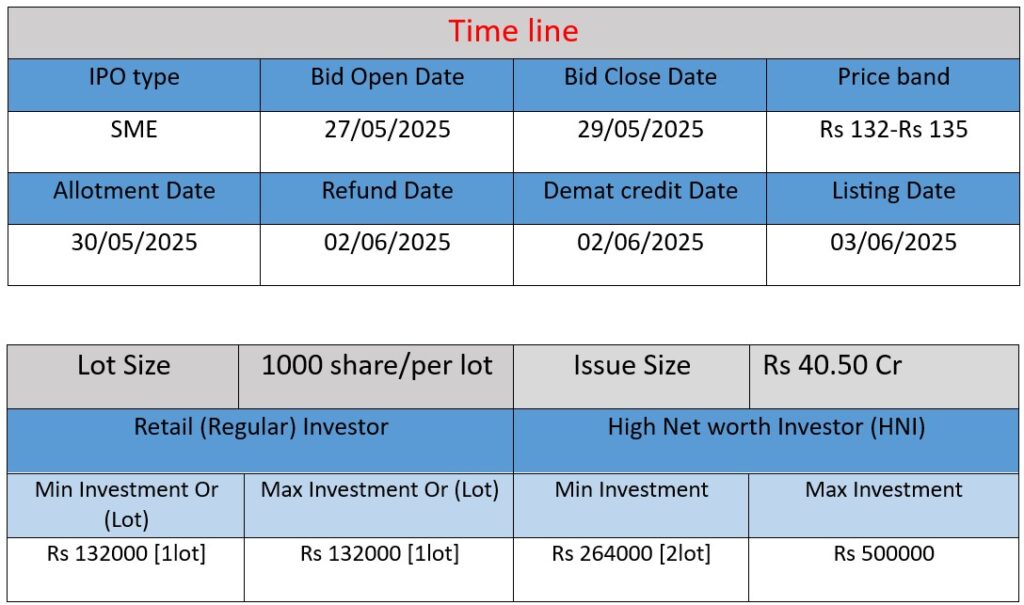

Blue Water Logistics Limited’s Initial Public Offering (IPO) is currently open for subscription from May 27 to May 29, 2025. The company aims to raise ₹40.5 crore through the issuance of 30 lakh fresh equity shares, priced between ₹132 and ₹135 per share. The funds will be utilized for purchasing commercial vehicles, meeting working capital requirements, and general corporate purposes. This IPO marks a significant step in the company’s expansion strategy within the logistics sector

Blue Water Logistics Limited (BWL) is a comprehensive logistics service provider. The company specializes in multimodal transport solutions, encompassing ocean, air, and road freight, along with supply chain management and warehousing services. BWL operates through a network of branches across major Indian cities, including Chennai, Delhi, Jaipur, Visakhapatnam, and Thane, and is registered under the Multimodal Transportation of Goods Act, 1993.

Core Services

1. Freight Forwarding (Ocean, Air, Road):

BWL offers end-to-end freight solutions:

- Ocean Freight: Handles Full Container Load (FCL) and Less than Container Load (LCL) shipments, with services like cargo pick-up, customs clearance, and port handling.

- Air Freight: Manages air cargo exports and imports, including cargo pick-up, customs clearance, and coordination with airlines.

- Road Freight: Provides domestic and cross-border trucking services, utilizing a dedicated fleet and partnerships with trucking companies.

2. Supply Chain Management:

BWL delivers customized supply chain solutions, focusing on speed-to-market, vendor management, and cost-effective logistics strategies.

3. Warehousing and Value-Added Services:

The company offers warehousing solutions, export packaging, palletization, fumigation, and pest control services, ensuring cargo meets international standards.

4. Specialized Services:

BWL has initiated services in break bulk cargo handling, stevedoring, vessel agency services, and is in the process of acquiring mini bulk carriers to enhance coastal shipping capabilities.

Strengths

- Diverse Service Portfolio: BWL’s comprehensive range of services allows it to cater to various industries, including confectionery, chemicals, textiles, electronics, and fitness equipment.

- Strategic Partnerships: The company maintains contract codes with shipping lines, enabling it to secure competitive ocean freight rates.

- Experienced Team: BWL boasts a skilled and committed workforce that seeks innovative solutions to meet customer needs.

