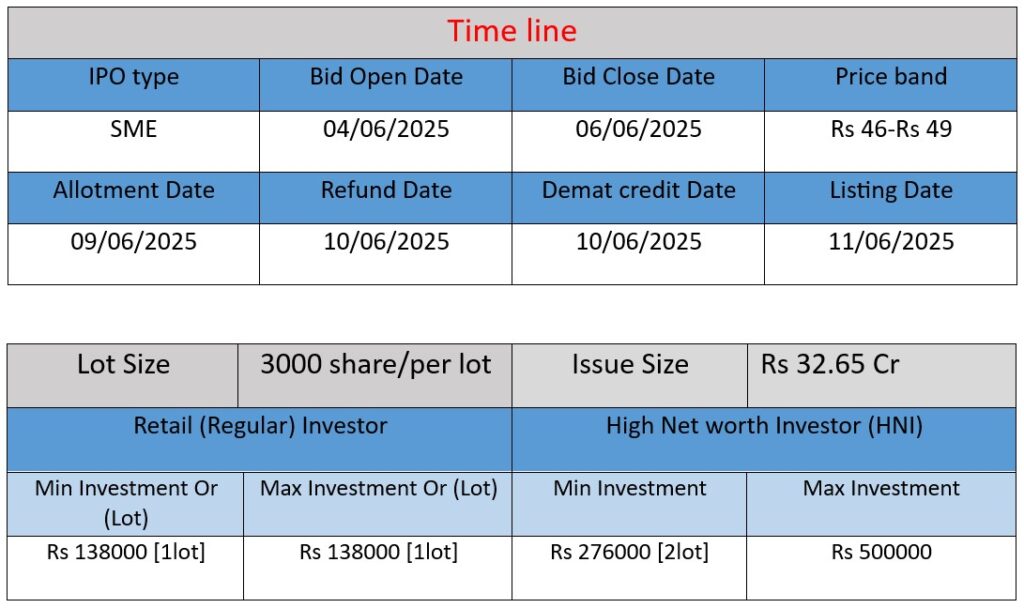

Ganga Bath Fittings Limited’s SME IPO opens on June 4, 2025, and closes on June 6, 2025. The company aims to raise ₹32.65 crore through a fresh issue of 66.63 lakh equity shares. The IPO proceeds will be utilized for capital expenditure, repayment/prepayment of certain borrowings, funding working capital requirements, and general corporate purposes. Shares are proposed to be listed on the NSE Emerge platform.

Ganga Bath Fittings Limited is an Indian manufacturer specializing in bathroom accessories and sanitaryware. Established in 2010 as Ganga Industries, the company has evolved into a public limited entity, incorporating as Ganga Bath Fittings Limited in May 2024. Headquartered in Rajkot, Gujarat, the company operates a state-of-the-art manufacturing facility in Shapar-Veraval, blending advanced technology with skilled manpower to produce a diverse range of bath fittings under the brand name “GANGA”.

Operations and Business Model

Product Portfolio

Ganga Bath Fittings offers a comprehensive range of bathroom products, including:

- CP Brass Fittings

- PTMT Taps

- ABS Products

- Sanitary Ware

- Designer Showers

The company emphasizes quality and innovation, with products designed for both residential and commercial applications. Features such as high plating thickness, advanced water-saving flow restrictors, and aerators with honeycomb structures highlight their commitment to durability and efficiency .

Manufacturing and Quality Assurance

The manufacturing facility in Shapar-Veraval integrates contemporary technology with skilled manpower. The company adheres to Total Quality Management principles, ensuring quality at every stage—from raw material inspection to final product testing. Each faucet undergoes rigorous testing, including cartridge tests up to 500,000 cycles, to guarantee longevity and performance .

Leadership and Governance

The company is led by a team of experienced professionals:

- Mr. Tusharkumar Tilva: Founder & Director with over 30 years of experience in trading and manufacturing.

- Mr. Jimmy Tilva: Managing Director with over 20 years of experience in the plastic segment and technical product manufacturing.

- Mr. Sajan Tilva: Managing Director with over 14 years of experience in finance and administration .

Their combined expertise drives the company’s strategic decisions and operational excellence.

Strengths: Competitive Advantages

1. Diverse and Innovative Product Range

Ganga Bath Fittings offers a wide array of products catering to various customer preferences and budgets. Their focus on innovation and design ensures they meet the evolving demands of the market .

2. Commitment to Quality

The company’s adherence to stringent quality standards, including the use of high-quality materials and advanced manufacturing processes, positions them as a reliable brand in the industry. Their products are designed to withstand extreme conditions, ensuring durability and customer satisfaction .

