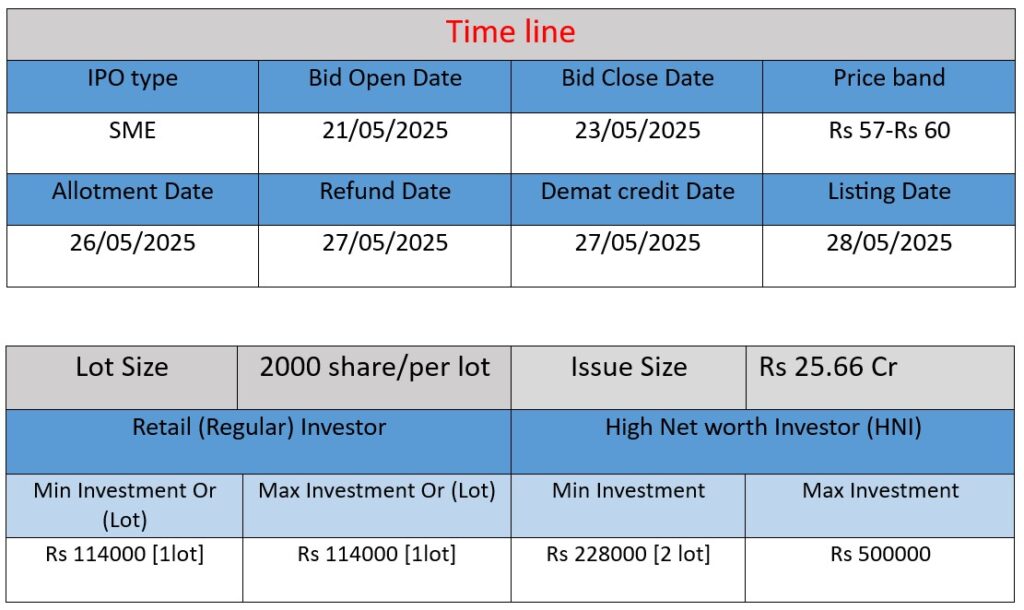

Dar Credit & Capital Ltd. IPO opens on May 21, 2025, aiming to raise ₹25.66 crore through a book-built SME issue on NSE Emerge. The IPO proceeds will augment the company’s capital base, support general corporate purposes, and cover issue expenses. Dar Credit focuses on providing financial solutions to underserved segments, including low-income individuals and small-scale entrepreneurs.

Core Business Focus

Dar Credit & Capital Ltd. (DCCL) is a Non-Banking Financial Company (NBFC) established in 1994, headquartered in Kolkata with a regional office in Jaipur. The company focuses on providing financial services to underserved and low-income segments, including Class IV municipal employees, small vendors, and women entrepreneurs. Below is an analysis of DCCL’s operations, strengths, and risks based on information from multiple sources.

DCCL offers three primary loan products:

- Personal Loans: Targeted at self-employed and salaried individuals for purposes like income generation, education, and medical needs.

- Unsecured MSME Loans: Designed to support small businesses and economically challenged individuals aiming to improve their livelihoods.

- Secured MSME Loans: Intended for small business owners to generate income, meet seasonal requirements, or support business growth, backed by property as collateral.

The company operates through branch offices in West Bengal, Rajasthan, Bihar, and Jharkhand, with additional camp offices in Madhya Pradesh and Gujarat.

Strengths

1. Focused Customer Segment

DCCL specializes in offering credit solutions to low-income individuals, particularly those in Class IV employment roles such as cleaners, sweepers, and peons working in municipalities. The company also extends credit to small-scale shopkeepers and vendors, with a strong focus on empowering women entrepreneurs.

2. Digital Transformation

The company has implemented digital sourcing and disbursement of loans. A significant proportion of their sourcing and collections across assets and liabilities are digitalized using mobile phones and tablets, with an emphasis on Straight Through Processing (STP) while incorporating fraud and regulatory checks.

3. Financial Growth

DCCL has demonstrated steady financial growth over the years. The company reported revenue of ₹33.01 crores in 2024 compared to ₹25.57 crores in 2023. Profitability also improved, with a net profit of ₹3.68 crores in 2024, up from ₹2.72 crores in 2023.

