LGT Business IPO Overview

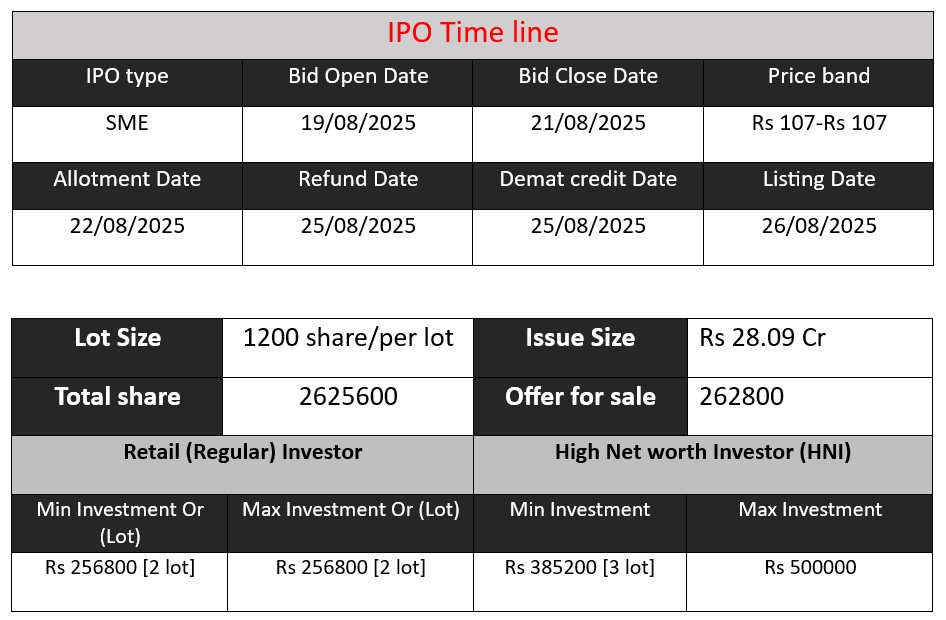

LGT Business Connextions Ltd IPO opens 19 Aug 2025, closes 21 Aug 2025, offering 26.26 lakh shares (₹28.09 crore) at ₹107/share, comprising fresh issue of ₹25.28 cr and offer-for-sale of ₹2.81 cr. Proceeds will fund capital expenditure, working capital, and general corporate purposes. Listing is scheduled for 26 Aug 2025.

LGT Business Subscription and GMP Status

| Category | Subscription (x) |

| QIBs | 0.00 |

| NIIs | 0.85 |

| Retails | 1.72 |

| Total | 1.22 |

| Last Updated: 21 Aug 2025- 7 PM Source: NSE/BSE | |

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 107 | |

| Last Updated: 21 Aug 2025- 7 PM | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Date

Core Business & Overview

LGT Business Connextions Limited, established in 2016, functions as a service aggregator in the travel and tourism industry. It consolidates offerings from a variety of third-party providers—such as hotels, airlines, car rental services, cruise operators, and more—to deliver end-to-end travel solutions to both corporate and individual clients. These services include ticketing (with IATA accreditation), MICE (Meetings, Incentives, Conferences & Exhibitions) packages, cruise bookings, transit and local sightseeing arrangements, visa processing, and customized travel plans.

The company also operates leased accommodations in Chennai and Thiruvananthapuram to support its hotel and lodging services.

Strengths

- Comprehensive Service Offering

The company’s ability to “cross-sell services under one roof”—spanning everything from visa assistance to event management—sets it apart in a crowded market. - Scalable Business Model & Operational Efficiency

LGT Business operates a scalable structure, efficiently leveraging resources to grow and serve diverse customer needs. Its organizational stability and experienced management team add to its credibility.

Potential Risks

- Revenue Concentration in Limited Services

Nearly 100% of the company’s revenue comes from just two segments—MICE packages and hotel bookings—making it highly vulnerable to fluctuations in these areas. - Geographic Concentration

Operations are heavily concentrated in Southern India, exposing the company to regional risks such as local economic downturns or regulatory issues. - Dependence on Few Key Clients & Lack of Long-Term Agreements

A large share of business comes from the top 10 clients, and the company hasn’t entered formal long-term contracts (except for accommodation services), which can jeopardize business continuity if client relationships shift. - Reliance on External Vendors Without Long-Term Ties

The firm depends on third-party travel suppliers and vendors without long-term agreements, risking service quality disruptions or cost pressures. - Leased Business Premises

All operational facilities—including offices and lodging—are rented, introducing exposure to lease-related risks and potential instability. - Financial Vulnerabilities

The company has incurred indebtedness and reported negative cash flows in prior years, which could strain ongoing operations and hamper expansions. - Litigation Exposure

Group entities are involved in pending legal cases, which could lead to financial liabilities or reputational damage

Financial Performance Overview (₹ in Crore)

| Financial Year | Revenue | Profit | Assets |

| FY 2023 | 60.99 | 2.97 | 8.69 |

| FY 2024 | 89.36 | 3.63 | 14.93 |

| FY 2025 | 100.43 | 5.21 | 27.17 |

Revenue

- FY 2023 → ₹60.99 Cr

- FY 2024 → ₹89.36 Cr

- FY 2025 → ₹100.43 Cr

Revenue has grown strongly—up 47% in FY24 and 12% in FY25. This shows the company is expanding its business steadily, though growth slowed in FY25 compared to FY24.

Profit

- FY 2023 → ₹2.97 Cr

- FY 2024 → ₹3.63 Cr

- FY 2025 → ₹5.21 Cr

Profit rose consistently. In FY25, profit jumped by 43% from the previous year, meaning the company is controlling costs better and becoming more efficient.

Total Assets

- FY 2023 → ₹8.69 Cr

- FY 2024 → ₹14.93 Cr

- FY 2025 → ₹27.17 Cr

Assets more than tripled in two years, showing aggressive expansion, possibly due to IPO funds and reinvested profits. A higher asset base supports future growth.

✅ Pros

- Diversified travel services under one roof (MICE, hotels, ticketing, visa).

- Consistent revenue and profit growth with strong FY25 performance.

- IPO proceeds to boost capital expenditure and working capital.

- Experienced management with scalable business model.

- Expanding asset base supports future growth.

❌ Cons

- High revenue concentration in MICE and hotel bookings.

- Operations limited mainly to South India.

- Dependence on top clients and external vendors without long-term contracts.

- Entire business run from leased premises.

- Past instances of negative cash flows and existing indebtedness.

- Pending litigations could affect reputation/finances.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.