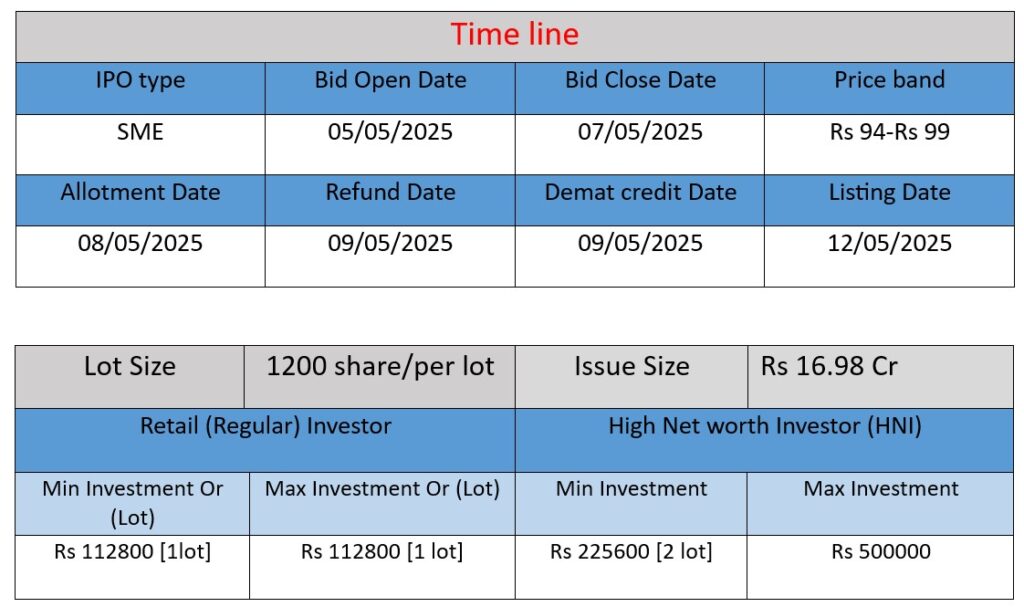

Srigee DLM Limited IPO offers integrated manufacturing services in plastic molding, electronics assembly, and polymers. The issue size is ₹16.98 crore. The IPO aims to fund working capital, repay debts, and support general corporate purposes. Strong client base, in-house tooling, and focus on quality make it a promising SME offering in the manufacturing sector.

Core Business Focus

Srigee DLM Limited is a prominent Indian manufacturing company specializing in plastic injection molding, electronics assembly, and polymer compounding. Below is an overview of the company’s operations, strengths, and risks, based on information from its official website and related sources.

Established in 2005 and headquartered in Greater Noida, Uttar Pradesh, Srigee DLM Limited has evolved into a comprehensive manufacturing solutions provider. The company’s key operational areas include

- Plastic Injection Molding: Operating over 10 machines and additional subcontracting arrangements, Srigee caters to sectors such as electronics, electrical appliances, and automobiles

- Electronics and Electrical Assembly: Since 2015, Srigee has been involved in the assembly of mobile phones and home utility products, serving as an Original Equipment Manufacturer (OEM) for various multinational corporations, including South Korean brands.

- Polymer Compounding and Trading: Through its subdivision ‘Polymos,’ the company manufactures granules like PP, ABS, and GPPS, and engages in trading various polymer grades.

- Tooling Services: Srigee’s in-house tool room, ‘SG Tools,’ specializes in precision mold designing, prototyping, and maintenance, offering cost-effective solutions for diverse industries.

💪 Strengths: Competitive Advantages

Srigee DLM Limited’s notable strengths include:

- Integrated Manufacturing Capabilities: The company’s ability to offer end-to-end solutions—from polymer compounding to final assembly—positions it as a one-stop manufacturing partner.

- Strategic Client Relationships: Srigee has established strong partnerships with leading multinational corporations, including being the only Indian firm in the National Capital Region assigned mobile assembly projects from Samsung.

- Skilled and Diverse Workforce: With over 650 employees, including a significant proportion of women, the company emphasizes workforce training and empowerment, enhancing productivity and social responsibility.

