

Outlook & Key Considerations

- Moderate payout capacity and minimal debt mean they’re well-positioned for internal growth.

- Watch capex execution—especially funding source—as that will determine liquidity and credit risk.

- Sustained demand in steel-intensive sectors will be critical to uphold utilization and margins.

Here is a brief financial performance analysis across FY2023 to FY2025:

Detailed Analysis of Financial Performance

Revenue

- FY2023: ₹94.25 Cr

- FY2024: ₹82.27 Cr

- FY2025: ₹80.47 Cr

Analysis:

The company’s revenue has declined steadily over three years, dropping nearly 15% from FY2023 to FY2025. This suggests reduced sales volume or pricing pressure in the sponge iron/steel market. However, the decline has slowed from FY2024 to FY2025.

Profit

- FY2023: ₹10.52 Cr

- FY2024: ₹10.17 Cr

- FY2025: ₹9.20 Cr

Analysis:

Despite falling revenue, profit remained relatively stable, reflecting good cost management. A minor 12.5% dip in FY2025 suggests pressure on margins, possibly due to input costs or lower plant utilization.

Total Assets

- FY2023: ₹58.58 Cr

- FY2024: ₹75.73 Cr

- FY2025: ₹93.15 Cr

Analysis:

Assets have grown significantly (≈59% rise in two years), mainly due to ongoing expansion (captive power plant, new cast iron unit). The capital base is strengthening, indicating preparation for scale-up.

✅ Summary

| Metric | FY2023 | FY2024 | FY2025 | Trend |

| Revenue | ₹94.25 Cr | ₹82.27 Cr | ₹80.47 Cr | ⬇️ Declining |

| Profit | ₹10.52 Cr | ₹10.17 Cr | ₹9.20 Cr | ⬇️ Slight fall |

| Assets | ₹58.58 Cr | ₹75.73 Cr | ₹93.15 Cr | ⬆️ Growing |

Conclusion:

Shri Hare Krishna Sponge Iron Ltd is in a transitional growth phase. While revenue and profits have slightly declined, the substantial rise in assets signals capacity building. If the new power plant and cast iron unit start yielding returns, it could stabilize earnings and reverse the revenue fall. However, in the short term, operational efficiency and market demand will be key.