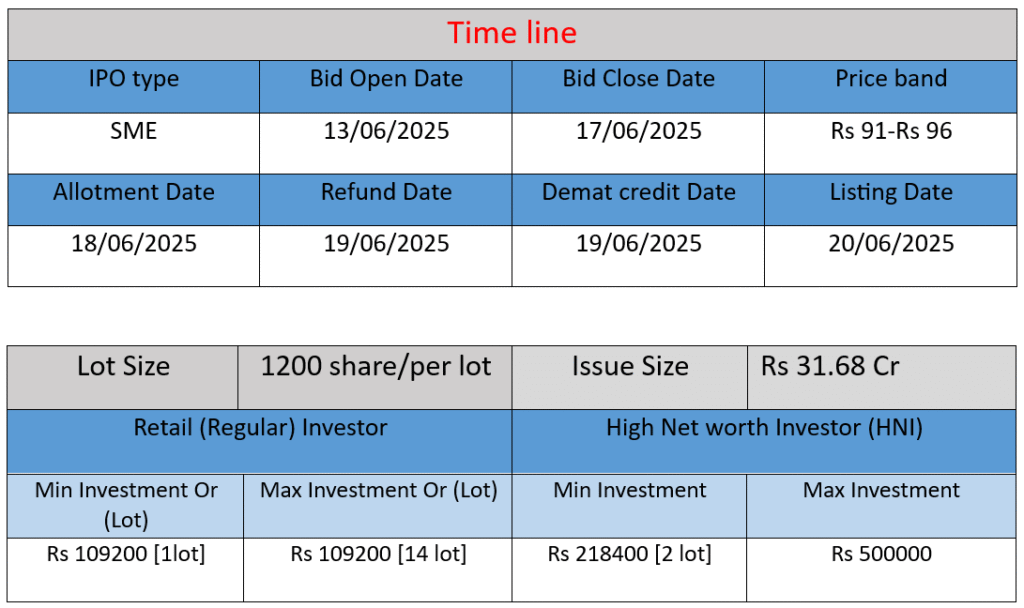

Aten Papers and Foam Ltd IPO opens on June 13 and closes on June 17, 2025. The issue size is ₹31.68 crore, offering 33 lakh shares at a price band of ₹91–96 per share. The IPO aims to fund working capital, set up a wastepaper processing unit, and meet general corporate needs. Stay updated with subscription status and key financials.

Company Overview (Work)

- Founded: Incorporated January 7, 2019 (private), converted to public limited on May 16, 2024

- Location: Headquartered in Ahmedabad, Gujarat; operates as a key intermediary in the paper-product supply chain

- Core Activities:

- Procurement and trading of Kraft paper and duplex boards from paper mills

- Sales to clients in packaging (grocery, medical, décor, tubes)

- Wastepaper trading and plans for wastepaper-processing expansion

- IPO Launch:

- SME IPO opened June 13, 2025; closes June 17

- Issue: 33 lakh shares at ₹91–96 per share, targeting ₹31.68 cr

Strengths

- Rapid-scale growth: FY25 revenue surged ~43% YoY to ₹138.7 cr; PAT grew ~152% to ₹7.01 cr

- Diversified product mix: Kraft paper, duplex boards, and wastepaper processing aims to strengthen supply-chain integration

- Strong supply-chain positioning: Ready stock, in-house logistics, established mill & packaging client relationships

- Experienced management: Promoters with over two decades in industry; growth bolstered by planned capex

Risks

- Raw material volatility: Exposure to paper pulp/wastepaper price swings could squeeze margins

- Regional concentration: Primarily operates in Gujarat, adding geographical risk

- Expansion risks: New wastepaper processing capacity could introduce execution or efficiency challenges

- SME IPO limitations: No existing trading history → illiquidity, share price volatility post-listing

- Regulatory uncertainties: Compliance, tax and corporate governance risks noted in RHP

Summary Table

| Category | Highlights |

| Business Model | B2B paper-trading; caters to packaging industry; venturing into wastepaper processing |

| Growth | Strong FY25 performance: 43% revenue growth; 152% profit jump |

| IPO Use of Funds | ₹4.3 cr capex, ₹15.5 cr working capital, balance for general corp. needs |

| Upside Potential | Robust supply chain, SME growth profile, management stability |

| Downside Risks | Price fluctuations, regional focus, SME-share illiquidity, execution & reg compliance |

Verdict

Aten Papers & Foam shows promising growth backed by solid supply chain capabilities and an ambitious IPO that fuels expansion. Potential investors should weigh these gains against the risks tied to commodity pricing, geographic concentration, and the inherent uncertainties of SME IPOs. Those comfortable with the risk profile and bullish on paper packaging demand may find value, especially if IPO pricing is favorable and execution follows through.

Here is a brief financial performance analysis across FY2022 to FY2024:

Revenue

- FY2022: ₹89.81 crore

- FY2023: ₹91 crore

- FY2024: ₹96.8 crore

Analysis:

The company’s revenue has grown steadily over the three years. While FY2023 saw marginal growth (1.3%), FY2024 witnessed a stronger rise of about 6.37%, indicating improved sales or operational scale.

Profit

- FY2022: ₹0.76 crore

- FY2023: ₹0.5 crore

- FY2024: ₹2.78 crore

Analysis:

Profit dipped in FY2023 but rebounded sharply in FY2024 by over 456%. This may reflect improved cost efficiency, better margins, or increased scale of operations.

Total Assets

- FY2022: ₹27.85 crore

- FY2023: ₹29.62 crore

- FY2024: ₹32.92 crore

Analysis:

Assets have shown healthy and consistent growth (~18% increase over 2 years), suggesting capital expansion and stronger asset base—likely preparing for upcoming capacity or infrastructure expansion.

📌 Summary

- Revenue growth is stable and accelerating.

- Profitability showed a massive improvement in FY2024.

- Asset base is expanding steadily.

- The sharp profit jump indicates strong operational performance heading into the IPO.