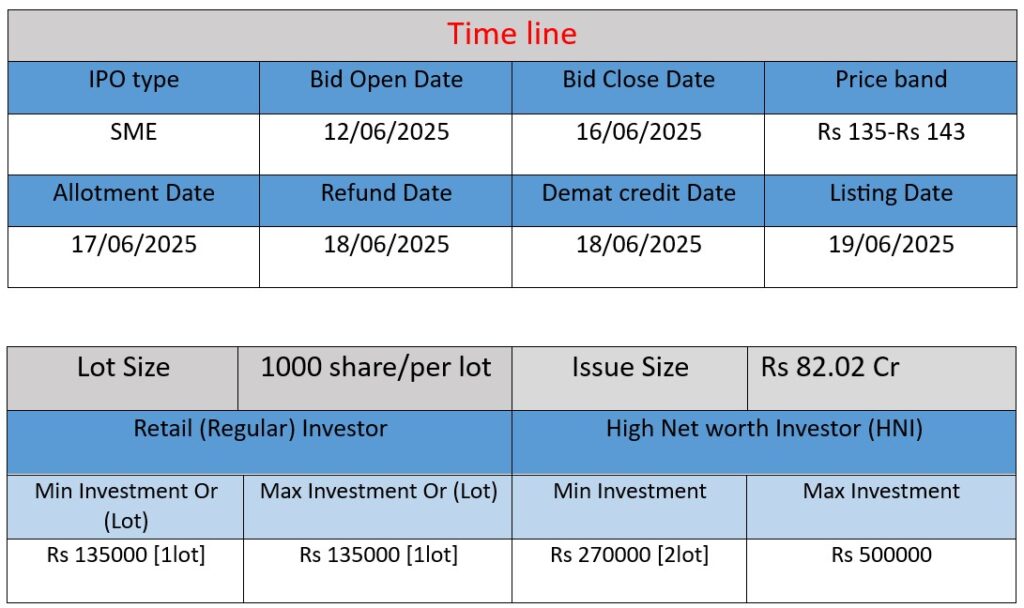

Monolithisch India Ltd is launching an SME IPO on NSE Emerge to raise ₹82.02 Cr via a fresh issue of 57.36 L shares (face value ₹10, price band ₹135–143). The issue opens on June 12, 2025 and closes on June 16, 2025. Proceeds will fund a new manufacturing plant (₹16.57 Cr), capital investment in subsidiary Metalurgica India (₹27.89 Cr), working capital (₹20 Cr), and general corporate purposes

Core Business

Monolithisch India Limited, founded in 2018 and based in Ranchi with manufacturing in Purulia, West Bengal, specializes in manufacturing silica‑based premixed ramming mass—a crucial refractory material for induction furnaces in the iron and steel industry

Capacity & Distribution

- Production capacity stands at 132,000 MTPA, with an upcoming expansion to ~250,000 MTPA

- They serve 41 clients in FY23, which grew to 63 in FY25 (a 53% increase), primarily across West Bengal, Jharkhand, and Odisha

Upcoming IPO

- Launched SME IPO on NSE Emerge (₹135–143/share) from June 12–16, 2025, aiming to raise ₹82 cr

- Funds will finance a new plant (

₹16.6 cr), asset expansion in subsidiary Metalurgica (₹27.9 cr), and working capital

Strengths

A. Strategic Location & Capacity

The Purulia plant benefits from proximity to raw-material suppliers, underpinning cost efficiency and operational resilience

B. Financial Growth & Profitability

- Revenue rose from ₹41.9 cr (FY23) → ₹68.9 cr (FY24) → ₹97.3 cr (FY25).

- PAT jumped from ₹4.54 cr → ₹8.51 cr → ₹14.49 cr

- EBITDA margins >21%, ROCE ~46%, ROE ~54%, debt-to-equity <1

C. Experience & Management

Leadership by industry veterans: Prabhat Tekriwal (36 years experience) and Harsh Tekriwal as Managing Director; plus ISO-certified processes, R&D investments

D. Customer & Product Traction

- Fastest-growing premixed ramming mass producer.

- Customer base broadened significantly (~53% growth)

Risks

A. Customer & Geographic Concentration

Heavy reliance on Eastern India + limited product line (ramming mass) heighten exposure to regional steel market fluctuations

B. Commodity Cycle & Raw Material Volatility

Steel-sector cyclicality and quartzite price swings could impact margins

C. Competitive Pressure

Faces competition from established refractory companies; limited national/international footprint.

