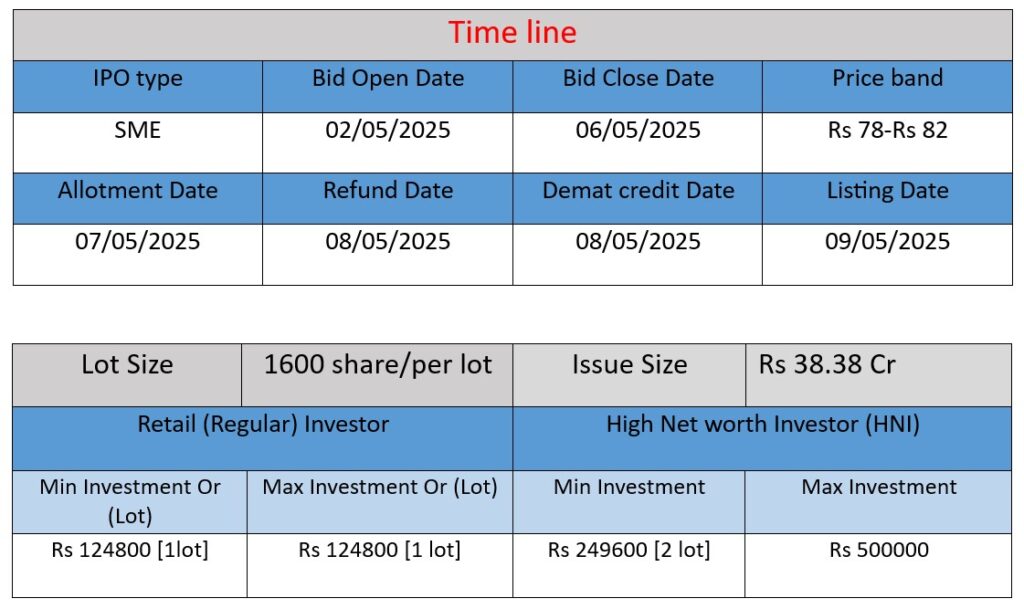

Wagons Learning Limited is launching its SME IPO on the BSE Emerge platform, opening on May 2, 2025, and closing on May 6, 2025. The issue comprises 46.8 lakh equity shares, including a fresh issue of 30.8 lakh shares and an offer for sale of 16 lakh shares, totaling ₹38.38 crore. Priced between ₹78–₹82 per share, the IPO aims to fund working capital needs, repay certain borrowings, and address general corporate purposes.

Core Business Focus

Wagons Learning Limited is a prominent Indian company specializing in corporate training, skill development, and educational technology solutions. With a focus on enhancing human capital, the company offers a range of services aimed at improving employability and organizational performance. Below is an overview of the company’s operations, strengths, and potential risks.

Corporate Training and Skill Development

Wagons Learning provides comprehensive training programs across various sectors, including sales, marketing, HR, finance, manufacturing, and operations. These programs are designed to enhance business skills and are tailored to meet the specific needs of organizations .

Educational Technology Solutions

The company has developed innovative platforms such as the Learning Experience Platform (LXP) and SmartSiksha. The LXP offers personalized, scalable, and interactive learning experiences, while SmartSiksha serves as an AI-based school management system to improve institutional efficiency

Government and CSR Initiatives

Wagons Learning actively participates in government programs like the Deen Dayal Upadhyaya Grameen Kaushalya Yojana (DDU-GKY) and has its own CSR initiatives aimed at skill development for underprivileged youth and women. These efforts have led to significant employment outcomes and community impact .

Strengths: Competitive Advantages

Extensive Training Reach

With over 1 million individuals trained and more than 1,200 trainers, Wagons Learning has a substantial presence in the training sector. Their experience spans across 40+ CSR projects and 1,400+ e-learning initiatives .

Technological Innovation

The company’s adoption of advanced technologies, including AI-based platforms and gamified learning solutions, positions it at the forefront of modern educational methodologies

Industry Diversification

Wagons Learning caters to a diverse range of industries such as automotive, banking, IT, pharma, and healthcare, allowing for a broad client base and reduced dependency on a single sector

Risks: Potential Challenges

Employment Model Concerns

Employee reviews indicate concerns regarding job security, particularly for project-based roles. This employment model may lead to uncertainty and affect employee retention .

Moderate Employee Satisfaction

While the company has a decent overall rating, areas such as salary satisfaction and job security have received lower scores, suggesting room for improvement in employee engagement and compensation strategies .

Market Competition

The corporate training and ed-tech sectors are highly competitive, with numerous players offering similar services. Maintaining a competitive edge requires continuous innovation and adaptation to market trends.

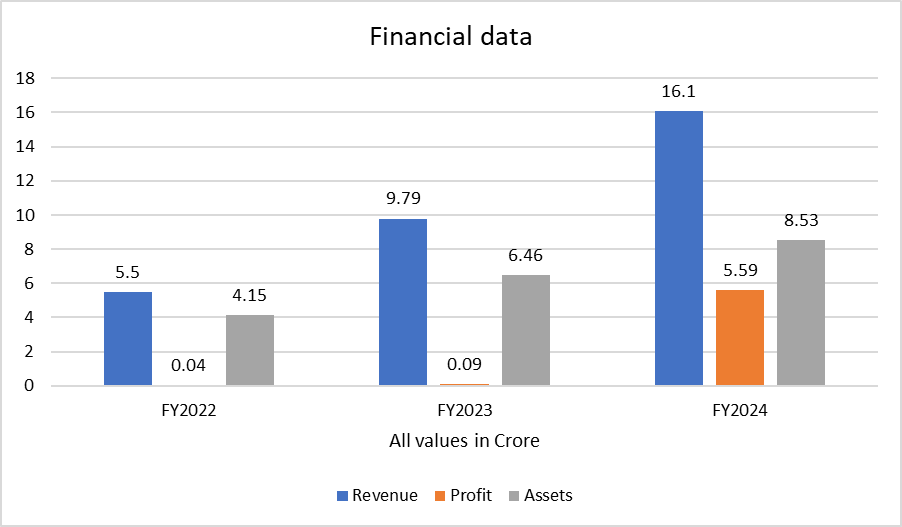

Financial Analysis of Wagons Learning Limited (FY2022-FY2024)

📊 Revenue

- FY2024: ₹16.1 crore

- FY2023: ₹9.79 crore

- FY2022: ₹5.5 crore

Analysis: Revenue has shown strong growth over the past three years. From FY2022 to FY2023, revenue grew by around 78%, and from FY2023 to FY2024, it further increased by about 64%. This indicates rising demand for their services and possible expansion into new clients or offerings.

💰 Profit

- FY2024: ₹5.59 crore

- FY2023: ₹0.09 crore

- FY2022: ₹0.04 crore

Analysis: Profitability has significantly improved, especially in FY2024. This suggests better cost management, improved margins, or higher-value services being offered. The sharp jump from ₹0.09 crore to ₹5.59 crore is a key highlight and may attract investor attention.

🏦 Total Assets

- FY2024: ₹8.53 crore

- FY2023: ₹6.46 crore

- FY2022: ₹4.15 crore

Analysis: Steady growth in assets indicates expansion of business operations, investment in technology, or better capital utilization. The increasing asset base also strengthens the company’s financial position.

📌 Summary

- Consistent and strong revenue growth over three years.

- Major jump in profit in FY2024, indicating improved operational efficiency.

- Gradual increase in total assets supports business scalability.

- Financial trend is positive and suggests growing stability and potential for further expansion.