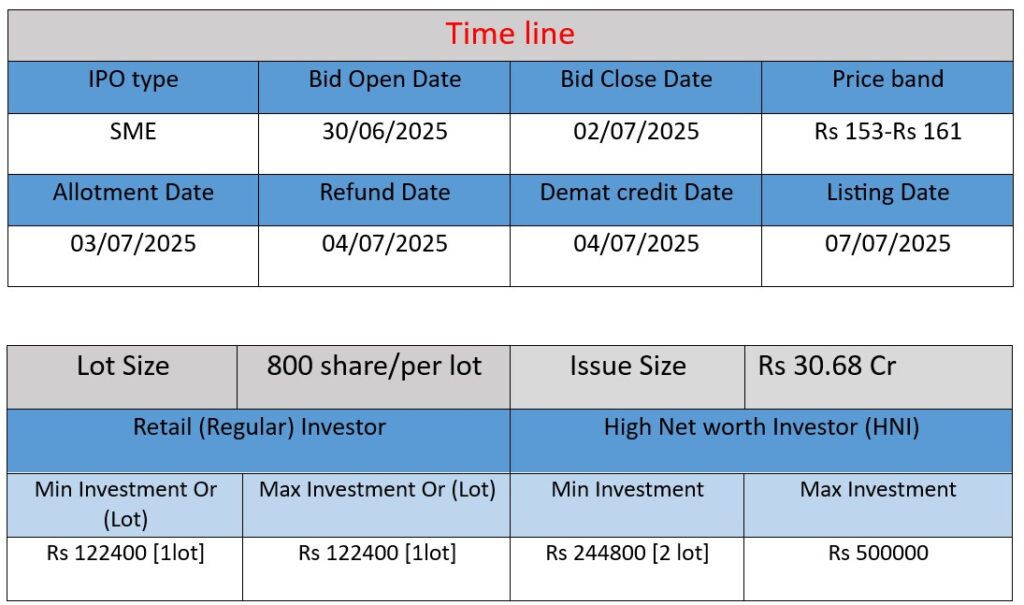

Silky Overseas Ltd IPO opens on June 30 and closes on July 2, 2025. The ₹30.68 crore issue is a 100% fresh offer priced between ₹153–₹161 per share. Proceeds will be used for capacity expansion, debt repayment, and working capital needs. The company, engaged in home textile manufacturing under the Rian Décor brand, aims to strengthen operations with this IPO. Investors can apply via BSE SME platform.

Company Overview

- Core Business: Silky Overseas, incorporated on 1 May 2016 (converted to public in Nov 2023), is engaged in the manufacturing and supply of home textiles—primarily blankets, bedsheets, comforters, baby blankets, and curtains—under the brand Rian Décor. Its vertically integrated facility covers all stages: knitting, dyeing, printing, processing, and packaging.

- Facilities & Reach: Based in Delhi-NCR with a production unit in Sonepat (Panipat region), the company sells through B2B and D2C channels, including e‑commerce platforms like Flipkart, Amazon, and Ajio, and exports to the Middle East.

Strengths

- Vertical Integration: Single-location operations help control quality and reduce lead time .

- Quality sourcing: High thread-count fabrics at cost-effective rates, supporting premium positioning.

- Experienced leadership: Promoter led by Sawar Mal Goyal, with robust industry knowledge and strategic foresight.

- ISO-certified quality systems: ISO 9001:2015 certification underscores commitment to consistent product standards .

- Improving financials: Robust growth in revenue, EBITDA, and profitability; FY24–25 PAT margin rising significantly.

Risks & Weaknesses

- Revenue concentration: Blankets represent ~65% of sales—making the firm vulnerable to shifts in blanket demand.

- Supplier & customer concentration: Heavy reliance on a few key vendors and clients could disrupt supply chains or revenue streams .

- Single-site risk: Only one major manufacturing unit at Panipat; disruptions (logistical, social, environmental) could halt operations.

- Legal exposure: Ongoing litigations and a yet-unregistered logo could impact reputation or finances.

- Cash flow concerns: The company has posted negative cash flows in operating and investing activities for multiple years.

- Rating uncertainty: CRISIL assigned a “B/Stable – Issuer Not Cooperating” rating; lack of recent disclosures raises concerns about financial transparency.

Conclusion

Silky Overseas has built a strong foundation in the home textile sector, leveraging its integrated manufacturing setup, quality sourcing, and growing product portfolio. Solid improvements in top-line and profitability further bolster its profile. However, the company still faces concentration risks (product, supplier, location), cash flow weaknesses, unresolved legal issues, and limited credit rating transparency.

Here is a brief financial performance analysis across FY2022 to FY2024:

Revenue

- FY2024: ₹69.7 crore

- FY2023: ₹68.31 crore

- FY2022: ₹50.12 crore

Analysis:

The company’s revenue grew steadily from ₹50.12 crore in FY2022 to ₹69.7 crore in FY2024, indicating consistent demand for its textile products. The growth slowed between FY2023 and FY2024, but it still reflects business stability and a strong market position.

Profit

- FY2024: ₹5.53 crore

- FY2023: ₹0.98 crore

- FY2022: ₹-0.42 crore (loss)

Analysis:

The company turned profitable in FY2023 and reported a 5.6x jump in net profit in FY2024. This sharp improvement shows better operational efficiency and cost control, strengthening investor confidence.

Total Assets

- FY2024: ₹50.69 crore

- FY2023: ₹40.7 crore

- FY2022: ₹37.07 crore

Analysis:

A consistent increase in assets over the three years shows expansion in operations and infrastructure. The growth in FY2024 indicates readiness for scaling up production, aligning with its IPO fund utilization plans.

📌 Summary

- Strong revenue and asset growth

- Impressive turnaround from losses to profits

- Signs of improving operational and financial health

- Well-positioned for expansion with IPO funding