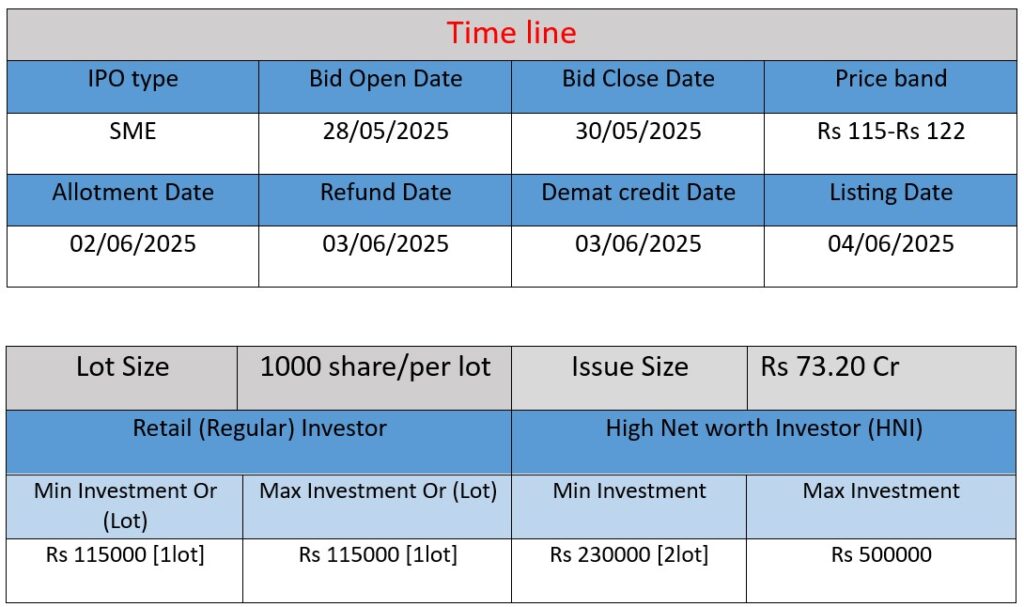

Neptune Petrochemicals Limited is launching its IPO with an issue size of ₹73.20 crore through a fresh issue of 60 lakh equity shares. The primary objective of the IPO is to fund capital expenditure for installing additional plant and machinery, purchasing office space, meeting working capital needs, and addressing general corporate purposes. The IPO opens on May 28, 2025, and closes on May 30, 2025.

Neptune Petrochemicals Limited is a prominent Indian company specializing in the production and distribution of bituminous products. Established in 2004, the company has expanded its operations across India and neighboring countries, offering a range of products and services in the petrochemical sector. Below is a comprehensive overview of the company’s operations, strengths, and potential risks.

Company Overview

Founding and Evolution: Founded in 2004 by Mr. Paresh Shah, Neptune Petrochemicals began as a trading entity and progressively integrated backward into manufacturing and imports to meet the nation’s petrochemical needs. The company has established manufacturing plants across India, including locations in Gujarat, Haryana, and Assam.

Product Portfolio: Neptune’s diverse product range includes:

- Penetration Grade Bitumen

- Viscosity Grade Bitumen

- Bitumen Emulsion

- Polymer Modified Bitumen (PMB)

- Crumb Rubber Modified Bitumen (CRMB)

- Base Oil

- Fuel Oil

- Lubricants

- Urea

- Sulphur

- Mixed Glycol

- Heavy Aromatics

These products cater to various industries, including road construction, waterproofing, and other construction-related sectors.

Strengths

1. Advanced Manufacturing Infrastructure

Neptune operates fully automated manufacturing plants equipped with world-class technology. The company’s facilities are designed to produce high-quality products efficiently, adhering to stringent quality control measures.

2. Robust Quality Assurance

The company holds multiple certifications, including:

- ISO 9001:2015 (Quality Management System)

- ISO 14001:2015 (Environmental Management System)

- OHSAS 18001:2007 (Occupational Health and Safety Management System)

- NABL Accreditation for its laboratory

These certifications reflect Neptune’s commitment to maintaining high standards in product quality, environmental responsibility, and employee safety.

3. Research and Development Focus

Neptune’s in-house R&D department is equipped with the latest testing equipment and staffed by skilled professionals. The team is dedicated to continuous innovation, developing new and improved products to meet evolving market demands.

4. Extensive Market Presence

The company has a strong presence across multiple Indian states, including Gujarat, Rajasthan, Madhya Pradesh, Maharashtra, Haryana, Punjab, Himachal Pradesh, Uttar Pradesh, Uttarakhand, Odisha, Bihar, West Bengal, Karnataka, Assam, Manipur, Meghalaya, Tripura, Nagaland, Arunachal Pradesh, and Chhattisgarh. Additionally, Neptune has expanded its reach to neighboring countries like Nepal, Bhutan, and Bangladesh.

