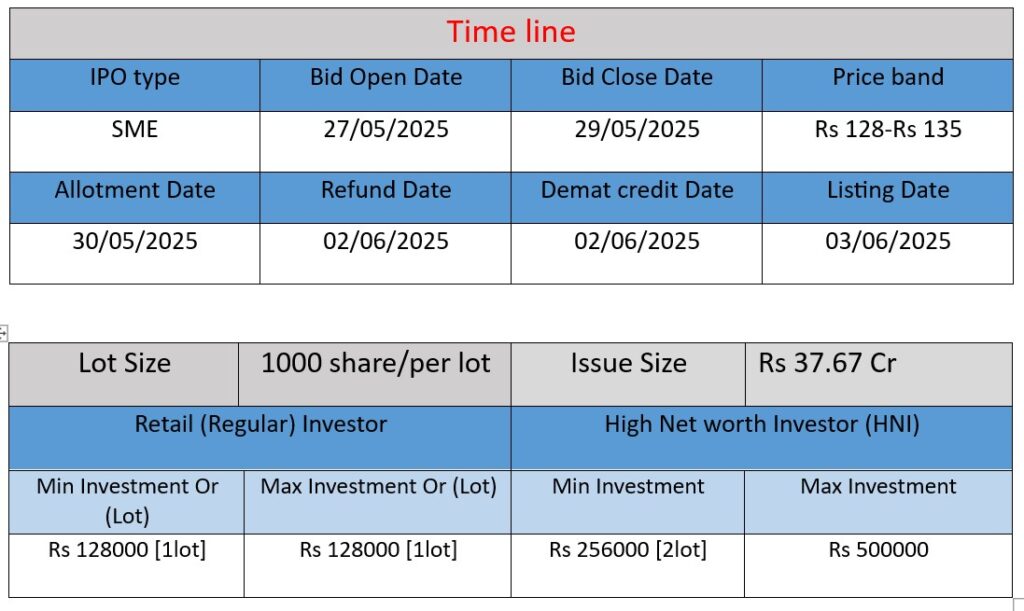

Astonea Labs Ltd IPO opens on May 27, 2025, and closes on May 29, 2025, with an issue size of ₹37.67 crore. The price band is ₹128–₹135 per share. Funds will be used for setting up a new manufacturing unit, plant & machinery, working capital, brand promotion, and international product registrations. The shares will be listed on the BSE SME platform on June 3, 2025.

Astonea Labs Limited is a prominent Indian pharmaceutical and cosmeceutical manufacturer with over 35 years of industry experience. Headquartered in Panchkula, Haryana, the company has established itself as a key player in both domestic and international markets. Below is an overview of the company’s operations, strengths, and potential risks, compiled from multiple sources.

Work: Core Operations and Capabilities

Diverse Manufacturing Portfolio

Astonea Labs specializes in the production of a wide range of pharmaceutical and cosmetic products, including:

- Tablets, capsules, softgels, powders, ointments, creams, and lotions

- Herbal and nutraceutical formulations

- Cosmeceutical products

The company’s state-of-the-art manufacturing facility spans over 16,000 square meters and operates in strict compliance with ISO standards and USFDA guidelines. This facility enables Astonea Labs to efficiently cater to both domestic and international markets.

Research and Development Focus

Astonea Labs places a strong emphasis on research and development (R&D), with a dedicated formulation development unit that allows for the swift creation of new formulations and anticipation of market trends. This proactive approach ensures the company remains at the forefront of innovation in the pharmaceutical and cosmetic sectors.

Contract Manufacturing and Global Reach

The company offers contract manufacturing services, acting as an extension of clients’ brands by producing large-scale quantities of registered and approved formulations. Astonea Labs boasts state-of-the-art facilities and experienced personnel to handle various dosage forms, ensuring products meet both international and regional regulatory standards.

Strengths: Competitive Advantages

Robust Quality Assurance

Astonea Labs is certified with multiple international standards, including WHO GMP, ISO 9001, ISO 22000, CE, PETA, HALAL, and ECO CERT. These certifications underscore the company’s commitment to maintaining high-quality products that meet rigorous industry standards.

Sustainable Manufacturing Practices

The company operates a zero-liquid discharge manufacturing facility, employing advanced technologies such as reverse osmosis (RO) to treat and recycle water. Gaseous emissions, including steam, undergo rigorous purification processes before release, ensuring minimal environmental impact.

