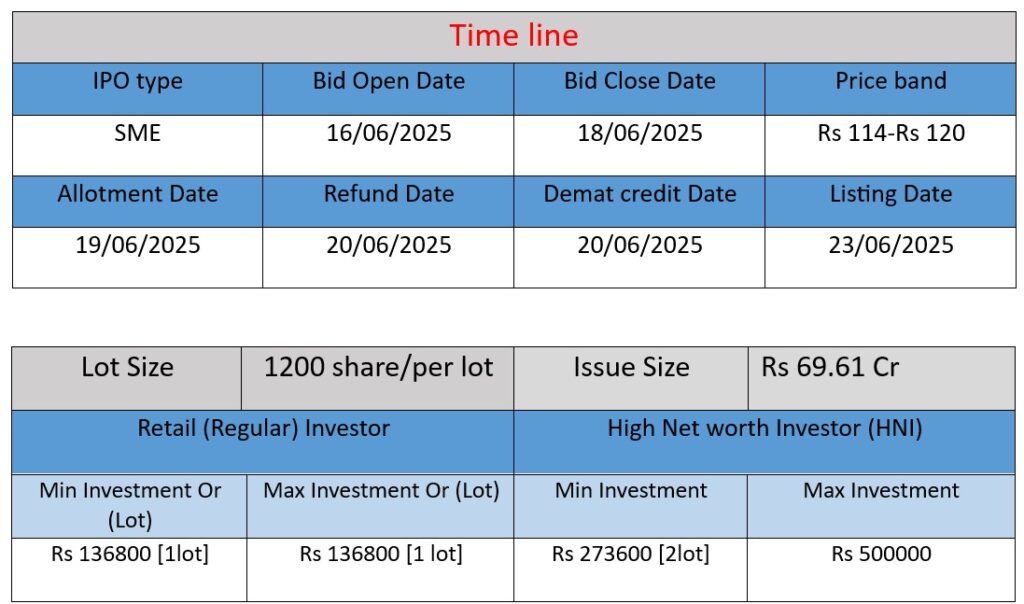

Patil Automation Ltd IPO: A fresh issue of 5.80 million equity shares (≈₹ 69.61 crore) priced between ₹114–120/share opens June 16–18, 2025. Proceeds will fund a new manufacturing facility, repay borrowings, and support corporate purposes. Shares will list on NSE SME.

Work (Business Operations & Services)

Patil Automation Limited, founded in 2015 and based in Pune, is an industrial automation firm specializing in turnkey solutions across welding, assembly, and line automation.

- It operates five facilities in India, with two in Pune, covering ~460,000 sq ft of manufacturing space.

- The company’s offerings include robotic welding systems (spot, MIG, TIG), assembly lines, conveyor/gantry systems, special-purpose machines, and jigs & fixtures.

- Its integrated engineering capabilities extend to mechanical/electrical design, PLC/robotic programming, and use of simulation tools (Solid Edge, Catia, AutoCAD, Delmia, etc.).

In FY 2024–25, PA reported ₹122 cr in revenue (+3% YoY) and ₹11.7 cr in PAT (+49% YoY), with a strong 27% ROE and ~10% net margin.

Strength (Key Advantages)

A SWOT snapshot highlights several strengths:

- Revenue & Profit Momentum: PATIL’s PAT is growing faster than its industrial peers, with net profit rising ~50% in FY 25.

- High Efficiency Metrics: Improving ROA and ROE, reflecting efficient asset use.

- Low Leverage: The company maintains low debt levels—debt/equity around 0.4x—reducing financial risk.

- Strong Operational Setup: Robust in-house engineering, a large skilled team of ~650, and standardized, modular designs reinforce quality and scalability.

Additional strengths include ISO certifications and tie-ups with credible anchor investors ahead of its IPO.

Risk (Potential Challenges)

Although formal weaknesses weren’t highlighted in public SWOTs, several risks are notable:

- IPO & Market Volatility

- As an SME IPO priced at ₹114–₹120/share, listing gains depend on market appetite. GMP (~₹22/share) suggests speculative premium, not guaranteed gains.

- Subscription levels on June 17 hit ~2.2×, showing strong demand—but performance post-listing remains to be seen.

- Credit Transparency Concerns

- CRISIL highlighted limited credit data and non-cooperation, assigning a “B/Stable/A4 issuer not cooperating” rating—indicating risk for lenders and opacity in forward guidance.

- Sector Competition & Dependency

- The firm’s heavy focus on the automotive segment makes it vulnerable to cyclical demand. Limited direct public competitors could both be an opportunity and a concentration risk .

- Working Capital & Cash Flow

- FY 25 cash flow from operations was modest (~₹0.6 cr), with working capital stretched as receivables/inventory days rose—indicative of potential liquidity pressure.

Conclusion:

Patil Automation is a structurally strong SME automation player with impressive growth, margins, and capabilities. However, financial transparency, sector concentration, and liquidity management remain areas to monitor closely, especially during and after its SME IPO on NSE.

Here is a brief financial performance analysis across FY2023 to FY2025:

Revenue

- FY2023: ₹77.81 crore

- FY2024: ₹115.28 crore

- FY2025: ₹119.05 crore

Analysis:

Revenue grew significantly in FY2024 (48.2% YoY), reflecting expansion in operations and client base. FY2025 saw slower growth (3.3% YoY), suggesting a near-plateau in top-line growth, possibly due to capacity constraints or project cycle timing.

Profit (Net Profit)

- FY2023: ₹4.2 crore

- FY2024: ₹7.84 crore

- FY2025: ₹11.7 crore

Analysis:

Profit grew impressively each year — by 86.7% in FY2024 and 49.2% in FY2025. This shows strong cost control and better margins even with modest revenue growth in FY2025.

Total Assets

- FY2023: ₹94.04 crore

- FY2024: ₹91.77 crore

- FY2025: ₹115.35 crore

Analysis:

Assets dipped slightly in FY2024, likely due to depreciation or lower capex. However, FY2025 saw a sharp 25.7% jump in total assets, indicating fresh investments—possibly linked to capacity expansion or pre-IPO positioning.

📌 Summary

- Strong profit growth outpaced revenue, showing operational efficiency.

- Slower revenue growth in FY2025 suggests maturing projects or capacity saturation.

- Asset expansion in FY2025 supports future scaling potential, aligning with IPO plans.