5. Corporate Social Responsibility (CSR) Initiatives

Neptune actively engages in CSR activities, such as:

- Providing oxygen cylinders during the COVID-19 pandemic

- Organizing blood donation camps

- Tree plantation drives

- Campaigns to protect birds during festivals

These initiatives demonstrate the company’s commitment to social and environmental causes.

Risks and Challenges

1. Employee Feedback

According to a review on AmbitionBox, Neptune Petrochemicals received an overall rating of 4.0 out of 5. While aspects like company culture, salary, and work-life balance were rated positively, job security and opportunities for skill development received lower scores. It’s important to note that this rating is based on a single review, which may not fully represent the overall employee experience.

2. Market Competition

The petrochemical industry is highly competitive, with numerous players vying for market share. Maintaining a competitive edge requires continuous innovation, cost efficiency, and adherence to quality standards.

3. Regulatory Compliance

Operating in the petrochemical sector necessitates strict compliance with environmental and safety regulations. Any lapses can lead to legal repercussions and damage to the company’s reputation.

4. Economic Fluctuations

The company’s performance can be influenced by economic factors such as fluctuations in raw material prices, currency exchange rates, and changes in government policies related to the petrochemical industry.

Recent Developments

- 2024: Received the award for the fastest-growing company in Gujarat by the Honorable Chief Minister of Gujarat.

- 2023: Established a new plant in Changasari, Assam, and opened another branch in Punjab.

- 2022: Received an award from Petrosil for the highest bitumen import.

Neptune Petrochemicals Limited has established itself as a significant player in the Indian petrochemical industry, particularly in the bitumen segment. With a focus on quality, innovation, and social responsibility, the company continues to expand its footprint both domestically and internationally. While it faces challenges common to the industry, such as regulatory compliance and market competition, Neptune’s strategic initiatives and robust infrastructure position it well for sustained growth.

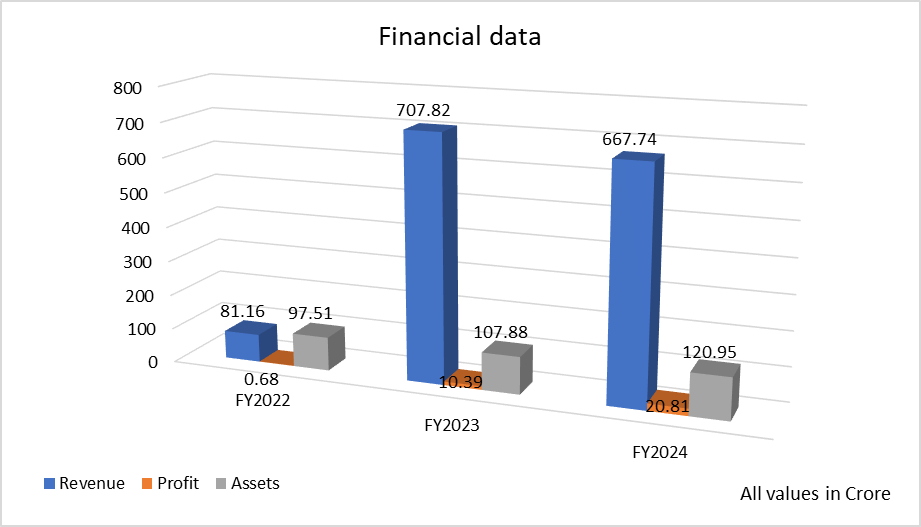

Based on the data provided for Neptune Petrochemicals Limited, here is a brief financial performance analysis across FY2022 to FY2024:

Revenue Analysis

- FY2022 to FY2023: The company witnessed a sharp increase in revenue from ₹81.16 crore to ₹707.82 crore, showing over 8x growth, indicating strong business expansion.

- FY2023 to FY2024: Revenue slightly declined by 5.66%, which may indicate stabilization or slight dip in demand or sales volume.

Profit Analysis

- FY2022 to FY2023: Net profit grew significantly from ₹0.68 crore to ₹10.39 crore.

- FY2023 to FY2024: Profit doubled to ₹20.81 crore, reflecting better operational efficiency and cost management despite a slight revenue dip.

Asset Growth

- Assets increased steadily over the years:

- FY2022 to FY2023: from ₹97.51 crore to ₹107.88 crore

- FY2023 to FY2024: further to ₹120.95 crore

- This reflects consistent capital investment and strengthening of the company’s asset base.

Summary

- The company has shown remarkable revenue and profit growth over the three years.

- Profitability is improving consistently, showing strong financial health.

- Assets are expanding steadily, indicating strategic reinvestment and long-term growth plans.

This financial trend demonstrates Neptune Petrochemicals’ strong business trajectory ahead of its IPO.