Jay Ambe Supermarkets IPO Overview

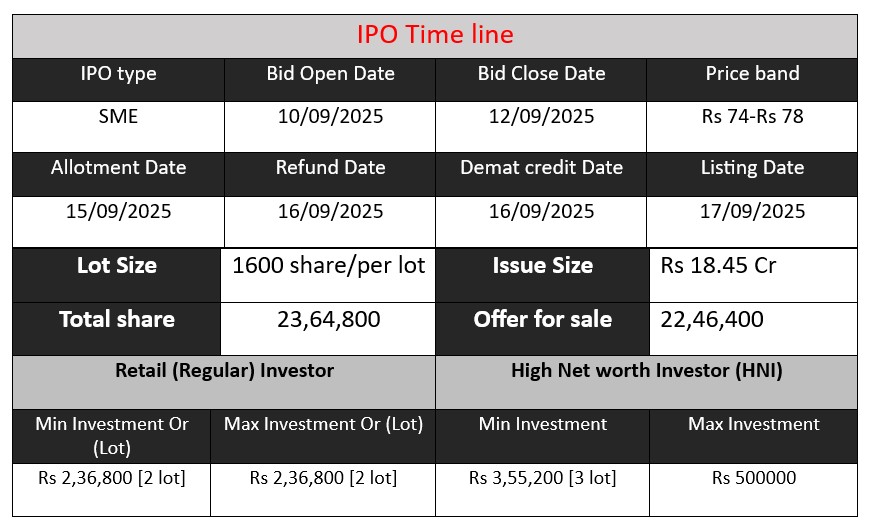

Jay Ambe Supermarkets Ltd (City Square Mart) is launching an SME IPO to raise approximately ₹18.45 crore through the issuance of up to 2,364,800 equity shares (₹10 face value) at a price band of ₹74–₹78. The offering opens on 10 September 2025 and closes on 12 September 2025. Proceeds will fund acquisition of an existing Nana Chiloda store, fit-outs for three new outlets, working capital, and general corporate purposes.

Jay Ambe Supermarkets GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 8 | 74-78 |

| Last Updated: 14 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Jay Ambe Supermarkets Core Business & Overview

Originally incorporated as Jay Ambe Supermarkets Private Limited on 23 November 2020, the company converted into a public limited company on 25 February 2025.

It is registered with the Registrar of Companies, Ahmedabad, and has a CIN of U74999GJ2020PLC118385.

Location & Brand

Headquartered at Kudasan, Gandhinagar, Gujarat.Operates under the retail brand City Square Mart, with the first outlet launched in August 2018, expanding rapidly across Gujarat.

Business Model & Product Range

Engages in the retail trade of FMCG, groceries, general merchandise, consumer durables, fruits & vegetables, garments & footwear, toys, gift articles, and various household items through both company-operated and franchise outlets.

Utilizes both FOCO (Franchise-Owned, Company-Operated) and FOFO (Franchise-Owned, Franchise-Operated) franchise models.

Scale & Footprint

As of recent filings, the company runs 15 outlets across Gujarat with a total retail space of over 93,000 sq ft.

Some sources report expansion to 17 stores in Gujarat.

Strengths

- Rapid expansion across Gujarat: Grew from one store in 2018 to 15–17 retail outlets, demonstrating strong market traction.

- Diversified product range: Offers a wide mix of groceries, apparel, home goods, toys, etc., appealing to a broad customer base.

- Franchise model flexibility: The FOCO and FOFO models support scalable expansion with lower capital risk and diversified revenue streams.

- Fiscal growth momentum: Strong uptick in revenue and profitability—from ₹ 33.4 crore (2024) to ₹ 47.4 crore (2025); PAT rose 78%.

- Seasoned leadership: Leadership under Mr. Jignesh Patel brings nearly two decades of national and international retail experience.

Potential Risks

- SME IPO and growth funding pressure: They are relying on fresh capital via SME IPO to fund store acquisition, fit-outs, working capital, and corporate activities. Any delays or fundraising shortfalls could impact expansion plans.

- Franchise management complexity: FOCO and FOFO models require strong oversight. Franchisee performance variability could affect brand consistency and profitability.

- Retail sector competition: Highly competitive segment within Gujarat’s retail landscape, with risk from established chains and online platforms. (Implied from diversification and expansion context.)

- Regulatory and operational risks: As a public limited SME company, must maintain compliance with SEBI, BSE SME norms, and normal financial/operational reporting timelines. Missteps may affect reputation or listing.

- Geographic concentration: Currently focused solely in Gujarat—exposure to regional economic cycles or regulatory shifts.

Financial Performance Overview (₹ in Crore)

| Year | Revenue | Profit | Assets |

| FY 2023 | 32.69 | 0.35 | 16.79 |

| FY 2024 | 33.39 | 1.55 | 22.02 |

| FY 2025 | 47.35 | 2.75 | 26.78 |

Revenue

- FY 2025: ₹47.35 crore

- FY 2024: ₹33.39 crore

Revenue grew strongly by 42% YoY in FY 2025 after a nearly flat growth in FY 2024. This shows that the company managed to scale operations more effectively, likely from expansion of outlets and improved sales per store.

Profit

- FY 2025: ₹2.75 crore

- FY 2024: ₹1.55 crore

- FY 2023: ₹0.35 crore

Profit has shown consistent improvement – up almost 8x in two years. The rising profitability suggests better cost control and higher operational efficiency, moving from thin margins toward sustainable earnings.

Total Assets

- FY 2025: ₹26.78 crore

- FY 2024: ₹22.02 crore

- FY 2023: ₹16.79 crore

Assets increased steadily, reflecting ongoing investment in new outlets and infrastructure. Growth of ~60% over three years indicates the company is expanding its footprint aggressively.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.