D. Execution & Capital Risk

Recent debt increase post-capex, unfinalized subsidiary plans, and potential promoter/group conflicts represent execution and governance risks.

E. Labor & Regulatory Risks

Labour dependence and possible disputes, plus future regulatory/tax changes may pose operational or financial disruptions .

📌 Summary Table

| Aspect | Highlights |

| Work | Leading premixed ramming mass manufacturer targeting major expansion and IPO to fund growth |

| Strengths | Strong financial growth, strategic location, experienced leadership, expanding client base |

| Risks | Regional dependency, commodity exposure, competition, execution uncertainties, labour & compliance risks |

Conclusion

Monolithisch India Limited shows strong upward momentum through profitable financials, strategic capacity expansion, and a solid management pedigree. However, its value hinges on successful national/international diversification, raw-material cost control, and disciplined execution of its expansion and subsidiary investments.

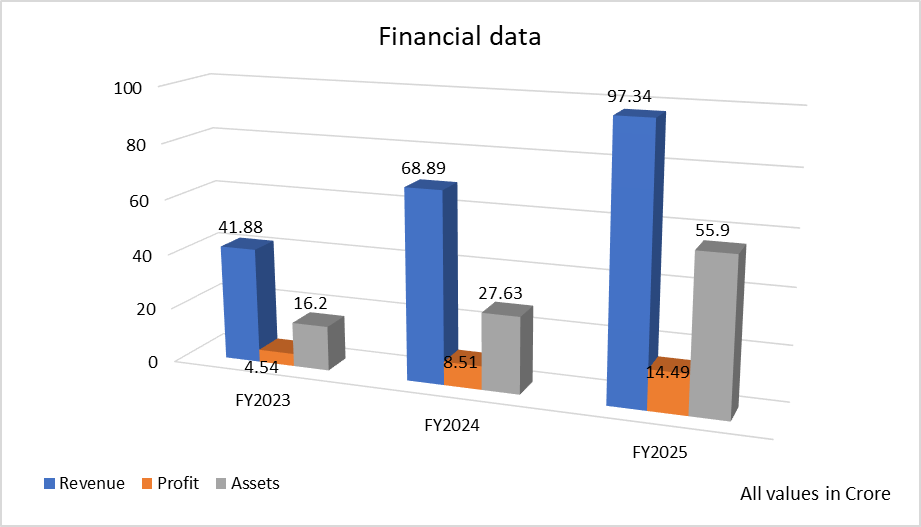

Based on the data provided for Monolithisch India Limited, here is a brief financial performance analysis across FY2023 to FY2025:

Revenue

- FY2023: ₹41.88 Cr

- FY2024: ₹68.89 Cr

- FY2025: ₹97.34 Cr

Analysis:

Revenue has grown by:

- +64.5% from FY2023 to FY2024

- +41.3% from FY2024 to FY2025

This consistent growth indicates strong demand and effective market expansion.

Profit (PAT)

- FY2023: ₹4.54 Cr

- FY2024: ₹8.51 Cr

- FY2025: ₹14.49 Cr

Analysis:

Profit has grown by:

- +87.4% from FY2023 to FY2024

- +70.3% from FY2024 to FY2025

This sharp rise in profitability reflects operational efficiency and better cost control.

Total Assets

- FY2023: ₹16.20 Cr

- FY2024: ₹27.63 Cr

- FY2025: ₹55.90 Cr

Analysis:

Assets have more than tripled over three years, indicating major capital investments and strong balance sheet expansion, likely tied to their growth and IPO plans.

Summary

| Metric | FY2023 | FY2024 | FY2025 | Growth (FY23–FY25) |

| Revenue | ₹41.88 Cr | ₹68.89 Cr | ₹97.34 Cr | +132.5% |

| Profit | ₹4.54 Cr | ₹8.51 Cr | ₹14.49 Cr | +219% |

| Assets | ₹16.20 Cr | ₹27.63 Cr | ₹55.90 Cr | +245% |

Conclusion

Monolithisch India Limited has shown exceptional financial growth over the last three years, with revenue more than doubling, profit tripling, and asset base expanding significantly. This reflects a strong foundation, scalability, and readiness for IPO-backed expansion.