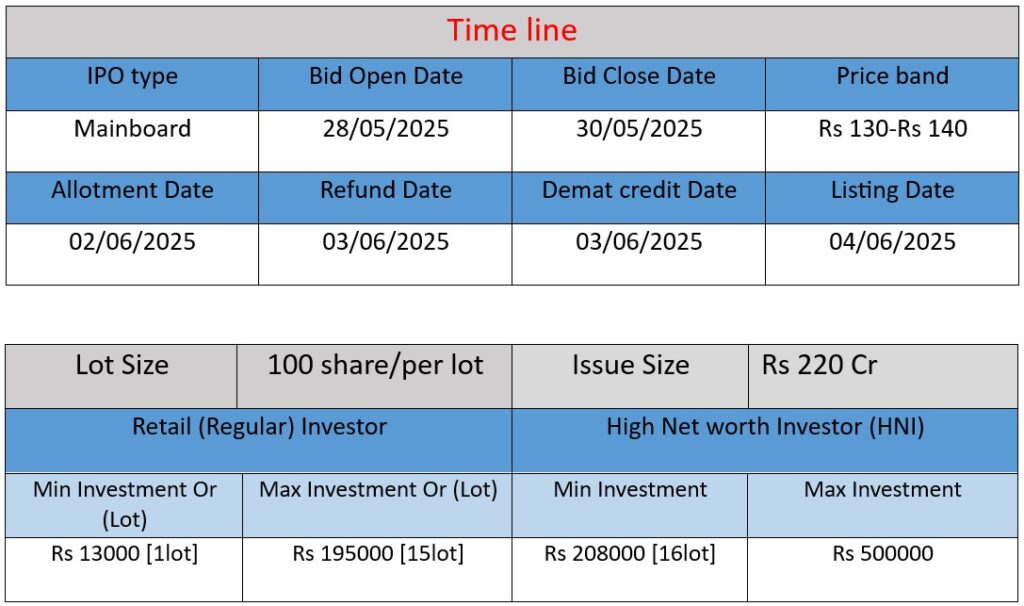

Scoda Tubes Ltd IPO opens on May 28 and closes on May 30, 2025, with a price band of ₹130–₹140 per share. The ₹220 crore fresh issue aims to expand production capacity, meet working capital needs, and fund general corporate purposes. Listing is expected on June 4 on BSE and NSE. Invest with a minimum lot of 100 shares. Stay updated on GMP, allotment, and listing details for this stainless steel tube manufacturer.

Scoda Tubes Limited is a prominent Indian manufacturer specializing in stainless steel pipes and tubes. Established in 2008, the company has evolved from a small-scale operation into a global player in the stainless steel industry. Below is an analysis of Scoda Tubes Limited, focusing on its operations, strengths, and potential risks, based on information from its official website, industry publications, and employee reviews.

Company Overview

Scoda Tubes Limited, founded in 2008, is headquartered in Gujarat, India. The company specializes in manufacturing a wide range of stainless steel products, including seamless and welded pipes, tubes, and heat exchanger tubes. Its product portfolio caters to various industries such as oil and gas, chemicals, fertilizers, power, pharmaceuticals, automotive, railways, and transportation.

Over the years, Scoda Tubes has expanded its manufacturing capabilities, with a facility boasting an installed capacity of 20,000 metric tons per annum for mother hollow, 10,068 metric tons for seamless products, and 1,020 metric tons for welded products.

Strengths

1. Diverse Product Range

Scoda Tubes offers an extensive array of stainless steel products, including:

Seamless pipes and tubes

- Welded pipes and tubes

- Heat exchanger tubes and “U” tubes

- Instrumentation tubes

- This diverse product line enables the company to serve a broad spectrum of industries and meet various customer requirements.

2. Global Market Presence

The company has established a significant international footprint, exporting to countries such as Germany, Spain, Denmark, the Netherlands, and Estonia. In the fiscal year 2023-24, Scoda Tubes reported substantial export values, with Germany accounting for over $1.5 million in exports.

3. Quality Certifications

Scoda Tubes holds several quality and safety certifications, including:

- ISO 9001:2015

- ISO 14001:2018

- ISO 45001:2018

- PED 2014/68/EU

- AD 2000 Merkblatt WO

These certifications underscore the company’s commitment to quality management, environmental responsibility, and occupational health and safety.

