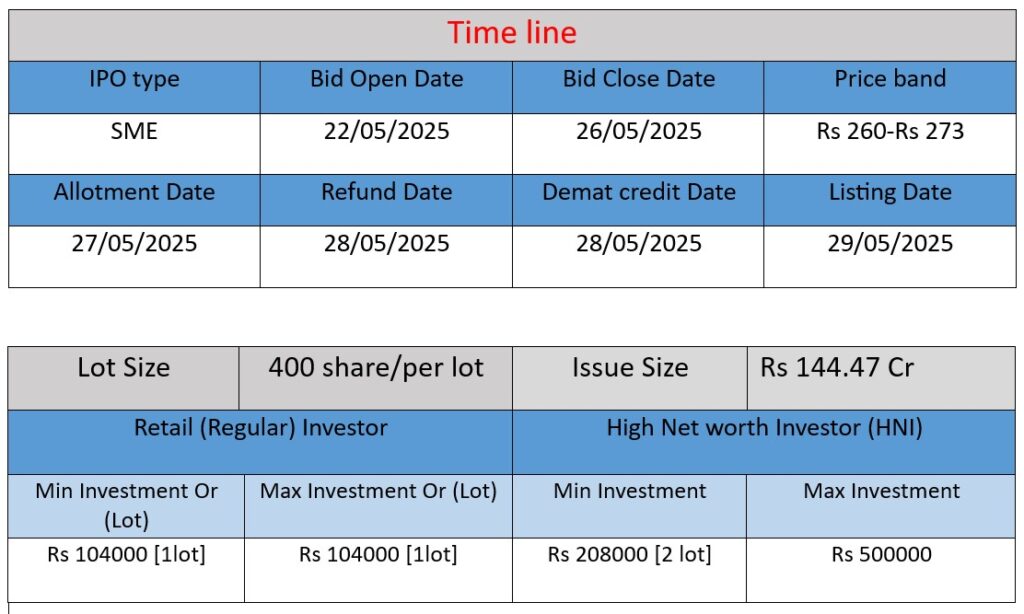

Unified Data-Tech Solutions Ltd. has launched its ₹144.47 crore IPO, entirely an Offer for Sale of 52.92 lakh equity shares by existing shareholders. The IPO opens on May 22, 2025, and closes on May 26, 2025. The shares are proposed to be listed on the BSE SME platform. The primary objective is to list the equity shares on the stock exchange, providing liquidity to existing shareholders.

Core Business Focus

Unified Data-Tech Solutions Pvt. Ltd. (UDTechs), established in 2010 and headquartered in Mumbai, is a prominent Indian IT services company specializing in system integration, infrastructure solutions, and digital transformation. With additional branches in Pune and Ahmedabad, UDTechs serves clients across major Indian cities, offering tailored IT solutions to a diverse clientele, including sectors like banking, insurance, manufacturing, and pharmaceuticals.

Services and Operations

UDTechs provides a comprehensive suite of IT services, focusing on:

- System Integration & Infrastructure: Designing and implementing data centers, cloud infrastructure, and core banking systems.

- Cybersecurity & Compliance: Offering secure IT environments, notably for financial institutions.

- Technology Consulting: Developing long-term IT strategies aligned with clients’ business goals.

- Training & Support: Ensuring clients are well-equipped to manage and utilize their IT solutions effectively.

Their clientele includes major banks, insurance companies, and manufacturing firms, highlighting their capability to handle complex IT challenges across various industries.

Strengths

1. Client-Centric Approach

UDTechs is renowned for its commitment to customer satisfaction, offering customized solutions and proactive support. Their emphasis on client training and handholding ensures seamless adoption of IT solutions.

2. Diverse Industry Experience

The company’s portfolio spans multiple sectors, including finance, manufacturing, and pharmaceuticals, demonstrating versatility and adaptability in addressing industry-specific IT needs.

3. Recognition and Awards

UDTechs has been acknowledged in the India 5000 Best MSME Awards, reflecting its excellence in the IT services domain.