3. Customer-Centric Approach

Ganga Bath Fittings places significant emphasis on customer satisfaction. Their customer service is proactive, addressing issues promptly and effectively, which is reflected in positive customer testimonials .

4. Strategic Market Expansion

The company’s recent Initial Public Offering (IPO) aims to raise ₹32.65 crore to support financial strategies and expansion plans, indicating a proactive approach to growth and market penetration .

Risks: Challenges and Considerations

1. Employee Satisfaction and Retention

Employee reviews indicate moderate satisfaction levels, with concerns about work-life balance, salary benefits, and job security. The company has a rating of 3.1 out of 5 on AmbitionBox, suggesting room for improvement in employee engagement and retention strategies .

2. Financial Transparency

As a newly incorporated public company, comprehensive financial data is limited. Investors and stakeholders may seek more detailed financial disclosures to assess the company’s performance and stability .

3. Competitive Market Landscape

The bath fittings industry is highly competitive, with established players like Jaquar, Cera Sanitaryware, and Hindware. Ganga Bath Fittings must continuously innovate and maintain quality to sustain and grow its market share.

4. Operational Risks

Dependence on a single manufacturing facility could pose risks related to production disruptions. Diversifying manufacturing locations may mitigate potential operational challenges.

Conclusion

Ganga Bath Fittings Limited has established itself as a reputable player in the bath fittings industry, known for its quality products and customer-centric approach. While the company exhibits strengths in product innovation and market expansion, addressing internal challenges such as employee satisfaction and financial transparency will be crucial for sustained growth and competitiveness.

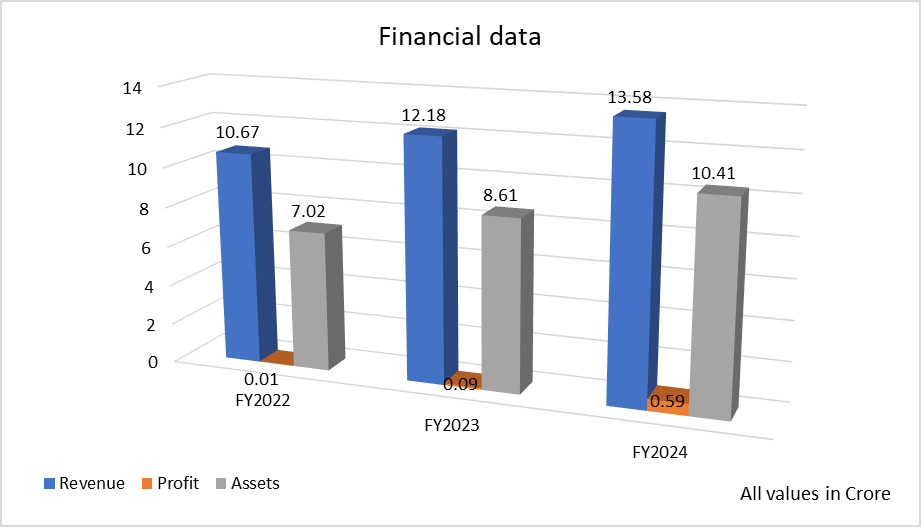

Based on the data provided for Ganga Bath Fittings Limited, here is a brief financial performance analysis across FY2022 to FY2024:

Revenue

- FY2024: ₹13.58 Cr

- FY2023: ₹12.18 Cr

- FY2022: ₹10.67 Cr

Analysis:

The company has shown consistent growth in revenue over the last three financial years. From FY2022 to FY2024, revenue increased by nearly 27%, indicating steady demand and business expansion.

Profit (Net Profit)

- FY2024: ₹0.59 Cr

- FY2023: ₹0.09 Cr

- FY2022: ₹0.01 Cr

Analysis:

Net profit has seen a sharp improvement, especially in FY2024, where it jumped more than 6x from the previous year. This suggests better cost control, improved margins, and stronger operational efficiency.

Total Assets

- FY2024: ₹10.41 Cr

- FY2023: ₹8.61 Cr

- FY2022: ₹7.02 Cr

Analysis:

Assets have steadily increased, reflecting capital investment, capacity building, and long-term growth planning. A rise of nearly 48% in assets from FY2022 to FY2024 signals a growing and expanding business foundation.

Summary

- Consistent Revenue Growth: CAGR of ~13% over three years.

- Profitability Surge: FY2024 shows the company turned significantly profitable.

- Stronger Asset Base: Indicates reinvestment in business expansion.

Conclusion: Ganga Bath Fittings is on a stable upward path in terms of growth and financial health. FY2024 stands out with a major improvement in profitability, which is a positive signal for investors considering the IPO.