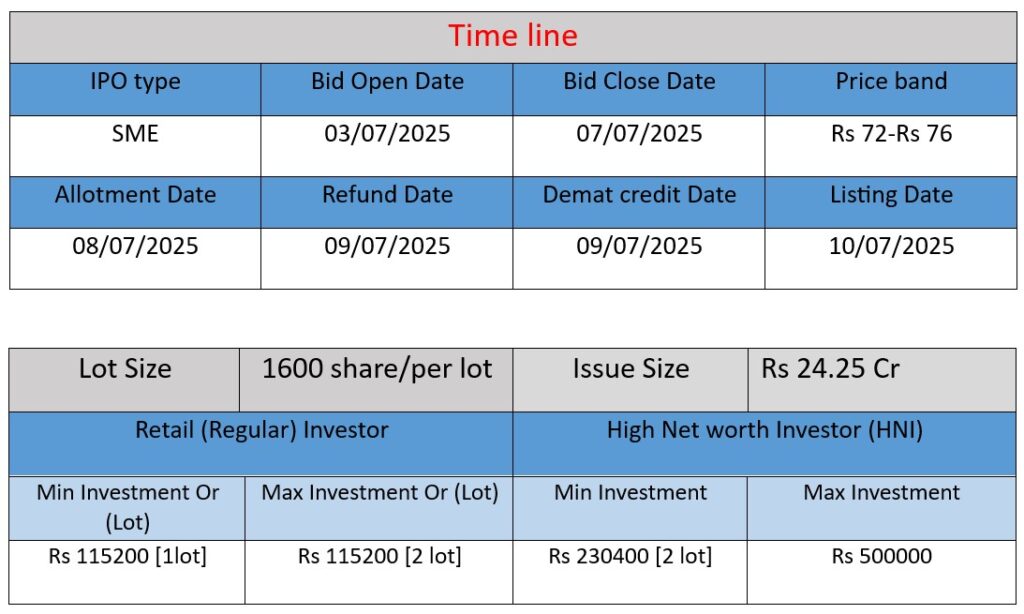

White Force IPO opens on July 3 and closes on July 7, 2025, with an issue size of ₹24.25 crore. The SME IPO is priced at ₹72–₹76 per share. Operated by Happy Square Outsourcing Services Ltd, the company offers HR outsourcing, recruitment, and payroll services. With multiple ISO certifications and over 1 million jobseekers on its platform, White Force aims to use the IPO proceeds for working capital, debt repayment, and general corporate purposes.

Company Overview & Core Work

- Who they are: An India‑based HR outsourcing firm (operating under Happy Square Outsourcing Services Ltd), founded in 2017, headquartered in Jabalpur & Delhi, with 200–500 employees.

- Services offered:

- End‑to‑end HR outsourcing: contract staffing, permanent staffing, recruitment, payroll, onboarding .

- Operates a job portal (“White Force Jobs”) with over 1 million registered candidates.

- Certifications & standards:

- ISO‑9001:2015 quality management certified.

- Additional ISO certifications (14001, 45001, 50001, 27001, 10667‑2) under parent Happy Square brand

Strengths

- Large candidate base: Over 1 million jobseekers on its platform, boosting placement reach.

- Comprehensive service scope: Offering recruitment, payroll, onboarding, compliance and facility management.

- Strong quality credentials: Multiple ISO accreditations indicate formal processes and service reliability .

- Financial growth: ROE of ~61% in FY23, consolidated revenue ₹52 Cr.

Risks & Challenges

- High leverage: IPO commentary points to significant debt; refinancing may be needed under market variations .

- SME IPO category: Small IPO size and limited secondary market float may lead to low liquidity and price volatility .

- Competitive market: Faces competition from larger consultancy and staffing firms; margins might be pressured.

- Execution risks: As a growing, publicly‑listed entity, it’ll need to scale governance, reporting, and compliance effectively.

Summary & Outlook

White Force is a rapidly expanding HR-outsourcing platform with scale, quality credentials, and traction across recruitment and payroll. Its strengths lie in its candidate network, service range, and certified processes. The upcoming IPO (03–07 July 2025) offers growth capital, though the company must manage debt and navigate the constraints of an SME public listing. Execution and competitive positioning will be key to sustaining momentum.

Here is a brief financial performance analysis across FY2023 to FY2025:

Revenue

- FY2023: ₹52.7 crore

- FY2024: ₹69.29 crore

- FY2025: ₹97.41 crore

Analysis:

The company’s revenue has grown consistently year-on-year:

- 31.5% increase from FY23 to FY24

- 40.6% increase from FY24 to FY25

This reflects strong demand for its HR and staffing services, along with improved operational outreach and client acquisition.

Profit (Net Profit)

- FY2023: ₹1.79 crore

- FY2024: ₹4.39 crore

- FY2025: ₹5.90 crore

Analysis:

Profitability improved significantly:

- Grew 145% in FY24

- Further grew 34.6% in FY25

Indicates better cost management, increased service margins, and business maturity.

Total Assets

- FY2023: ₹14.32 crore

- FY2024: ₹28.42 crore

- FY2025: ₹39.64 crore

Analysis:

- Assets nearly doubled from FY23 to FY24

- Grew 39.5% in FY25

Asset growth supports business scalability—potentially from tech platforms, talent base, and branch expansion.

📌 Summary

| Metric | FY2023 | FY2024 | FY2025 | Growth (FY23–FY25) |

| Revenue | ₹52.7 Cr | ₹69.29 Cr | ₹97.41 Cr | ▲ 84.8% |

| Profit | ₹1.79 Cr | ₹4.39 Cr | ₹5.90 Cr | ▲ 229.6% |

| Total Assets | ₹14.32 Cr | ₹28.42 Cr | ₹39.64 Cr | ▲ 176.9% |

Conclusion

White Force has shown robust and consistent growth across revenue, profit, and assets from FY2023 to FY2025. The company’s profitability has improved significantly, indicating operational efficiency. Asset growth signals long-term investment and scalability. With a planned IPO and strong fundamentals, White Force appears well-positioned for future expansion in India’s growing HR outsourcing sector.