- Commitment to Quality: Srigee’s focus on quality is evident in its disciplined approach to manufacturing and its dedication to delivering products that meet stringent standards.

⚠️ Risks: Potential Challenges

While Srigee DLM Limited has demonstrated robust growth, it faces several risks:

Market Volatility: The company operates in industries subject to rapid technological changes and fluctuating demand, which can impact its business stability.

- Operational Risks: As a manufacturing entity, Srigee is exposed to risks related to production processes, supply chain disruptions, and equipment maintenance.

- Regulatory Compliance: Adherence to various regulations, including environmental and labor laws, is essential. Non-compliance can lead to legal and financial repercussions.

- Dependence on Key Clients: A significant portion of revenue may be derived from a few major clients, making the company vulnerable to changes in these business relationships.

To mitigate these risks, Srigee has implemented a comprehensive Risk Management Policy, focusing on identifying, assessing, and managing potential threats to its operations.

In summary, Srigee DLM Limited stands out as a versatile manufacturing company with integrated services, strong client relationships, and a commitment to quality and workforce development. However, it must navigate industry-specific risks and maintain compliance with regulatory standards to ensure sustained growth.

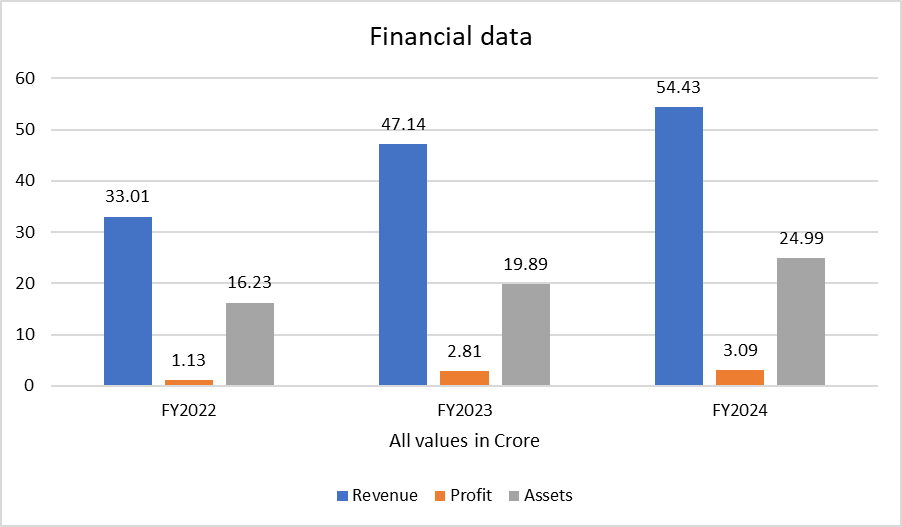

Financial Analysis of Srigee DLM Limited (FY2022-FY2024)

📊 Revenue

- FY2022: ₹33.01 crore

- FY2023: ₹47.14 crore

- FY2024: ₹54.43 crore

Analysis:

Srigee’s revenue has shown consistent growth over the last three years. From FY2022 to FY2023, revenue increased by 42.8%, followed by a 15.4% increase in FY2024. This steady growth reflects expanding operations and stronger client engagement.

💰 Profit (Net Profit)

- FY2022: ₹1.13 crore

- FY2023: ₹2.81 crore

- FY2024: ₹3.09 crore

Analysis:

Profit more than doubled in FY2023 (up ~149%) and further grew by 10% in FY2024. The increasing profit margin indicates better cost control, efficient scaling, and improved profitability.

🏦 Total Assets

- FY2022: ₹16.23 crore

- FY2023: ₹19.89 crore

- FY2024: ₹24.99 crore

Analysis:

Assets have grown steadily, rising by 22.5% in FY2023 and 25.6% in FY2024. This asset buildup suggests investments in infrastructure, machinery, or expansion, aligning with the company’s growth strategy.

🧾 Summary

- Srigee DLM has shown strong and consistent financial growth over three years.

- Revenue and profit are both rising, backed by increasing total assets.

- The company appears to be on a stable expansion path, making the IPO well-timed for scaling further.