- Growth Trajectory: With a current turnover of ₹200 crore, BWL aims to achieve ₹500 crore by 2025 and plans to list on the National Stock Exchange.

Risks and Challenges

- Infrastructure Limitations: The underdeveloped network of LNG refueling stations in India may pose challenges for the adoption of LNG-powered trucks, which BWL might consider for sustainable logistics solutions.

- Operational Risks: Handling diverse cargo types and managing complex logistics operations can lead to potential delays and increased operational costs if not managed efficiently.

- Market Competition: The logistics industry in India is highly competitive, with numerous players offering similar services, which may impact BWL’s market share and pricing strategies.

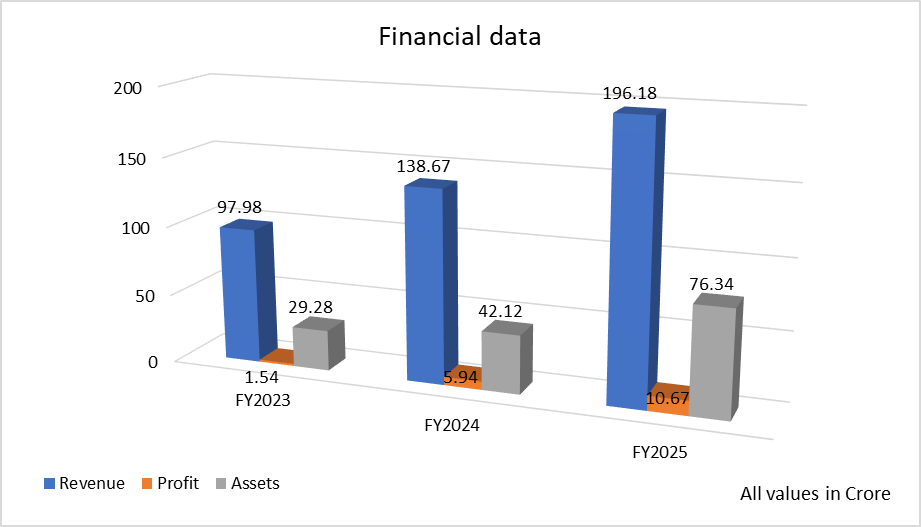

Based on the data provided for Blue Water Logistics Limited, here is a brief financial performance analysis across FY2023 to FY2025:

Revenue Growth

BWL’s revenue has shown a consistent upward trend:

- FY2023: ₹97.98 crore

- FY2024: ₹138.67 crore (approx. 41.5% increase from FY2023)

- FY2025: ₹196.18 crore (approx. 41.4% projected increase from FY2024)

This growth is attributed to the company’s expansion into various logistics services, including freight forwarding, customs clearance, and transportation handling .

Profitability Enhancement

The company’s Profit After Tax (PAT) has improved significantly:

- FY2023: ₹1.54 crore

- FY2024: ₹5.94 crore (approx. 285.7% increase from FY2023)

- FY2025: ₹10.67 crore (approx. 79.6% projected increase from FY2024)

This enhancement reflects BWL’s operational efficiency and strategic initiatives to optimize costs and expand its service offerings .

Asset Expansion

BWL’s total assets have grown substantially:

- FY2023: ₹29.28 crore

- FY2024: ₹42.12 crore (approx. 43.9% increase from FY2023)

- FY2025: ₹76.34 crore (approx. 81.3% projected increase from FY2024)

The asset growth is primarily due to investments in commercial vehicles and infrastructure to support the company’s expanding operations .

Key Financial Ratios (FY2024)

- Return on Equity (RoE): 62.66%

- Earnings Per Share (EPS): ₹7.43

- Net Asset Value (NAV): ₹11.85

- Debt-to-Equity Ratio: 1.82

These ratios indicate a strong financial position, with high returns to shareholders and a manageable debt level .

Conclusion

Blue Water Logistics Limited has demonstrated robust financial growth over the past three fiscal years, with significant increases in revenue, profitability, and assets. The company’s strategic investments and expansion into various logistics services have contributed to its strong financial performance. With a solid foundation and ongoing growth initiatives, BWL is well-positioned to achieve its target of ₹500 crore turnover by 2025 .