4. Positive Employee Feedback

Employee reviews indicate a favorable work environment at Scoda Tubes. On AmbitionBox, the company has an overall rating of 4.9 out of 5, with high scores in company culture, work-life balance, and skill development.

Potential Risks

1. High Debt Levels

The company has significant open charges totaling ₹242.05 crore, indicating a considerable level of debt. High debt can pose risks, especially if not managed effectively, potentially affecting the company’s ability to invest in growth opportunities.

2. Market Competition

The stainless steel manufacturing industry is highly competitive, with numerous domestic and international players. Maintaining market share and profitability requires continuous innovation, quality assurance, and cost management.

Future Outlook

Scoda Tubes has filed draft papers with the Securities and Exchange Board of India (SEBI) to raise ₹220 crore through an initial public offering (IPO). The proceeds are intended for expanding production capacity, funding working capital requirements, and general corporate purposes.

This strategic move indicates the company’s commitment to growth and its ambition to strengthen its position in both domestic and international markets.

Conclusion

Scoda Tubes Limited has demonstrated significant growth since its inception, with a diverse product range, global market presence, and a commitment to quality. While the company faces challenges such as financial fluctuations and market competition, its strategic initiatives, including the proposed IPO, position it well for future expansion and success in the stainless steel manufacturing industry.

related to employee satisfaction, market competition, and reliance on government initiatives.

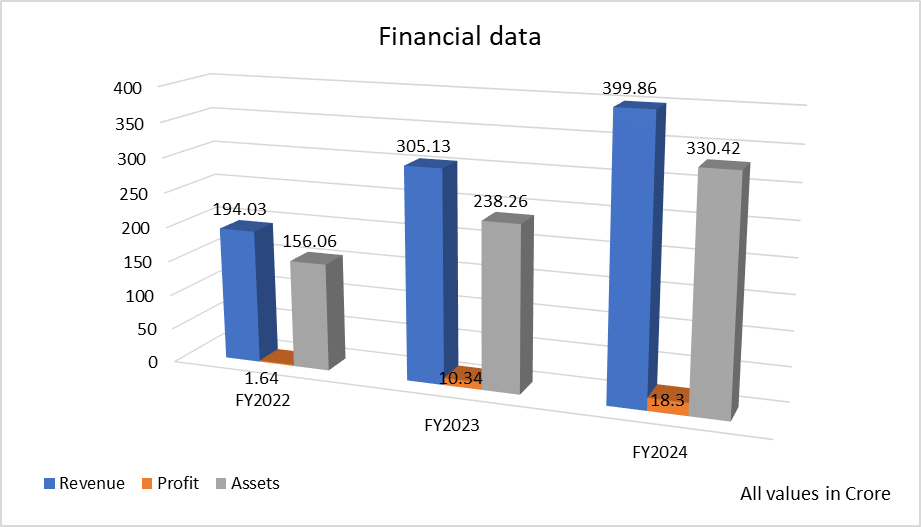

Based on the data provided for Scoda Tubes Limited, here is a brief financial performance analysis across FY2022 to FY2024:

Revenue

- FY2022: ₹194.03 crore

- FY2023: ₹305.13 crore

- FY2024: ₹399.86 crore

Growth:

- FY2023 vs FY2022: +57.26%

- FY2024 vs FY2023: +31.05%

Analysis:

The company has shown strong and consistent revenue growth over the past two years, with nearly 106% cumulative growth from FY2022 to FY2024. This suggests strong demand and expanding operations.

Profit

- FY2022: ₹1.64 crore

- FY2023: ₹10.34 crore

- FY2024: ₹18.30 crore

Growth:

- FY2023 vs FY2022: +530.49%

- FY2024 vs FY2023: +77.01%

Analysis:

Profitability has increased significantly, indicating improved margins and operational efficiency. The company has grown from a low-profit base to a solid double-digit profit figure.

Total Assets

- FY2022: ₹156.06 crore

- FY2023: ₹238.26 crore

- FY2024: ₹330.42 crore

Growth:

- FY2023 vs FY2022: +52.6%

- FY2024 vs FY2023: +38.7%

Analysis:

The asset base has more than doubled in two years, reflecting capital investments to support future growth, possibly for capacity expansion and infrastructure upgrades.

Summary

- Strong revenue growth year-on-year signals market demand and operational expansion.

- Exceptional profit jump, especially from FY2022 to FY2023, shows successful cost management and economies of scale.

- Asset expansion aligns with company growth strategy, likely fueled by retained earnings and possibly debt/funding.