Risks and Challenges

1. Employee Satisfaction

Employee reviews present a mixed picture. While some praise the learning opportunities and supportive culture, others highlight concerns regarding management practices and work-life balance.

2. Operational Consistency

Discrepancies in reported employee numbers and varying feedback suggest potential inconsistencies in internal operations and communication.

3. Market Competition

Operating in a highly competitive IT services market, UDTechs faces challenges from larger firms with more extensive resources and global reach.

Unified Data-Tech Solutions Pvt. Ltd. stands out for its client-focused services and diverse industry experience. However, to enhance its market position, the company may need to address internal operational challenges and employee satisfaction concerns.

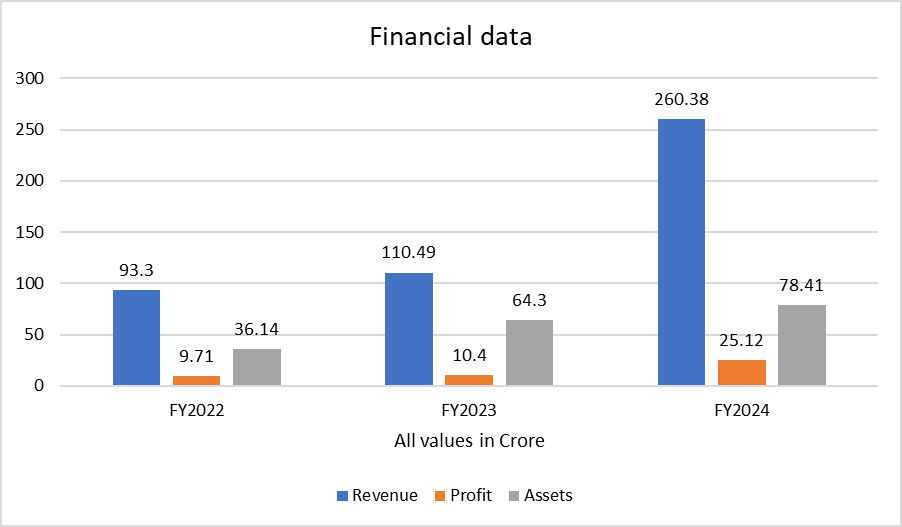

Based on the data provided for Unified Data Tech Limited, here is a brief financial performance analysis across FY2022 to FY2024:

Revenue Growth

- FY2022 → FY2023:

Revenue grew from ₹93.3 Cr to ₹110.49 Cr, an increase of ~18.39%. - FY2023 → FY2024:

Revenue jumped to ₹260.38 Cr, a 135.68% increase, showing a significant scale-up in operations.

➤ Analysis:

The company saw explosive growth in FY2024, possibly due to expanded client base, large IT contracts, or stronger service demand in digital infrastructure.

Profit Growth

- FY2022 → FY2023:

Profit rose from ₹9.71 Cr to ₹10.4 Cr (7.1% growth). - FY2023 → FY2024:

Profit increased to ₹25.12 Cr, up by 141.54%.

➤ Analysis:

Profit growth aligned with revenue growth in FY2024, indicating efficient cost control and strong profitability from core operations.

Assets Growth

- FY2022 → FY2023:

Assets almost doubled from ₹36.14 Cr to ₹64.3 Cr (~77.8% growth). - FY2023 → FY2024:

Assets increased to ₹78.41 Cr (21.9% growth).

➤ Analysis:

The asset base grew steadily, supporting infrastructure expansion needed for service delivery. Slower asset growth in FY2024 despite high revenue may reflect efficient utilization or outsourcing models.

Key Insights

- Strong Revenue Acceleration: Over 2.5x increase in FY2024 indicates business momentum.

- Profitability is Healthy: Net profit growth matches revenue growth, indicating operational efficiency.

- Balance Sheet Strengthening: Asset base nearly doubled over 3 years, supporting future scalability.

Conclusion

Unified Data-Tech Solutions Ltd. has shown impressive financial performance, especially in FY2024. The company appears to be in a rapid growth phase, with healthy profits and expanding assets, making its IPO fundamentally attractive for investors.