हिंदी में पढ़ने के लिए मेनू बार से हिंदी भाषा चयन करें।

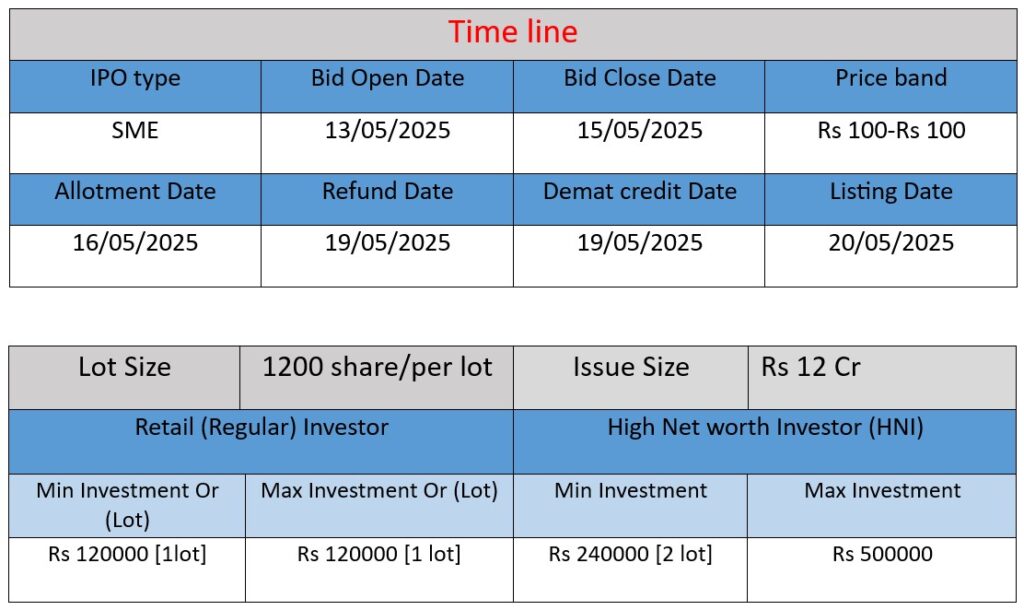

Integrity Infrabuild Developers Limited is launching its SME IPO on NSE Emerge, opening on May 13, 2025, and closing on May 15, 2025. The issue comprises 12,00,000 equity shares at a fixed price of ₹100 per share, aggregating to a total issue size of ₹12 crore .

Core Business Focus

Integrity Infrabuild Developers Limited (IIDL) is a Gujarat-based civil construction company that has rapidly expanded its footprint in government infrastructure projects. Below is an analysis of the company’s operations, strengths, and risks, based on information from its official website and regulatory filings.

Established in 2017, the company transitioned to Integrity Infrabuild Developers Limited in June 2024. It operates as an integrated civil contractor, registered as a Class-A contractor with the Government of Gujarat

Key Areas of Operation:

- Road Construction: Specializes in building and resurfacing state highways and rural roads.

- Bridge Construction: Develops durable bridges to enhance regional connectivity.

- Government Buildings: Constructs administrative and public-use facilities.

The company has completed over 100 projects and is currently handling 57 ongoing projects . Notable clients include the Gujarat State Roads & Buildings Department and the Gujarat Mineral Development Corporation.

Strengths: Competitive Advantages

1. Timely Project Completion

IIDL is recognized for completing projects ahead of schedule, often receiving bonuses for early delivery .

2. Experienced Leadership

Led by Managing Director Keyurkumar Sheth and a team of seasoned engineers and administrators, the company benefits from strong leadership .

3. Strategic Government Partnerships

As a Class-A contractor, IIDL has secured multiple government contracts, ensuring a steady pipeline of projects .

4. IPO and Capital Expansion

In October 2024, IIDL filed a Draft Red Herring Prospectus (DRHP) for an SME IPO on NSE Emerge. The proceeds are intended for purchasing machinery, funding working capital, and general corporate purposes .

Risks: Challenges and Considerations

1. Geographical Concentration

All projects are currently based in Gujarat, which may expose the company to regional economic or political risks .

2. Limited Profit Margins

For the fiscal year ending 2024, the company reported revenues of ₹38.04 crore but a modest profit after tax of ₹0.28 crore, indicating tight margins .

3. Regulatory and Compliance Risks

As a government contractor, IIDL must adhere to stringent regulatory standards. Any lapses could impact its eligibility for future contracts.

4. Dependence on Government Projects

A significant portion of the company’s revenue is derived from government contracts. Any reduction in public infrastructure spending could adversely affect its business.

In summary, Integrity Infrabuild Developers Limited has established itself as a competent player in Gujarat’s infrastructure sector, leveraging timely project execution and strong government ties. However, its regional focus and reliance on government contracts present certain risks that stakeholders should monitor.

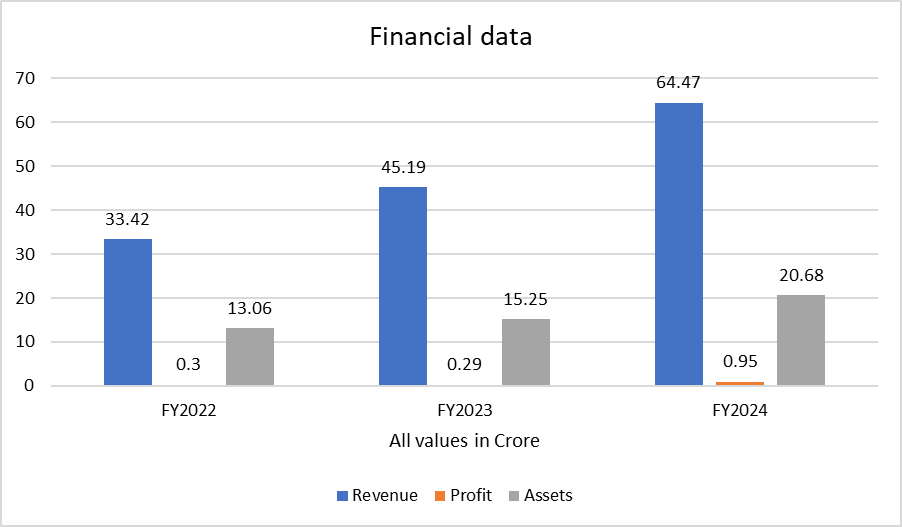

Financial Analysis of Virtual Galaxy Infotech Limited (FY2022-FY2024)

Revenue

- FY2022: ₹33.42 crore

- FY2023: ₹45.19 crore

- FY2024: ₹64.47 crore

Analysis:

The company’s revenue has grown significantly, showing a CAGR of ~39.9% over the three years. This indicates strong growth in project execution and order acquisition.

Profit (PAT)

- FY2022: ₹0.30 crore

- FY2023: ₹0.29 crore

- FY2024: ₹0.95 crore

Analysis:

While profit remained flat in FY2023, FY2024 shows a sharp increase (over 3x) to ₹0.95 crore. This improvement suggests better cost control or more profitable contracts in the latest fiscal year.

Total Assets

- FY2022: ₹13.06 crore

- FY2023: ₹15.25 crore

- FY2024: ₹20.68 crore

Analysis:

Total assets have steadily increased, reflecting continued investment in infrastructure, machinery, and working capital — aligning with the company’s growth in operations.

Conclusion

Integrity Infrabuild Developers Ltd has demonstrated strong revenue growth, improving profitability, and asset expansion, especially in FY2024. These trends reflect a positive business trajectory, supported by its ongoing government contracts. However, relatively low profits compared to revenue highlight that margins are still thin — a key risk investors should consider.