4. Strong Capital Adequacy

As of June 2024, the company reported a robust Capital Risk Assets Ratio (CRAR) of 30.91%, indicating strong capital adequacy.

Risks

1. Credit Risk

Serving low-income and underbanked segments inherently carries higher credit risk due to potential defaults, especially among borrowers with limited financial literacy or unstable income sources.

2. High Debt-to-Equity Ratio

The company’s debt-to-equity ratio stood at 2.53 in FY2024, which is relatively high and may impact financial stability during economic downturns.

3. Moderate Credit Rating

DCCL’s debentures have been rated BBB- by CARE Ratings, indicating moderate credit quality and suggesting that the company is more susceptible to adverse economic conditions.

Recent Developments

DCCL is planning an Initial Public Offering (IPO) in 2025, aiming to raise capital for expansion and strengthening its financial position. The IPO comprises a fresh issue and an offer for sale, with plans to list on the NSE.

In summary, Dar Credit & Capital Ltd. has carved a niche in providing financial services to underserved segments, demonstrating steady growth and a commitment to digital transformation. However, potential investors should consider the inherent credit risks, high leverage, and moderate credit rating when evaluating the company’s prospects.

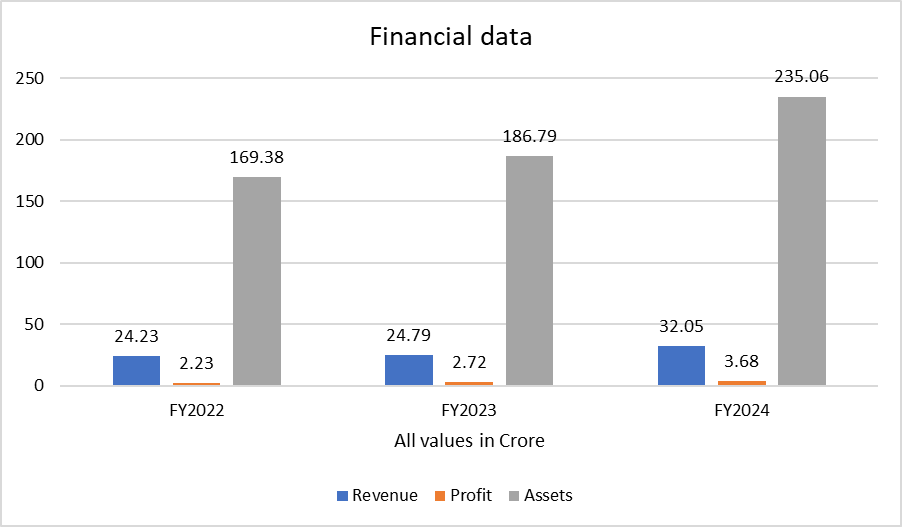

Based on the data provided for Dar Credit and Capital Limited, here is a brief financial performance analysis across FY2022 to FY2024:

Revenue Analysis

In FY2022, the company’s revenue stood at ₹24.23 crore. This slightly increased to ₹24.79 crore in FY2023 and then jumped significantly to ₹32.05 crore in FY2024.

This upward trend shows that the company has been steadily expanding its lending operations, with strong growth in FY2024 indicating better loan disbursement and an increasing customer base.

Profit Analysis

The net profit was ₹2.23 crore in FY2022, which rose to ₹2.72 crore in FY2023 and further to ₹3.68 crore in FY2024.

This reflects a total increase of nearly 65% over three years, highlighting the company’s improving operational efficiency, better cost control, and stronger profitability.

Assets Analysis

The total assets were ₹169.38 crore in FY2022, which grew to ₹186.79 crore in FY2023 and reached ₹235.06 crore by FY2024.

This asset growth of nearly 39% indicates that the company is building a larger lending portfolio and strengthening its financial position.

Conclusion

Dar Credit and Capital Ltd. has shown consistent and healthy financial growth over the past three years. The rise in revenue, profit, and assets signals a strong operational base and financial health. This positive trend strengthens the company’s profile as it moves forward with its IPO.