Experienced Leadership and Team

Under the leadership of Founder and Managing Director Ashish Gulati, who brings a unique blend of technical expertise and visionary leadership, Astonea Labs has flourished. The senior leadership team boasts a minimum of 20 years of experience in the industry, contributing significantly to the firm’s growth trajectory.

Positive Employee Feedback

Employee reviews indicate a generally positive work environment, with high ratings for job security, skill development, and company culture. The overall rating stands at 4.2 out of 5, reflecting employee satisfaction with various aspects of the company.

Risks: Potential Challenges

Limited Workforce Size

As of the financial year 2024, Astonea Labs employs 23 individuals. While this lean structure may contribute to operational efficiency, it could also pose challenges in scaling operations or managing increased demand.

Financial Obligations

The company has total open charges amounting to ₹48.81 crore, indicating significant financial commitments. While the company has shown substantial growth in revenue and profitability, these obligations necessitate careful financial management to ensure long-term sustainability.

Export Market Dependencies

Astonea Labs has exports in the pipeline for formulations and active pharmaceutical ingredients (APIs) to non-regulated markets in Eurasia, Africa, and Southeast Asia. While these markets offer growth opportunities, they may also present challenges related to regulatory compliance, market volatility, and geopolitical risks.

In summary, Astonea Labs Limited demonstrates a strong commitment to quality, innovation, and sustainability in the pharmaceutical and cosmeceutical manufacturing sectors. While the company enjoys several competitive advantages, it must navigate challenges related to workforce scalability, financial obligations, and market dependencies to sustain and enhance its growth trajectory.

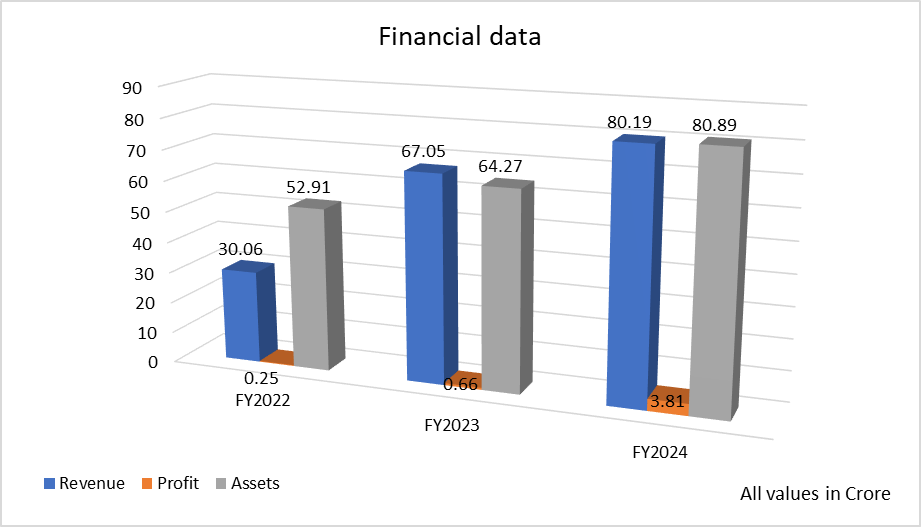

Based on the data provided for Astonea Labs Limited, here is a brief financial performance analysis across FY2022 to FY2024:

Revenue

- FY2022: ₹30.06 Cr

- FY2023: ₹67.05 Cr

- FY2024: ₹80.19 Cr

Analysis:

Revenue has grown impressively — more than 2x in FY2023 (123% growth) and 19.6% growth in FY2024. This indicates strong business expansion and market demand.

Profit

- FY2022: ₹0.25 Cr

- FY2023: ₹0.66 Cr

- FY2024: ₹3.81 Cr

Analysis:

Profit surged 2.6x in FY2023 and nearly 5.8x in FY2024, suggesting improved margins and operational efficiency. This reflects a transition from low-profit to a high-growth phase.

Total Assets

- FY2022: ₹52.91 Cr

- FY2023: ₹64.27 Cr

- FY2024: ₹80.89 Cr

Analysis:

Assets rose steadily, showing a 21.4% increase in FY2023 and 25.9% in FY2024. This growth supports capacity expansion and long-term investments.

Summary

- Consistent and strong revenue growth

- Significant rise in profits, showing operational strength

- Asset expansion indicates future scalability

Conclusion: Astonea Labs Ltd is on a robust growth path with rising revenues, profits, and assets. This upward trend adds strong fundamentals to its upcoming IPO.